As a seasoned crypto investor with over a decade of experience navigating the digital frontier, I find myself increasingly captivated by the strategic moves of companies like Marathon Digital Holdings. Their recent $67 million Bitcoin purchase following a $1 billion convertible note sale with a 0% interest rate is a testament to their long-term vision and risk appetite.

American Bitcoin mining company, Marathon Digital Holdings, invested around $67 million in their recent Bitcoin acquisition. This move followed a successful $1 billion bond issuance with zero percent interest rates.

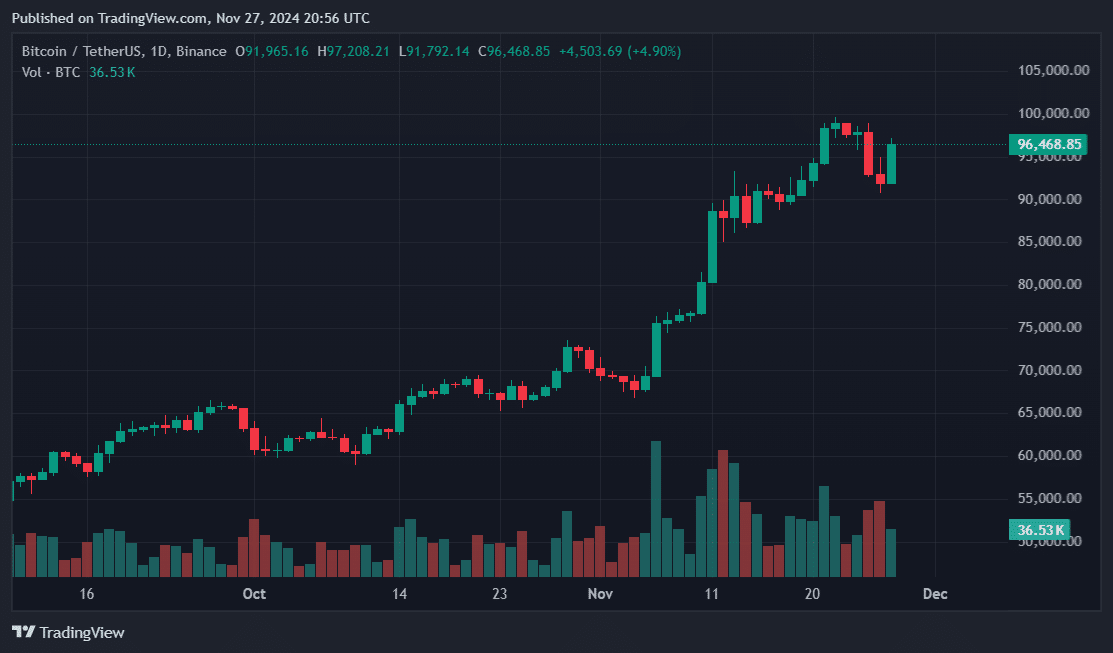

Based on an update from X by MARA Holdings, their Bitcoin (BTC) holdings have grown to 34,794 tokens, which equates to around $3.3 billion, given a price point of $95,000 per token. However, at the time this text was written on November 27th, BTC was being traded at $96,400.

Marathon Digital announced it purchased notes totaling $200 million and saved $160 million for potential Bitcoin acquisitions. The company suggested adopting a strategy known as “buying dips.” Additionally, Mara revised its year-to-date Bitcoin return, showing a 36.7% rise using an indicator that compares the expansion of Bitcoin holdings to share issuance dilution.

Corporate Bitcoin owners are increasingly adopting Bitcoin’s yield as a measure of performance, especially following the issuance of convertible notes. This trend was spearheaded by MicroStrategy, who, over a span of four years, amassed Bitcoin holdings partially funded through stock and note transactions.

We’re thrilled to announce some great news about our $1 billion convertible notes offering:

— MARA (@MARAHoldings) November 27, 2024

As a researcher, I’ve observed that various entities, such as Semler Scientific in the medical field, AI pioneers like Genius Group, and global powerhouse Metaplanet from Tokyo, have chosen to publicly disclose their Bitcoin reserves and Treasuries.

Nations and their administrations hurriedly worked on accumulating national strategic reserves of Bitcoin (BTC). U.S. Senator Cynthia Lummis suggested acquiring 4% of the total 21 million token inventory. The Brazilian Chamber of Deputies proposed a Bitcoin hedge to mitigate financial risks.

Additionally, many states showed interest, considering taking action ahead of federal governments. After President Donald Trump’s expected return to the White House, Pennsylvania proposed a Bitcoin reserve system and approved a Bitcoin Rights bill, which put forward on the table.

In Canada, Mayor Ken Sim of Vancouver has proposed a plan to maintain the city’s financial strength by adopting Bitcoin-compatible policies, such as creating a Bitcoin reserve.

breaking news: The mayor of Vancouver, Canada is advocating for the city to consider holding Bitcoin as a part of its reserve assets 🇨🇦.

— Bitcoin Magazine (@BitcoinMagazine) November 27, 2024

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-28 00:30