As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by Mantra’s resilience and its recent surge. The 10% rise on Tuesday, following a crucial support level retest at $1, is indeed an encouraging sign for this token that has been making waves in the Real World Asset tokenization sector.

On Tuesday, September 3, Mantra, the widely-used digital currency for Real World Asset tokenization, rebounded following its touch of a significant support threshold.

Mantra (OM) token price rose by 10% as it retested the important resistance point at $1 for the first time since Aug. 25. It has jumped by 15% from its lowest point on Monday. The token rose after the developer unveiled a new version of Mantra Zone, a platform that lets users earn rewards and explore on-chain activities.

Recently updated interface offers:

— MANTRA – Tokenizing RWAs 🕉️ (@MANTRA_Chain) September 3, 2024

For example, users can invest in the Ondo Finance’s (ONDO) USDY liquidity pool and share part of the 888,888 OM that will be rewarded. Data shows that the pool has attracted over $2.19 million in assets. The pool has an estimated APR of 576%

The Mantra token experienced an increase as well, coinciding with the continuous climb of the network’s staking return. As per StakingRewards, Mantra boasts one of the highest yields in the cryptocurrency market. The staking reward reached a high of 21.17%, its peak since Aug. 23, following a drop to 20.9% in August. Additionally, the staking participation ratio approached half at nearly 50%.

Instead, let’s compare Ethereum (ETH) and Solana (SOL). Ethereum offers a staking return of about 3.05%, with a staking participation rate of 28.40%. In comparison, Solana provides a higher yield of approximately 6.87% and a greater staking ratio of 65.54%.

Mantra price has found a strong support

As a researcher observing the cryptocurrency market, I noticed an intriguing phenomenon – Mantra’s rebound took place despite the overall sentiment within the industry remaining subdued. Despite Bitcoin (BTC) failing to surpass the $60,000 mark, and the combined valuation of all coins retreating to a total worth of approximately $2.07 trillion, it was Mantra that bucked this trend.

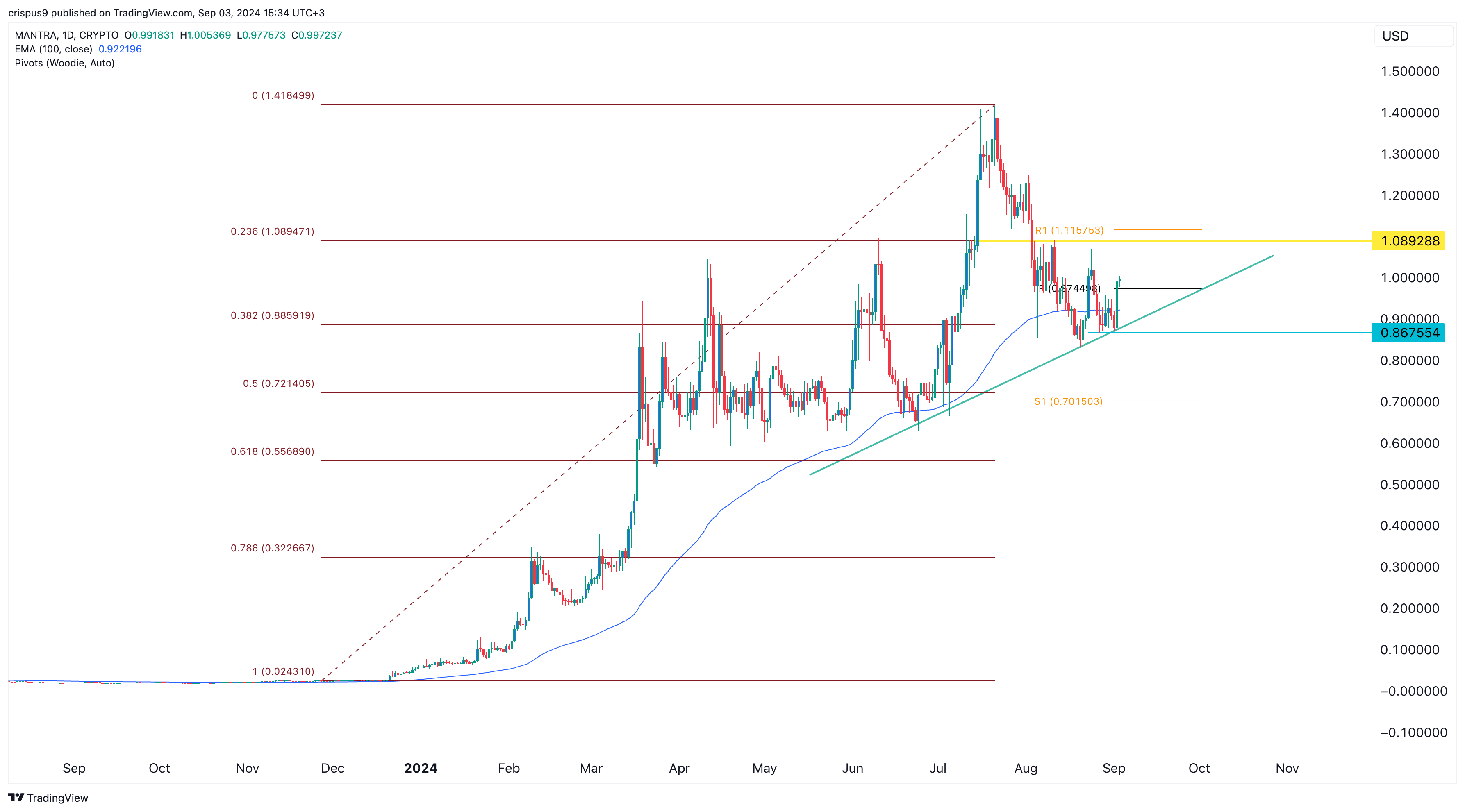

Its recovery occurred after falling to $0.8675, an important support level that coincided with the ascending trendline connecting the lowest swings since June 25. It was also along the 100-day exponential moving average and the 38.2% Fibonacci Retracement point.

It’s expected that Mantra will probably keep increasing, as investors aim for the significant resistance level at $1.090, which represents its 23.6% retracement point. However, if it falls below the ascending trendline, this could signal further declines, with bears looking to push prices down to the first pivot support at $0.70.

A potential risk for Mantra is that more traders are still shorting the token. According to CoinGlass, 50.75% of all traders are shorting the token, higher than Monday’s 49.9%. Its futures open interest of $17.7 million was also significantly lower than the July high of $37.4 million.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-09-03 16:23