As a seasoned crypto investor with over a decade of experience in this dynamic market, I find myself intrigued by the recent developments surrounding Litecoin (LTC). Having witnessed its meteoric rise and subsequent falls, I can’t help but feel a sense of deja vu as it currently trades at $64.

In simpler terms, the digital currency known as Litecoin stayed stable (consolidation phase) because there wasn’t much action in the futures market and the activity of large investors (whales) increased.

LTC whale activity increases

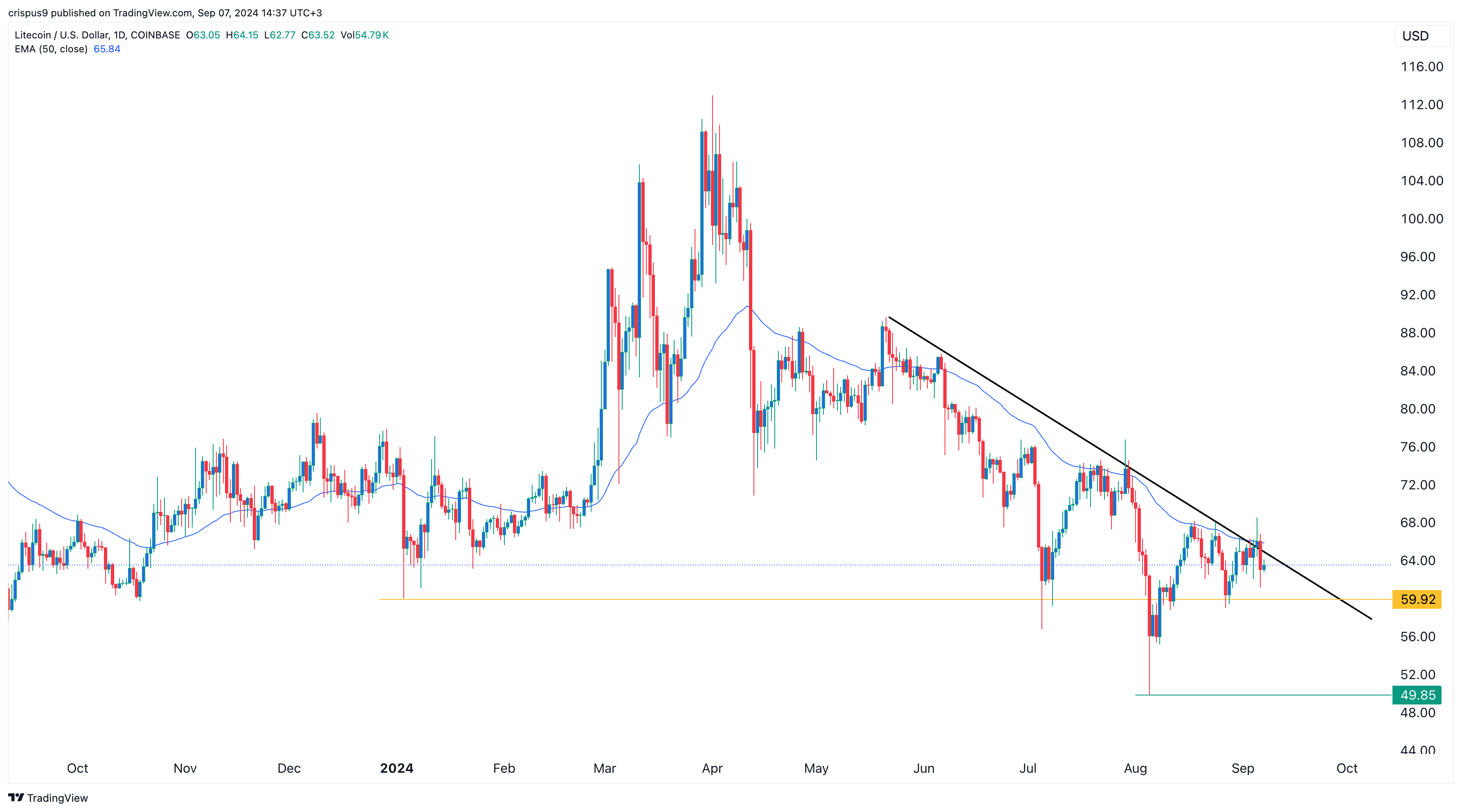

In the last fortnight, Litecoin (LTC), developed by ex-Google engineer Charlie Lee, has remained at a price of $64. This level is roughly 27% higher than its August low and approximately 44% lower compared to its peak price this year.

Bitcoin‘s price movement closely follows its own trend. In March, it reached an all-time peak of $73,800, then dipped to $49,000 in August, and currently trades around $54,000.

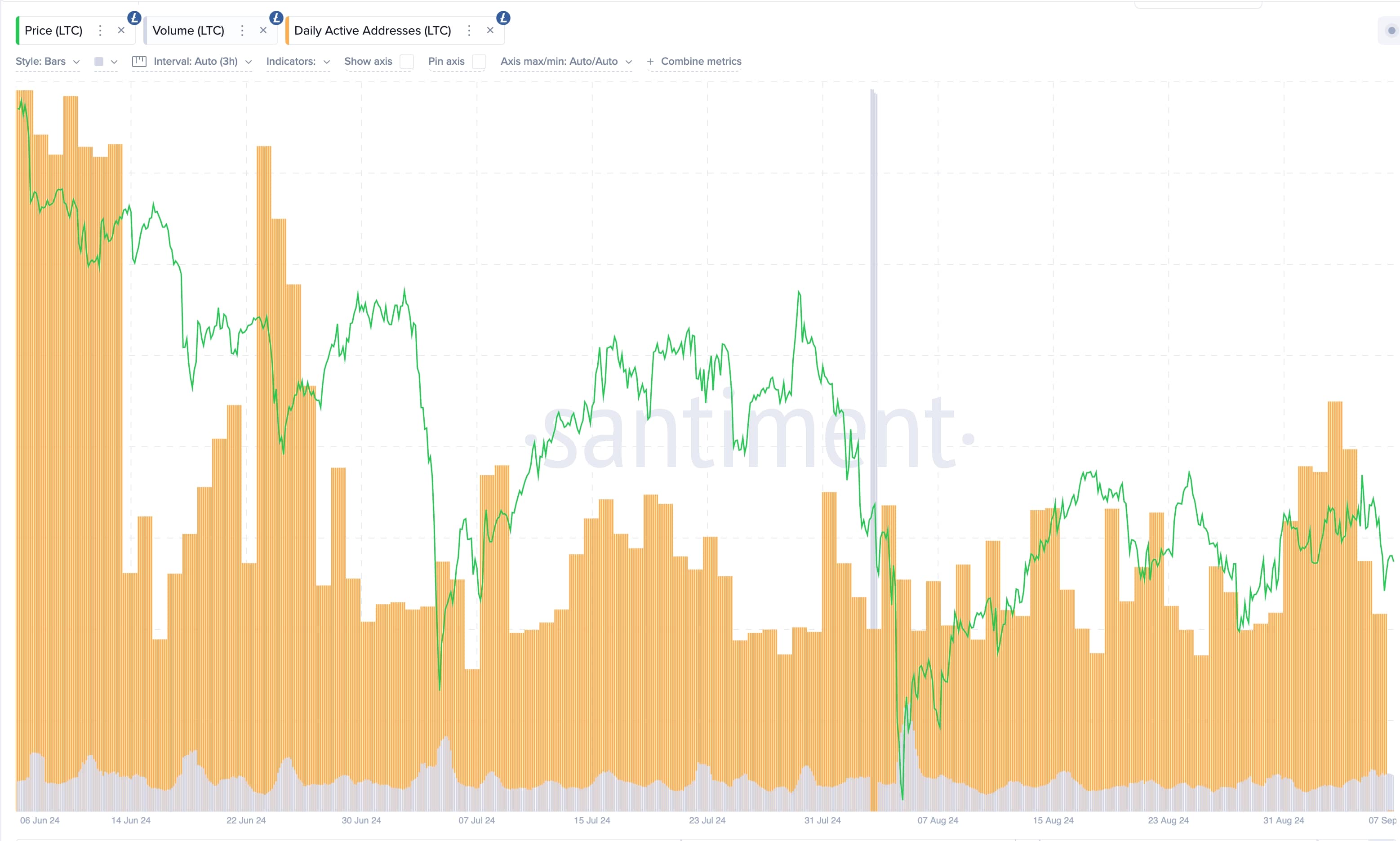

As per Santiment’s analysis, there’s been a substantial rise in large-scale Litecoin purchases over the past few weeks, suggesting these investors might be taking advantage of price drops. Moreover, Santiment has noted a significant uptick in social media discussions about Litecoin.

🌩️ Since late August, there’s been an unusual surge in whale activity with Litecoin. Additionally, conversations about the 19th largest market cap original coin, Litecoin (LTC), have skyrocketed. Regardless of your feelings towards LTC, it’s something to monitor closely.— Santiment (@santimentfeed) September 7, 2024

Yet, recent Santiment data indicates a significant decline in daily active addresses over the last couple of months.

Litecoin had over 327,000 active addresses on Friday, Sep.6, down from 801,000 in June.

As a crypto investor, I’ve noticed that Litecoin’s future open interest has been relatively quiet lately. On Saturday, September 7, the interest in the futures market was around $243 million, which is significantly lower than the year-to-date high of over $708 million.

As a crypto investor, I find that futures open interest serves as a crucial piece of information within the financial market. This figure represents the unfulfilled contracts still outstanding, which often indicates increased demand for a particular cryptocurrency among investors when it’s higher.

Currently, Litecoin’s funding rate has decreased from 0.078% earlier this week to 0.0016%. This indicates that when long positions (holders who expect the price to rise) are dominant, they pay a fee to short position holders (those who bet on a fall). As the funding rate approaches zero or even becomes negative, there’s a potential risk it could continue falling further.

Litecoin below this key resistance level

In simpler terms, Litecoin appears to be dropping below a trendline formed by its highest peaks since May 20th. Additionally, it’s been staying beneath its 50-day moving average, which suggests that its price may continue to fall.

Should this event occur, it’s possible that Litecoin, a prominent proof-of-work cryptocurrency, might fall to its subsequent significant support point at approximately $60 – a low point it reached on January 3.

As a crypto investor, if the price falls beneath my current support level, it could signal a downturn towards the critical support at $50 – the lowest point from August. Yet, should the market volume propel us above the descending trendline, it’s a sign of further potential gains ahead.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-07 17:08