In a rather curious turn of events, the inflation rate of the U.S. took a graceful bow in March, falling from a commendable 2.8% in February to a more modest 2.4%. This surprising performance came just before the May Federal Reserve shindig and was conveniently timed with President Trump’s announcement of a temporary 90-day vacation for some tariffs. Who knew tariffs needed a holiday? 😂

The Inflation Tango: Stocks and Bitcoin Stumble

It seems inflation decided to cool its heels, as revealed by the latest Consumer Price Index (CPI), a pedagogical contraption weaving together the spiraling costs of goods and services across our vast land. According to the U.S. Bureau of Labor Statistics, the CPI for All Urban Consumers (CPI-U) experienced a dramatic decline of 0.1 percent last month, following a previous rise of 0.2%. Ah, the delicate dance of numbers! 💃

The all-items index, meanwhile, proudly reported a 2.4% increase over the past year, prior to seasonal adjustments. Should the inflationary beast remain tamed, the decisions of the Federal Reserve will hinge upon a variety of delightful factors, including whimsical economic forecasts and their noble quest for price stability and full employment. At present, they seem cautiously perched upon their bench of rates, with dreams of reductions by the end of 2025. Let’s hope they don’t fall off! 😅

Interestingly, the CME’s Fedwatch tool indicates a 79.1% probability that the central bank will let the federal funds rate nap through May. In an unexpected twist, President Trump’s move to pause some tariffs has triggered a wave of market gains. The European Union has also decided to take it easy for 90 days while sipping tea with the U.S. leader. Bitcoin, on the other hand, remains trapped in a glass case of emotion, hovering just below the $82,000 threshold, while gold takes a big gulp of success at $3,134 per ounce. ✨

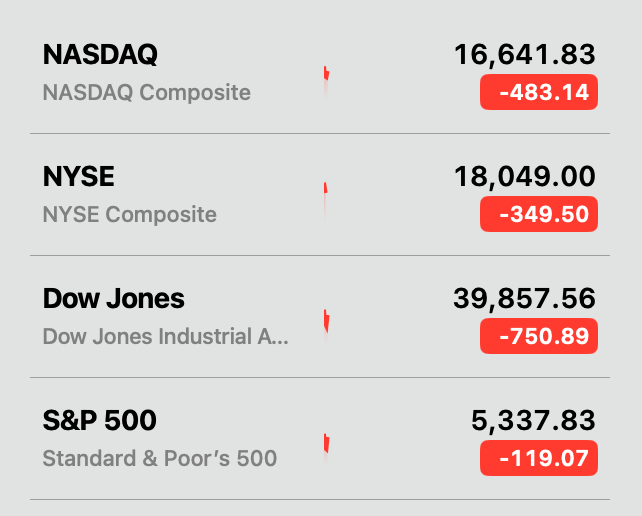

As Thursday dawned, the stock market experienced a dramatic plummet following a historic jubilee on Wall Street that reached its zenith the previous afternoon. The Nasdaq opened down 483 points, the Dow Jones Industrial Average took a nose dive of 750 points, and the S&P 500 slumbered down by 119 points a mere fifteen minutes into the market’s opening. “Inflation is down, jobs are up, and behold, the Golden Age of America is here!” insists the White House, as if reciting a tragicomedy. By 9:45 a.m., bitcoin ( BTC) was meandering around the $81,000 range, attempting to keep pace with the stocks’ graceful descent. Wonderfully tragic, isn’t it? 😜

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-04-10 17:27