As a seasoned researcher with years of experience following the cryptocurrency market, I find Marathon Digital’s Q2 financial report to be a complex mix of challenges and opportunities. On one hand, it’s concerning to see such a significant drop in revenue and a net loss of nearly $200 million. The continuous underperformance against analyst expectations is a red flag that demands attention.

Marathon Digital, a Bitcoin mining firm, revealed in their Q2 financial statement that they offloaded more than half (50%) of the Bitcoin they mined in the quarter to cover operational expenses.

On Thursday, August 1, shares of Marathon Digital Holdings, an American cryptocurrency mining company listed on the stock market, experienced a decline of over 7% after their earnings report was released. The report revealed that the company’s revenue fell substantially below what experts had anticipated.

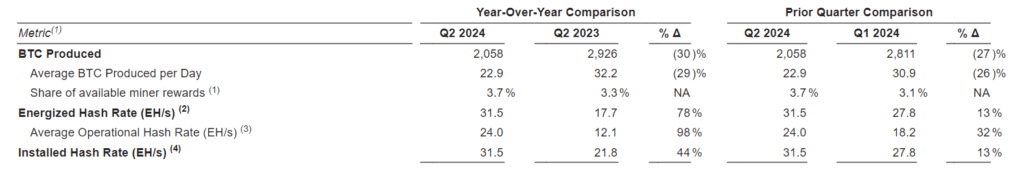

The report states that the company generated a total of 2,058 Bitcoins (BTC) in Q2, which is a 30% decrease compared to the same quarter in 2023. Marathon acknowledged that it was compelled to sell half of the mined Bitcoin during this period to meet operational expenses, as its losses skyrocketed close to $200 million.

Although Marathon saw an impressive 80% rise in quarterly earnings to $145.1 million, these figures fell short of analyst predictions of around $158 million. This discrepancy marks two straight quarters where the company failed to meet revenue expectations. The first instance was a 15% underperformance in Q1, as reported by Zacks Investment Research.

Marathon targets surge in hash rate power

As a crypto investor, I’ve been facing challenges lately due to unexpected equipment failures at Marathon, along with necessary transmission line maintenance, a surge in global hash rate, and the April halving event. It’s been a tough ride, but we’re doing our best to navigate through these difficulties.

Nevertheless, Thiel assured investors that Marathon had addressed and rectified the transformer problems at the Ellendale site after the quarter’s end. He also emphasized that the company aims to achieve “50 exahash of energized hash rate by the end of 2024, with further growth in 2025.”

Towards the end of July, Marathon revealed a $100 million investment in Bitcoin, following their “HODL” approach, which now gives them more than 20,000 Bitcoins in total. Additionally, they declared that they will keep all Bitcoin mined on their own and occasionally buy more strategically from the open market, as part of their updated plan.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-03 01:40