As a researcher with a background in cryptocurrency and financial regulation, I find it fascinating to observe how the implementation of MiCA regulations in Europe has significantly impacted the market share of compliant stablecoins, specifically Circle’s USDC and Euro-pegged stablecoin (EURC).

According to the data, only one company has experienced significant growth in demand for compliant stablecoins as Europe prepares to enforce MiCA regulations.

Europe’s MiCA regulation for crypto assets in Europe, which aims to oversee the crypto market with a focus on stablecoins, has incited a scramble among issuers to adhere. Surprisingly, only one stablecoin company, Circle, has gained an advantage from these strict guidelines thus far.

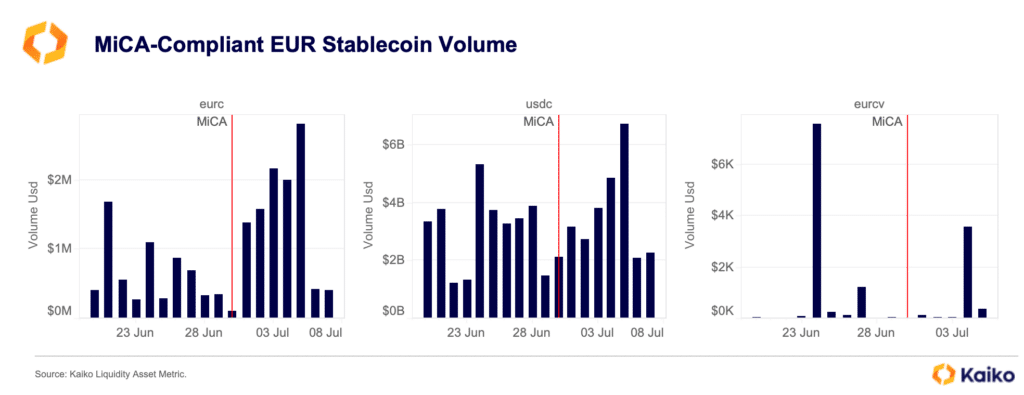

Based on information from Kaiko, a well-known blockchain data analyst firm based in France, Circle’s Euro-pegged stablecoin (EURC) and its widely used USD Coin (USDC) have seen the most substantial growth in daily trading volumes since the enactment of MiCA.

As an analyst, I’ve observed that Société Générale experienced an increase in trading volume after easing certain restrictions. According to data from Kaiko, this uptick reached approximately $4,000. However, it is important to note that this number remains relatively small, possibly because Euro Convertible (EURCV), the bank’s stablecoin, is only available for trading on Bitstamp at this time.

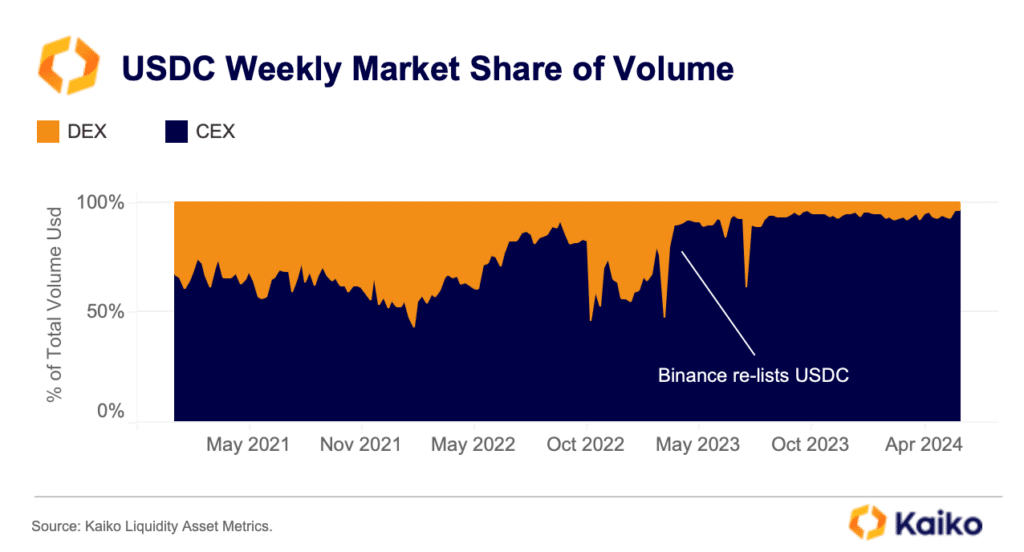

Over the past year, the proportion of compliant stablecoins has risen noticeably, indicating a growing preference for transparent and regulated options. To date, USDC has predominantly reaped the benefits from this trend.

Kaiko

As a crypto investor, I’ve noticed that non-compliant stablecoins hold the lion’s share of the market, making up approximately 88% of the total stablecoin volume. However, this could change with the implementation of MiCA (Markets in Crypto-Assets) regulation. This Paris-based firm predicts that exchanges and market makers may start favoring compliant stablecoins over their non-compliant counterparts due to increased regulatory certainty and risk mitigation. So, I might consider diversifying my portfolio towards compliant stablecoins as the market shifts in this direction.

Some major cryptocurrency platforms, including Binance, Bitstamp, Kraken, and OKX, have recently initiated the removal of non-compliant stablecoins from their offerings for European users.

In the year 2024, the weekly trading volume for USDC reached an astounding $23 billion. This represented a significant increase from the $9 billion traded in 2023 and the $5 billion traded in 2022. Kaiko reports that this surge led to a new record high market share for USDC. The cause of this growth is attributed to the increased adoption of USDC on both decentralized and centralized trading platforms.

As a researcher studying the digital currency market, I’ve discovered that one significant reason for US Dollar Coin (USDC) gaining popularity is its expanded role in settling perpetual futures trades. According to recent reports from major exchanges Binance and Bybit, the proportion of Bitcoin (BTC) and Ethereum (ETH) perpetual contracts settled in USDC has significantly increased. Specifically, the percentage of BTC and ETH perpetuals traded with USDC denomination surged from a mere 0.3% to 3.6% within just six months. Similarly, the usage of USDC in Ethereum perpetuals trading saw a substantial rise, with ETH-USDC trade volume escalating to over 6.8% from 1% at the beginning of the year.

Around the beginning of July, Circle made headlines as the initial stablecoin firm to meet MiCA regulations’ requirements. Simultaneously, concerns surfaced regarding Tether’s future in Europe following the removal of its Euro-backed stablecoin, Tether EURT, from exchanges like Bitstamp. Furthermore, Uphold, a European crypto trading platform, discontinued support for USDT and several other dollar-pegged stablecoins.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-07-09 11:24