As a researcher with a background in finance and technology, I’ve followed Mark Cuban’s evolving stance on cryptocurrencies with great interest. In the past, he was dismissive of Bitcoin and even preferred bananas due to their utility. However, his recent investments have shown a significant shift towards digital assets, making up as much as 80% of his portfolio outside of Shark Tank.

Cuban, a well-known figure, has once again grabbed headlines by stating that Gary Gensler’s adversity towards cryptocurrency might negatively impact Joe Biden’s chances of winning the presidential election in November.

Billionaire investor and Shark Tank star Mark Cuban hasn’t always been a fan of cryptocurrencies.

Approximately four years ago, I held a strong skepticism towards Bitcoin. In fact, I expressed my preference for bananas due to their practical uses.

Looking back at 2022, the scene has significantly shifted. During an engaging conversation with comedian Jon Stewart, I, as an analyst, disclosed that approximately 80% of my investments outside of “Shark Tank” were centered around digital assets.

As a passionate crypto investor, I completely resonate with the entrepreneur’s optimistic viewpoint regarding decentralized autonomous organizations (DAOs) and smart contracts. I firmly believe that businesses built on collective governance and self-executing agreements have immense potential to shape the business landscape of the 21st century.

In his opinion, regulatory stagnation is the major hindrance preventing digital assets from reaching their full capabilities in the United States.

Cuban has become a harsh critic of the Securities and Exchange Commission (SEC), led by Gary Gensler, for allegedly failing to take action as FTX was on the verge of collapse.

Last summer, the 65-year-old criticized the SEC for overconfidence and emphasized that the extensive financial harm inflicted by Sam Bankman-Fried could have been prevented. Referring to Japan’s experience following the collapse of Mt. Gox in 2014, he expressed this viewpoint on social media.

When the FTX platform collapsed, no one in FTX Japan incurred any losses. Had the USA/SEC instituted stringent regulations, such as mandating the segregation of customer and business funds and implementing specific wallet requirements, none of us would have suffered financial losses due to the FTX incident.

Mark Cuban

The Voyager debacle

It’s true that hindsight provides perfect clarity. Regarding Cuban, although his prominent public image didn’t link him to FTX’s collapse like Kevin O’Leary and others, it’s worth mentioning that Cuban has made questionable investments in the past.

Last week, I came across an article in The Dallas Morning News revealing that Cuban is still dealing with lawsuits linked to his association with the failed crypto lending platform, Voyager Digital.

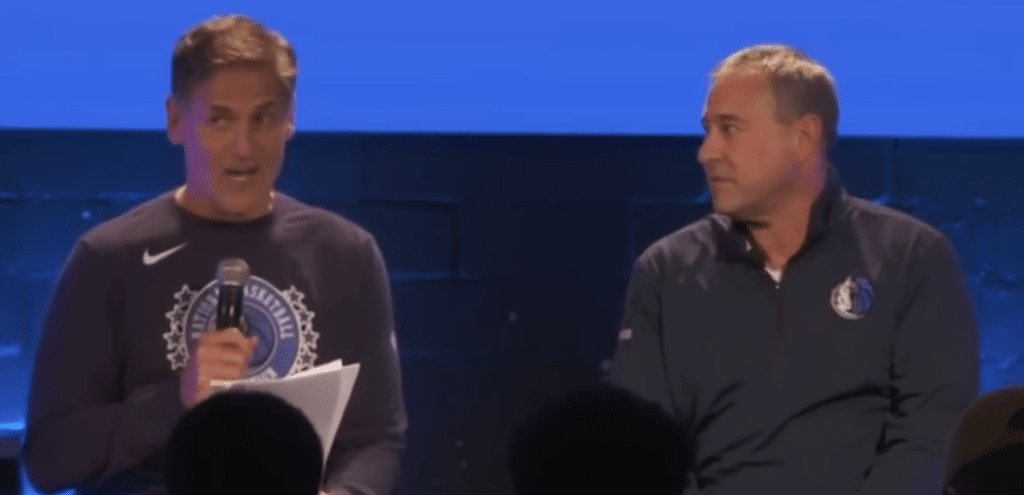

Mark Cuban, the proprietor of the Dallas Mavericks, announced a significant five-year collaboration with Voyager in 2021. During this period, Cuban expressed his intentions to broaden the horizons of sports enthusiasts regarding cryptocurrencies, expanding upon the team’s previous acceptance of Bitcoin and Dogecoin for ticket sales and merchandise. In a now-controversial quote from a press conference, he shared:

“I think Voyager is going to be a leader among sports fans and crypto fans around the country.”

Mark Cuban

In July 2022, within only seven months of Cuban’s assertion, Voyager shocked the market by halting withdrawals and deposits. The company later disclosed that customers might not fully recover their losses. A lawsuit followed in August, alleging that Cuban had lured unsuspecting investors to pour all their savings into what was essentially a “Ponzi scheme.” Ouch indeed, as Cuban had previously claimed Voyager was “as close to risk-free as you’ll find in crypto.”

According to the most recent article in the Dallas Morning News, unlike other athletes who have collectively paid $2.4 million in damages, Mark Cuban remains unwilling to reach a settlement. He has consistently refuted accusations that he deceived investors.

Despite Cuban’s strong criticisms towards FTX’s issues, it’s important to note that his past endorsements of crypto companies also have some flaws.

If Joe Biden fails to win, it’s likely that you can credit Gary Gensler and the New York SEC for this outcome. The crypto community, particularly younger and independent voters, highly value this digital asset. Regrettably, Gensler has yet to shield a single investor from fraud in this sector. All he has managed to accomplish is making it extremely challenging for legitimate players to operate within the regulations.

— Mark Cuban (@mcuban) May 10, 2024

What’s happening now?

As a analyst, I’d put it this way: I have found myself once again in the spotlight following my assertion that Gary Gensler’s appointment as Chair of the Securities and Exchange Commission (SEC) could potentially impact Joe Biden’s prospects in the upcoming presidential election in November. I felt compelled to issue a cautionary statement, emphasizing:

As a crypto investor, I’d like to emphasize that our community’s voice matters in the upcoming elections. We, the crypto enthusiasts, are a significant force to be reckoned with and we will make our presence felt. If President Biden is serious about addressing the regulatory challenges within the crypto industry, then passing legislation defining registration specifically for crypto would be an effective solution. Let us work together towards a clearer regulatory landscape that benefits all involved.

Mark Cuban

Progress is being made in this regard. Last month, Republican Cynthia Lummis and Democrat Kirsten Gillibrand introduced legislation focusing on stablecoins.

As an analyst, I’m thrilled to share that the Financial Innovation and Technology for the 21st Century Act (FIT21) is anticipated to reach a pivotal floor vote soon. This development brings optimism to the crypto community, as it may provide more certainty for firms in this sector, and offer clearer definitions regarding which regulatory body, either the Securities and Exchange Commission (SEC) or the Commodities Futures Trading Commission (CFTC), will oversee specific aspects.

As a researcher studying social media influence, I can assert that Mark Cuban, with his impressive following of 8.8 million people and an open public profile, is undeniably one of the most prominent and vocal advocates for cryptocurrencies in the digital sphere.

Although it’s extremely uncertain that Biden will relinquish the upcoming election due to cryptocurrencies alone, the wealthy businessman is persistently using his influence to prioritize the future of digital currencies as a significant national concern.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-15 13:04