As a seasoned crypto investor with a knack for navigating the volatile waters of digital assets, I find myself intrigued by the recent turn of events surrounding MicroStrategy. Having witnessed Bitcoin’s meteoric rise and subsequent corrections over the years, I am no stranger to the rollercoaster ride that is cryptocurrency investing.

In simpler terms, MicroStrategy’s market value plummeted by approximately 35% over the past few days, amounting to a staggering loss of over $30 billion since November 21. This massive decrease has once again sparked debates about its function as a tool for investing in Bitcoin on margin.

In my analysis, the publication of the Kobeissi Letter on the 26th of November brought to light an unexpected decline in the company’s performance. This revelation has raised intriguing questions regarding the company’s role as a Bitcoin investment vehicle that operates under leveraged conditions.

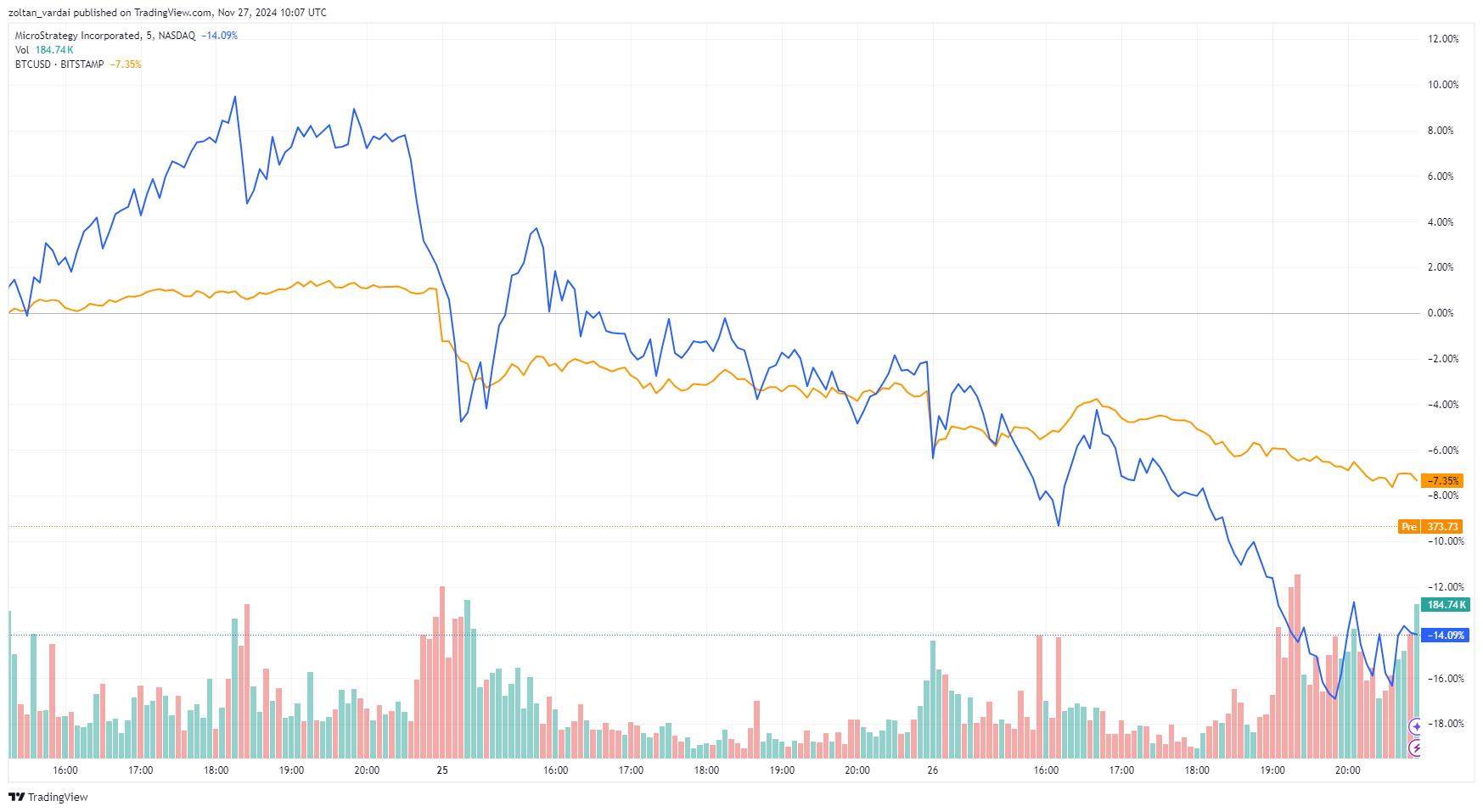

Over a span of four consecutive trading days, MicroStrategy’s market value decreased by a staggering $30 billion, and its stock price (MSTR) dropped a significant 35%. This is the largest decline in MSTR’s history, as pointed out by The Kobeissi Letter. This drop in stock price appears to follow Bitcoin’s correction after it reached an unprecedented high of $99,800 on November 22. On November 27 alone, MSTR experienced another dip of 7.5%, trading at $354.10.

It has emerged that retail investors have significantly increased their activity in buying MicroStrategy shares, amounting to approximately $100 million over the last week. Specifically, on November 22nd, these individual traders invested a record-breaking $42 million in MicroStrategy stock in a single day.

Significant organizations, such as Allianz, purchased approximately 24% of MicroStrategy’s $600 million bond issue in March, which underscores their ongoing enthusiasm for MicroStrategy’s approach to Bitcoin.

Regardless of the recent decline, both Bitcoin and MicroStrategy have experienced significant growth when viewed over a longer period. Specifically, in the last month, the value of Bitcoin increased by approximately 44%, and MicroStrategy’s shares saw a surge of more than 32%.

Compared to the end of last year, the price of Bitcoin has increased by 146%, while shares in MicroStrategy have soared over 599%. This highlights that MicroStrategy has a significant investment tied to Bitcoin’s success. Furthermore, MicroStrategy’s decision to offer $2.6 billion in notes has attracted more investors, demonstrating their dedication to their strategy focused on Bitcoin.

The Kobeissi Letter emphasized the growing volatility of MSTR, noting its 35% drop was over four times Bitcoin’s correction. The report attributed this to heightened retail interest, raising concerns about MicroStrategy’s role as a Bitcoin proxy.

With Bitcoin nearing the $100K mark, MicroStrategy’s dual role as both a business intelligence company and a Bitcoin investment platform is likely to face continued examination.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

2024-11-27 18:12