As a seasoned crypto investor with a keen eye for market trends and technical analysis, I can’t help but be impressed by the recent accuracy of the Lido DAO (LDO) price analysis. When the recommendation was made to short LDO at the resistance level of $2.30 on June 21, I didn’t hesitate to follow suit, initiating my short positions around $2.245 or even at the close of the day at $2.263.

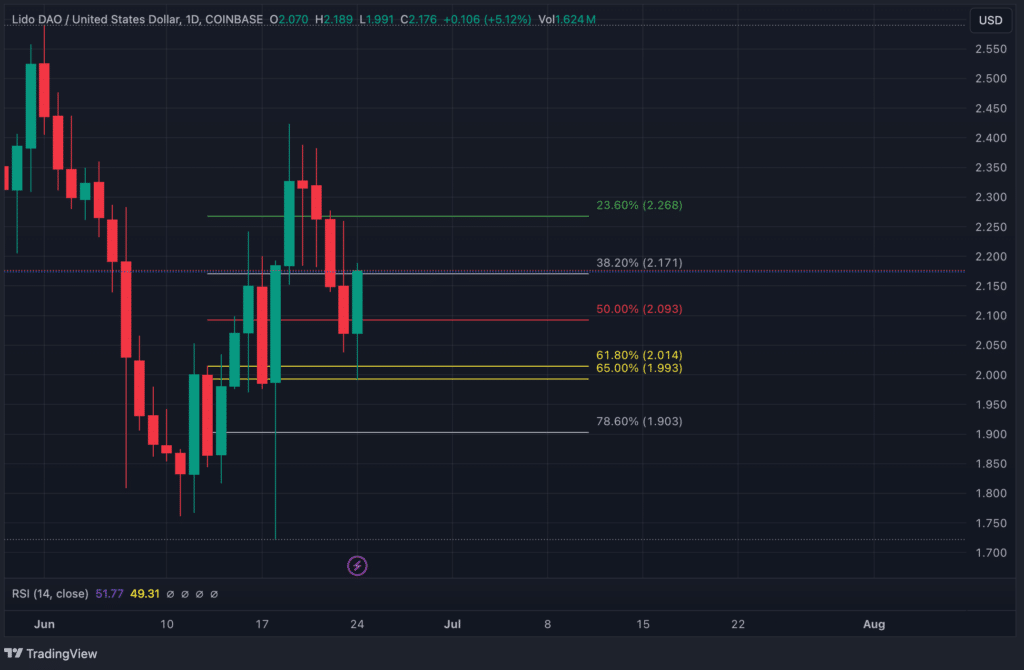

As a seasoned analyst, I’ve closely followed the Lido DAO (LDO) price movements, and my recent analysis has proven to be spot-on. On Friday, June 21, I advised shorting LDO at the resistance level of $2.30, anticipating a drop to the $2.00 support level. True to form, the price dipped down to a low of $1.991 – just as anticipated. This price action not only validated my strategy but also highlighted the significance of the golden pocket between $1.997 and $2.016.

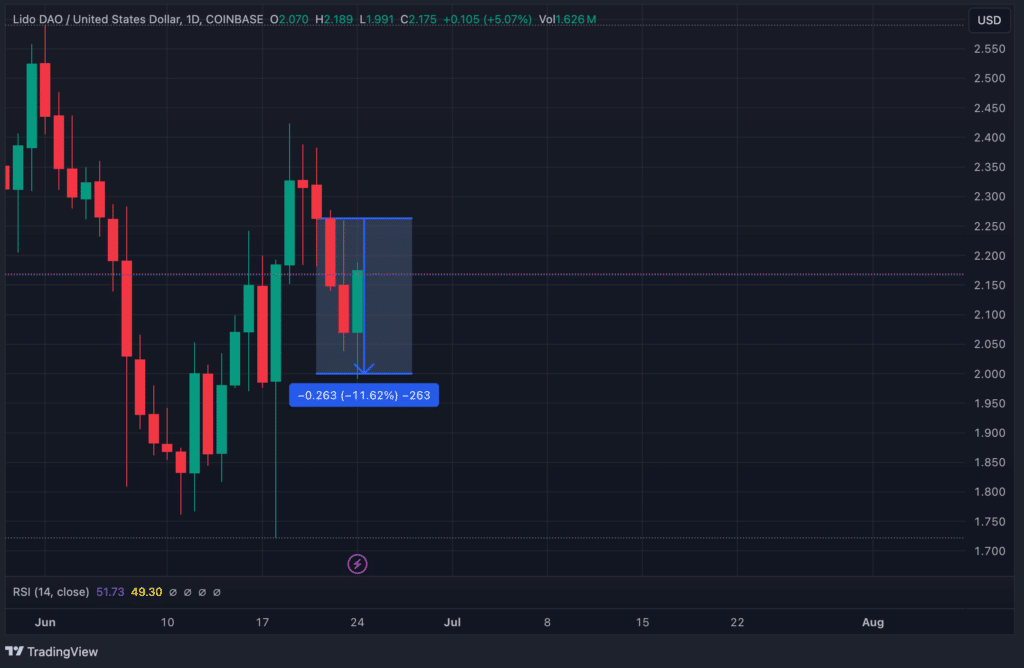

As an analyst, I would advise that taking short positions on June 21, around $2.245, or at the closing price of $2.263, would have yielded a significant return of approximately 11.62%.

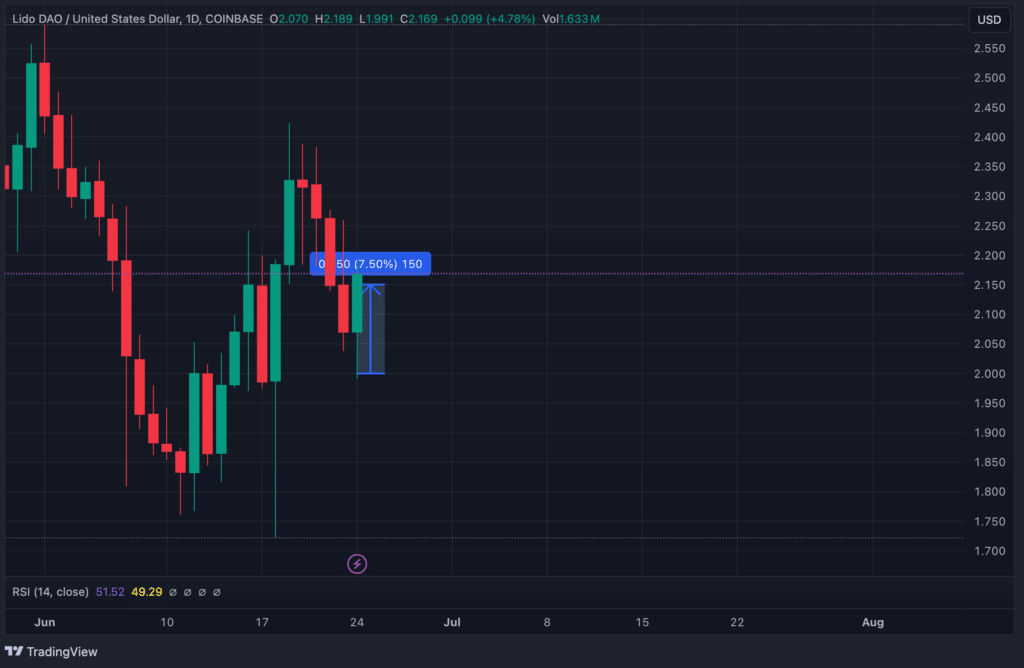

The suggestion to repurchase at $2.00 was validated as Lido reached a peak price of $2.199 during the day. By buying back at $2.00 and selling around $2.15, an additional profit of 7.5% could have been achieved.

With regards to your initial short position and subsequent long position, a $100 investment would have yielded a total earnings of $19.99 or a return of approximately 19.99% in roughly a 72-hour timeframe.

In the long run, the value of our Chart of the Week analysis will be evident. At present, our predictions boast a perfect success rate of 100%. Look forward to new analyses every Friday.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-06-24 15:05