As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by Michael Saylor’s bold prediction and unwavering confidence in Bitcoin’s price trajectory. His perspective, rooted in his deep understanding of the digital asset space, is not only captivating but also compelling.

The chief executive officer of MicroStrategy, Michael Saylor, anticipates that Bitcoin‘s value could reach $100,000 by the end of this year, asserting that the result of the 2024 U.S election represents one of the most significant events in the last four years for Bitcoin.

In a recent interview with CNBC on November 14th, MicroStrategy’s CEO announced plans for a New Year’s Eve celebration at his home, should Bitcoin (BTC) reach an unprecedented high of $100,000. When prompted about potential risks that could cause Bitcoin to plummet to $30,000, Saylor confidently stated that the value of BTC will not dip below $60,000.

According to Saylor, things are looking promising and he’s expecting them to get even better. He’s preparing for a grand celebration worth $100,000, tentatively scheduled around New Year’s Eve at his residence. Given this, it wouldn’t be unexpected if the costs associated with the party are incurred by November or December.

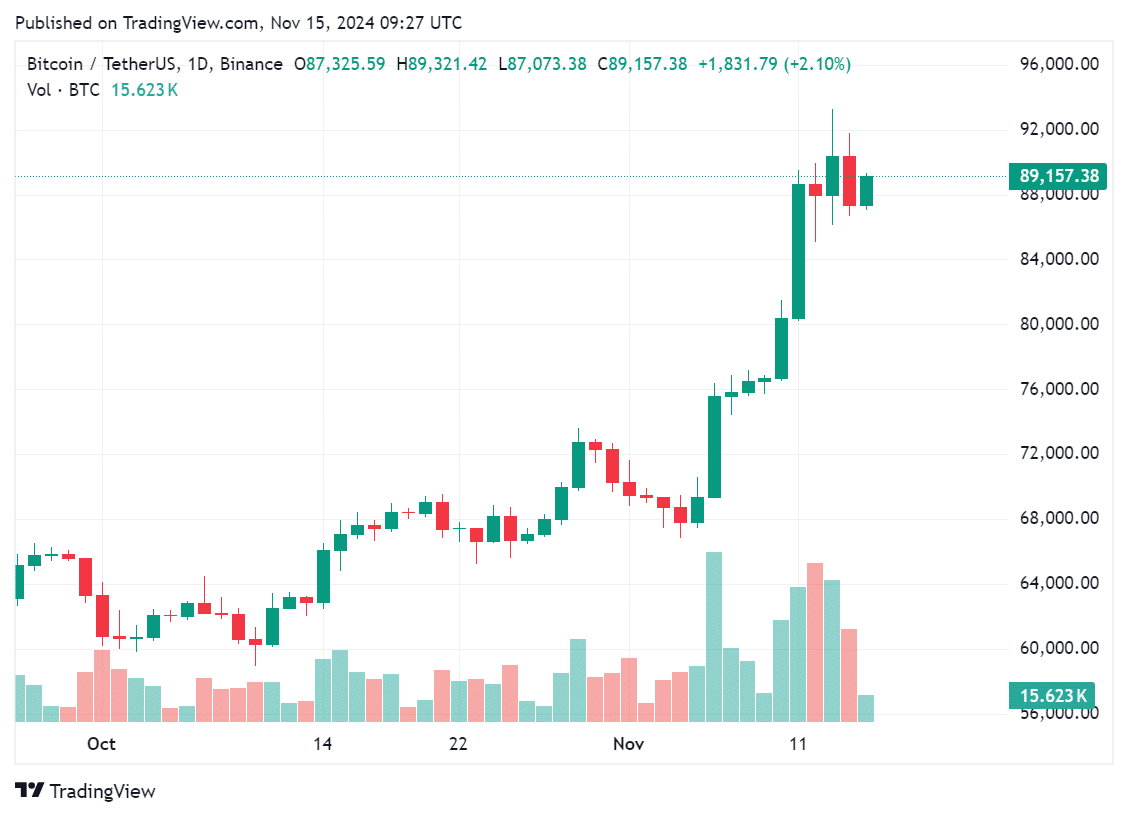

Just now, Bitcoin set a new record high of more than $93,400 following the release of the U.S. CPI report on November 13th. As per crypto.news data, it is currently being traded at $89,083, representing a drop of about 1.7% in the last 24 hours of trading.

Saylor asserts that Bitcoin’s continuous price surge can be linked to President-elect Trump’s victory and the Republican party’s control over both the House of Representatives and Congress. He explains that this “red wave” is likely one of the most significant events in the past four years for Bitcoin.

Immediately following Donald Trump’s election as the U.S. President, Bitcoin hit an unprecedented peak of $75,000. Since Bitcoin usually serves as a benchmark for other cryptocurrencies, coins like Ethereum (ETH), Solana (SOL), and even meme coins such as cat in a dog’s world (MEW) and Peanut (PNUT) have seen a surge in value as well.

According to Saylor, this situation is extremely positive for digital currencies. It’s advantageous for the cryptocurrency sector. We can expect more favorable Bitcoin policies in the future. We may witness a regulatory framework for digital assets. He also suggests that the ongoing battle against crypto might come to an end.

As I write this, it’s known that 272 pro-cryptocurrency candidates have been successfully elected to the House of Representatives, with most of these representatives belonging to the Republican party.

On November 11th, it was revealed that Michael Saylor disclosed MicroStrategy had invested an extra $2.03 billion in Bitcoin, increasing their total Bitcoin assets to 279,420 tokens. Currently, MicroStrategy boasts the most substantial Bitcoin reserve among all corporations.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-15 14:04