As a seasoned crypto investor with a knack for spotting undervalued gems, I’ve been closely watching Mantra (OM) this year. Its meteoric rise to over 2,130% has caught my attention, and I can’t help but feel like I’ve stumbled upon the next big thing. The upcoming mainnet launch, staking rewards, and strong technicals are all factors that have contributed to its surge.

As a researcher, I’ve been closely observing the market trends, and it’s clear that Mantra, one of the standout altcoins this year, has shown remarkable resilience. It has been on an upward trajectory, reaching a two-month peak in its performance.

mantra Coin surged to $1.3155, bucking the trend as Bitcoin, Ethereum, and various other alternative cryptocurrencies retreated under increasing geopolitical pressures. This year alone, it has soared by more than 2,130%.

The surge in its rally corresponds with the recent increase of its futures contract holdings, reaching a high not seen for several months at $30 million. An uptick in open interest suggests that the asset is experiencing significant investor interest.

There are three likely reasons for the ongoing surge. First, Mantra has hinted that it will launch its mainnet this month. While no date has been announced, it will likely happen on Oct. 23 during the Cosmoverse event in Dubai. In most cases, crypto companies launch big projects when there are significant events.

Mantra aspires that its mainnet will position it as the premier network for developers within the Real-World Asset tokenization sector. Experts predict that this industry will foster fractional asset ownership, enhance liquidity, and amplify transparency.

The Mantra network boasts of efficient transaction rates, a flexible design, robust security and compliance measures, and a decentralized structure. Being part of the Cosmos ecosystem, it benefits from the Inter-Blockchain Communication protocol, enabling seamless transfer of assets between various blockchain networks.

To elaborate, Mantra has experienced significant growth due to its exceptional staking rewards, which are among the highest within the industry. Currently, it boasts a staking yield of approximately 22.32%, and about half of its circulating tokens are staked. The staking ratio is a crucial indicator that assesses the proportion of tokens in circulation that have been committed to staking.

The extended campaign for OM‘s locked products offers a chance to earn interest rates of up to 19.9% APR! Use the hashtag #OM Locked Products and subscribe now!— Binance (@binance) September 30, 2024

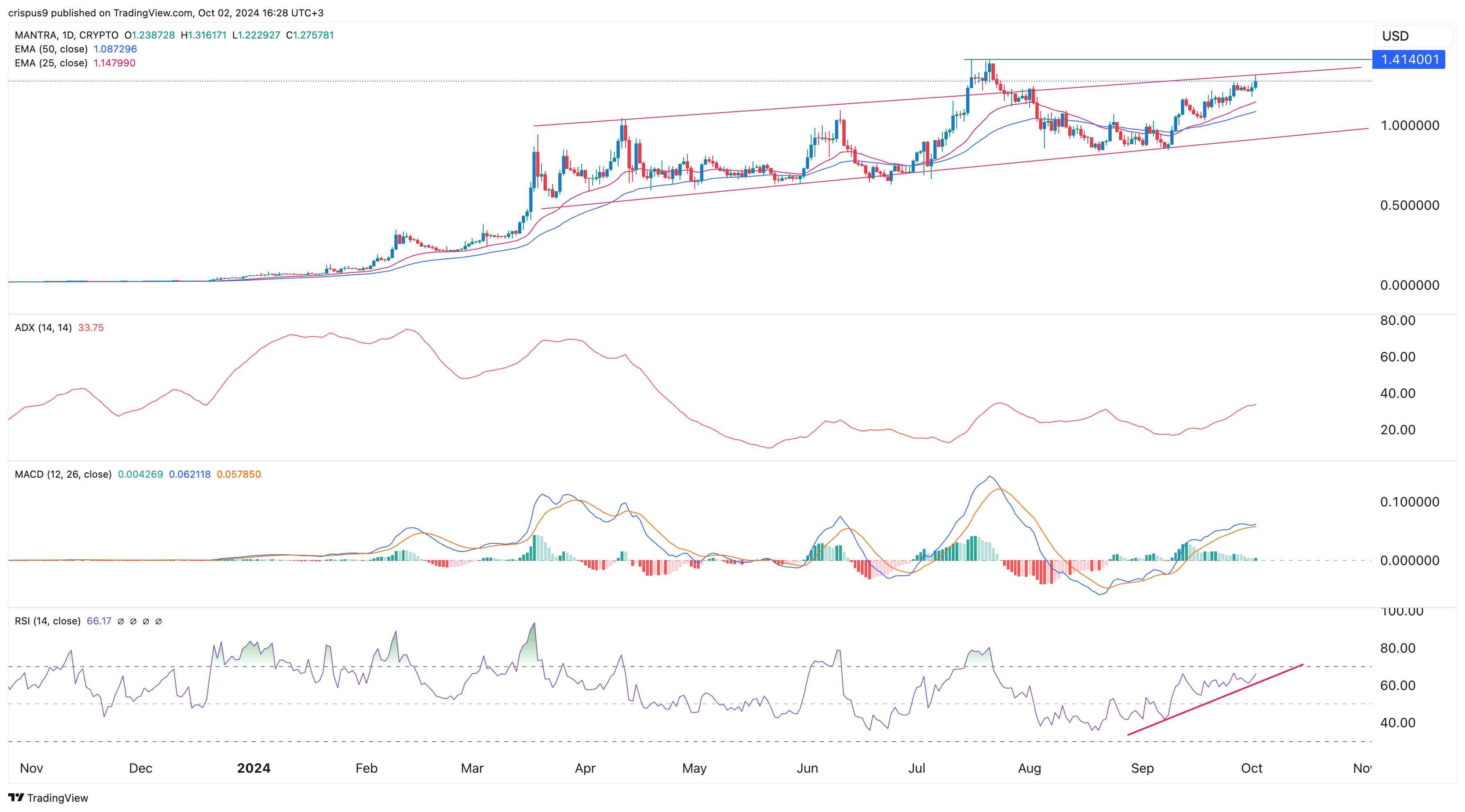

Mantra price has strong technicals

OM’s rally is further bolstered by its robust technical indicators. On the daily chart, the Relative Strength Indicator has been steadily climbing since August, when it hit a low of 36. It neared the overbought threshold of 70 around October 2nd.

As a crypto investor, I’m noticing an interesting development with the Average Directional Index (ADX), a tool we often use to gauge trend strength. Currently, it’s climbing up to 33. Generally, a trend is considered robust when it surpasses the 25 threshold, which it seems to be doing now.

Furthermore, it’s worth noting that both the moving averages in the MACD indicator have climbed as well. This suggests that the price of Mantra could potentially continue to increase, with its next potential reference point being $1.4140 – a level representing its all-time high and roughly 12% above its current value.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-02 17:04