As a researcher with extensive experience in the cryptocurrency market, I find Renzo’s recent token launch and subsequent market performance quite intriguing. The $300 million market cap and over $230 million trading volume across centralized exchanges are impressive numbers that indicate strong investor interest.

Recently, the liquid staking protocol named Renzo initiated its token airdrop, with a market value approaching $300 million, as people acquired REZ coins in large numbers.

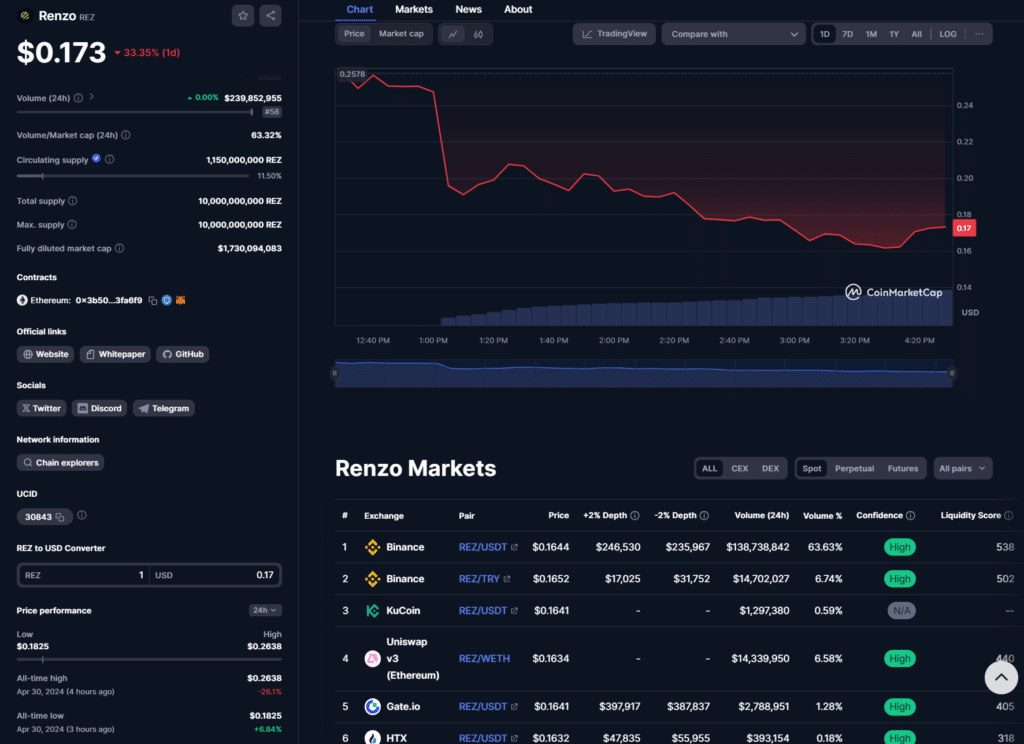

As a researcher examining the cryptocurrency market trends, I discovered that Renzo (REZ), specifically, accumulated an impressive trading volume of over $230 million on centralized exchanges such as Binance, Bitget, Huobi Global (HTX), KuCoin, and Gate.

At the launch of the REZ token on April 30, the Renzo team made it clear that this token could only be traded on the Ethereum (ETH) mainnet through approved centralized exchanges (CEXs). They also highlighted that trading pairs were currently absent from decentralized exchanges (DEXs).

As a token analyst, I’ve examined the official REZ token contract which is accessible on the protocol’s website. Meanwhile, traders have actively engaged in transactions on Uniswap, resulting in over $14 million worth of volume traded on the REZ/WETH pair as of now.

REZ started out with a circulating supply of 1.15 billion out of a total potential supply of 10 billion tokens. The remaining 8.85 billion tokens are secured and will be released gradually over a period of up to two years through vesting arrangements.

According to crypto.news, investors hold a 31% share of REZ’s total supply, while 20% is reserved for core contributors. The remaining 32% of the tokens will go to the community following Renzo’s adjusted airdrop distribution.

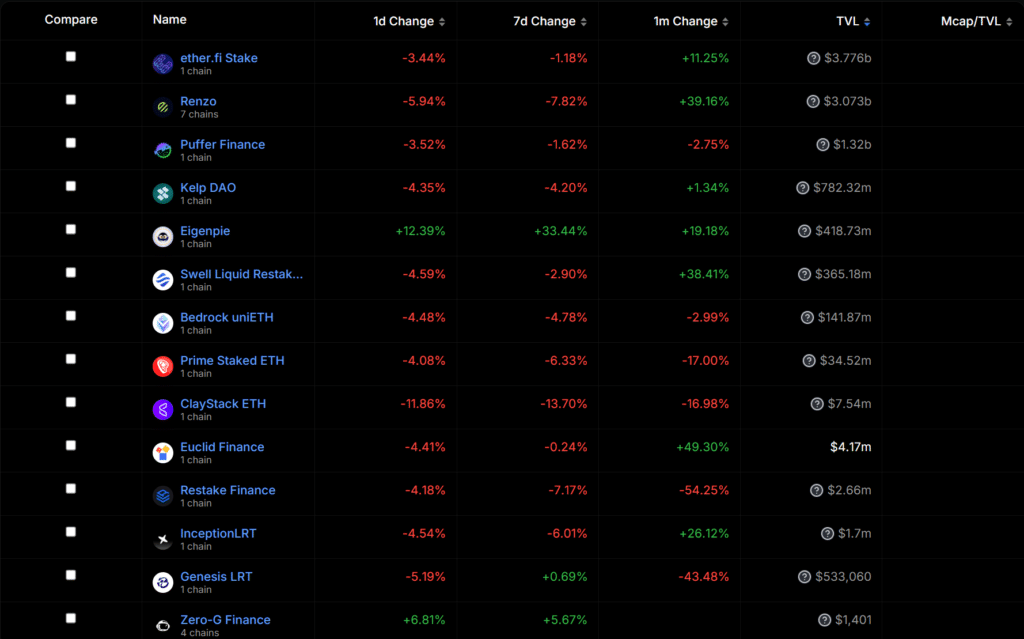

Renzo solidifies spot for second-largest liquid restaker

Similar to other liquid staking solutions, Renzo grants access to EigenLayer’s platform and enables users to generate returns by staking Ethereum (ETH). Furthermore, the initiative introduces ezETH as a derivative token, enhancing earning opportunities for individuals engaged within the decentralized finance (DeFi) sector.

Based on DefiLlama’s data, the REZ team constructed Ethereum’s second largest liquid staking platform. This project has accrued a total value of over $3 billion and trails only behind Ether.fi, the leading liquid staking platform in terms of value.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-04-30 20:02