During the weekend, the cost of Litecoin stayed quite volatile, imitating the pattern seen with Bitcoin, which stayed under the $95,000 mark.

As of a certain point in 2024, Litecoin (LTC), a well-known cryptocurrency that uses proof-of-work, was trading at $103.03, representing a drop of about 30% from its peak value in the same year. This decrease mirrors the trend observed among most cryptocurrencies, as they have scaled back some of the growth they experienced in the previous year.

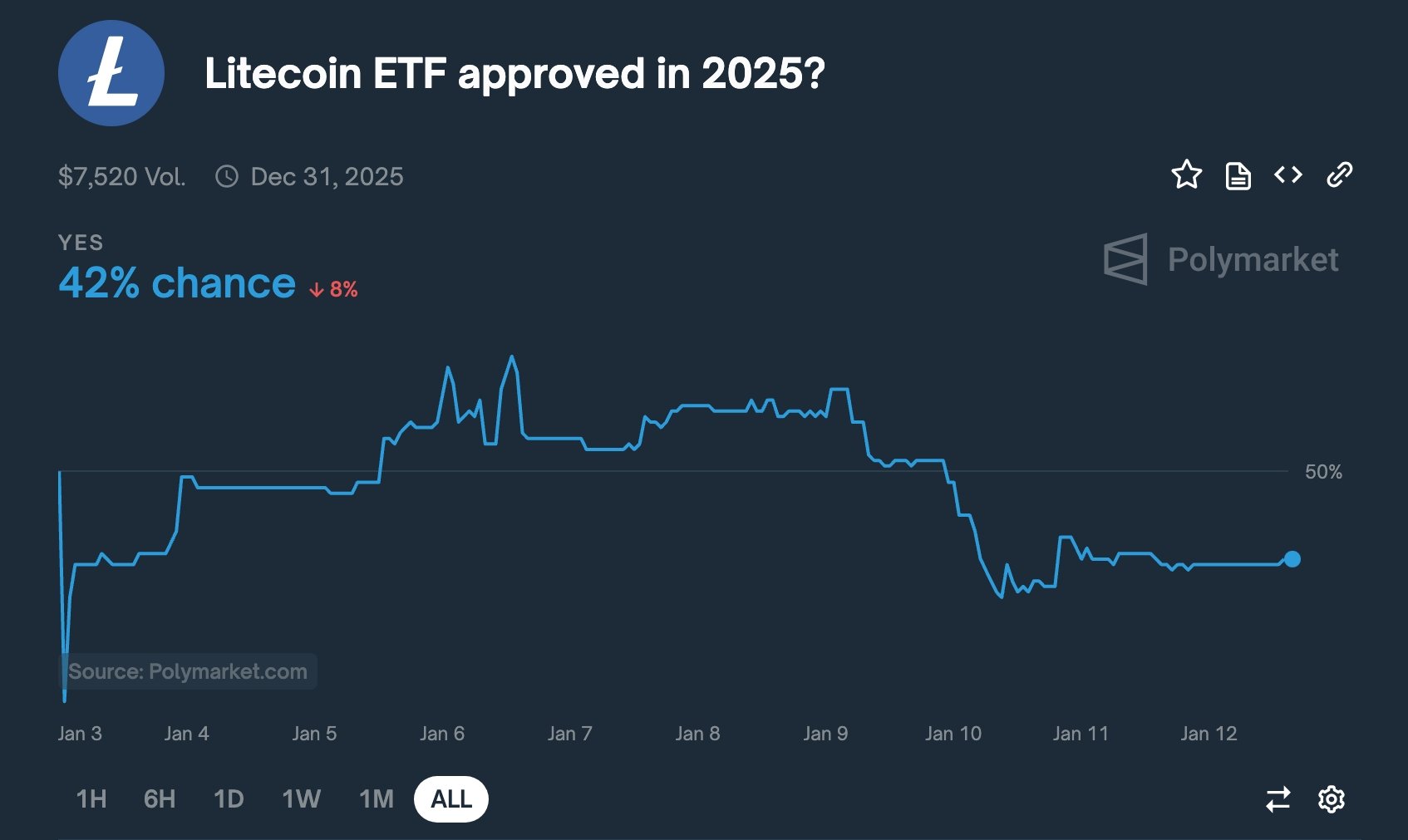

The strong showing of Litecoin might be attributed to decreased chances that the Securities and Exchange Commission will endorse a LTC spot ETF in 2025. As per Polymarket, these possibilities have dipped from a peak of 60% this year, now standing at 42%.

As a researcher, I, Eric Balchunas, senior ETF analyst at Bloomberg, expressed my belief that the Securities and Exchange Commission (SEC) might grant approval for a spot Litecoin (LTC) Exchange Traded Fund (ETF). In a recent post published in December, I presented my reasoning that the agency would find it relatively straightforward to endorse a Litecoin fund due to its connection as a hard fork of Bitcoin (BTC).

Next year, we anticipate a surge of Cryptocurrency Exchange-Traded Funds (ETFs). However, they won’t all appear simultaneously. The initial wave might include ETFs that combine Bitcoin and Ethereum, followed potentially by Litecoin (as it shares similarities with Bitcoin, categorizing it as a commodity), Harmony (because it’s not classified as a security), and then XRP or Solana (which have been labeled securities in pending litigation).

— Eric Balchunas (@EricBalchunas) December 17, 2024

It’s just Canary Capital that’s requested a position for a Litecoin ETF so far. However, Grayscale might also submit an application to transform its existing Litecoin Trust (worth more than $215 million) into a spot ETF, similar to how they handled Bitcoin and Ethereum.

A Litecoin ETF might be beneficial for the coin, but it’s uncertain if it will attract institutional investors due to its past performance, much like how spot Bitcoin and Ethereum ETFs have fared. For instance, Bitcoin funds manage over $107 billion in assets, representing 5.7% of the total market cap. Meanwhile, Ethereum funds hold $11.6 billion, equating to 2.96% of the market cap, suggesting that institutional interest is relatively low.

In comparison to Ethereum, there seems to be less enthusiasm for Litecoin due to its relatively smaller status within the cryptocurrency world. With a market capitalization of approximately $7.7 billion, it is dwarfed by Ethereum in terms of size and influence. Additionally, Litecoin has experienced a decline in its industry position, dropping from being among the top ten coins a few years ago to currently ranking at number 22. This shift indicates that it has lost significant market share within the crypto landscape.

It appears that traders on Polymarket are confident that regulatory approval for Ethereum-style investment products based on Solana (SOL) and Ripple (XRP) could be granted in 2022. The chances of the Securities and Exchange Commission (SEC) approving a spot XRP ETF stand at approximately 70%, while the odds for Solana ETFs are slightly higher, at around 73%. Given their substantial market capitalizations of $144 billion (Solana) and $67 billion (Ripple), these digital assets could potentially benefit from the success of such funds.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-01-12 20:40