As a seasoned crypto investor with a decade of experience under my belt, I find Michael Saylor’s presentation to Microsoft’s board to be nothing short of compelling. Having witnessed the meteoric rise of Bitcoin and its potential to disrupt traditional finance, I can confidently say that his argument for adopting Bitcoin as part of Microsoft’s balance sheet makes a lot of sense.

Michael Saylor pledged to Microsoft’s executive team that he could succinctly outline the benefits of Bitcoin within a span of three minutes, and indeed, he delivered on his promise.

As an analyst, I am reporting that Michael Saylor, Executive Chairman of MicroStrategy, fulfilled his promise by presenting a strategic reserve of Bitcoin to Microsoft’s board on December 1st. He emphasized that Bitcoin represents a transformation of digital capital and suggested that Microsoft should incorporate Bitcoin into their balance sheet over the coming years.

It’s anticipated that Bitcoin could become one of the most significant financial assets globally, potentially representing approximately $280 trillion in total value over the next two decades. This projected worth would surpass both gold and art markets, which are currently estimated to be around $45 trillion and $110 trillion respectively.

Saylor further pointed out that it was evident Microsoft relied heavily on digital capital, as the yearly growth of Bitcoin’s price far surpassed Microsoft shares by a factor of twelve. Shares of MicroStrategy (MSTR), following their acquisition of Bitcoin, soared by an astonishing 3,045%, whereas Microsoft’s performance was comparatively modest at just 103%.

In simpler terms, Saylor emphasizes in his YouTube presentation that Bitcoin stands out as the most valuable asset one could acquire. The statistics clearly support this viewpoint. It’s more advantageous to invest in Bitcoin than to buy individual stocks or hold bonds. If your goal is to surpass conventional returns, Bitcoin is a must-have for you.

The political and financial backing, exemplified by the Trump administration and Bitcoin ETF’s offerings on the stock exchange, is likely to significantly increase Bitcoin adoption in the coming years. Consequently, Microsoft is also anticipated to join this trend.

Michael Saylor gives a choices

Saylor proposes two options to the Microsoft board: either stick with the traditional fiscal approach, which progresses gradually and raises investor risks, or modernize that approach by adopting the future of Bitcoin, promising faster growth.

He also offers Bitcoin24 to the boards, which customizes Bitcoin products for corporations, and forecasts Microsoft shares would rise up to $584 from the recent share price.

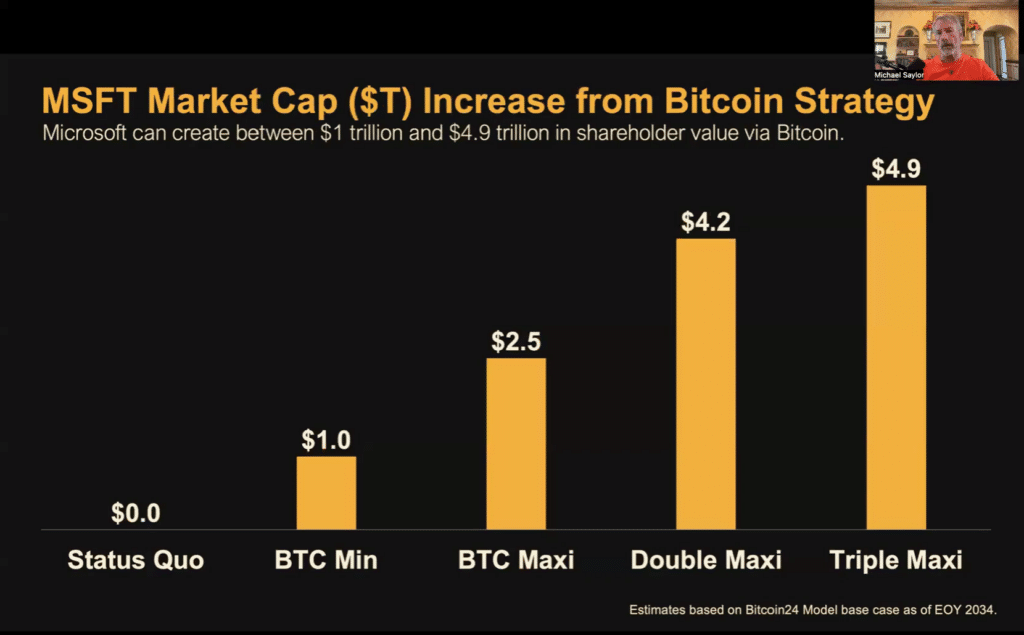

If the company adopts a strategic reserve similar to Bitcoin, its market value per share could potentially increase significantly, ranging from 1 trillion dollars to approximately 4.9 trillion dollars.

As an analyst, I foresee a significant shift in the risk-reward profile for investments between Bitcoin and Microsoft shares. The predicted decline of perceived value derived from Bitcoin investment, currently at 95%, will drop down to approximately 59%. Simultaneously, the annual recurring revenue associated with my Microsoft holdings is projected to surge from a modest 10.4% to a more substantial 15.8%. This transformation in the risk and revenue landscape presents an intriguing opportunity for strategic investment decisions moving forward.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-02 05:04