As a seasoned researcher with a decade of experience under my belt, I find the strategic move by Metaplanet to secure a loan for Bitcoin investments intriguing. Having witnessed the rise and fall of numerous markets, I can’t help but be reminded of the old saying, “Buy low, sell high.”

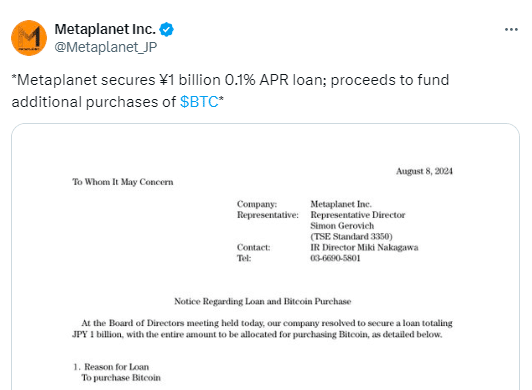

Metaplanet, a Japanese investment firm, has obtained a $6.8 million loan from shareholder MMXX Ventures to bolster its Bitcoin portfolio. This loan, charging an annual interest rate of 0.1% and spanning six months starting on August 8, will be repaid in full at once.

Metaplanet intends to use this loan to buy around 118.5 Bitcoins at their present market value. This decision follows on from the company’s recent disclosure of plans to gather $70 million through a stock rights offering, with approximately $58 million set aside for Bitcoin acquisitions.

Metaplanet’s approach mirrors MicroStrategy’s actions, as both companies are considering Bitcoin as a protective measure against Japan’s rising debt and a depreciating yen.

At the Bitcoin 2024 conference in July, CEO Simon Gerovich emphasized that their company had been struggling financially in the past. However, he expressed optimism about Bitcoin’s potential to bolster the firm’s future success.

So far, Metaplanet has obtained approximately 246 Bitcoins, equivalent to around $13.95 million, in seven distinct transactions. The average cost per Bitcoin purchased by the company is about $65,145. This represents a drop of 12.8% since their first Bitcoin investment on April 23.

Although experiencing a decline, Metaplanet’s stock price has significantly increased by approximately 290% since it revealed its Bitcoin strategy on April 9, currently trading at $4.39 (643 Japanese yen). However, it has descended from its peak of $20.50 (3,000 Japanese yen) reached on July 24, partly due to a 10% drop in Bitcoin’s value during the crypto market’s “Black Monday” on August 5.

Metaplanet’s strategic loan aimed at increasing Bitcoin investments signifies a daring wager on digital currencies as a protection against economic turbulence. This action echoes the rising tendency among investment companies to utilize Bitcoin for lasting monetary security.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-08 09:08