As someone who has navigated through numerous market cycles and geopolitical storms over the years, I find the current market reaction to the escalating conflict in the Middle East quite intriguing. It seems that investors are becoming more resilient, more adept at managing risk, and less prone to panic-driven decisions – a testament to their growing maturity and experience.

Is it plausible that financial markets remain composed despite the turmoil in the Middle East, or could Bitcoin‘s resilience to global political upheaval be a misleading perception, and if so, what might we be overlooking?

Table of Contents

Missiles fly, Bitcoin steady

About a year back, Israeli Prime Minister Benjamin Netanyahu proudly addressed the United Nations General Assembly, basking in the seeming tranquility of the Middle East. Yet, the current picture presents a stark contrast.

As we approach the first anniversary of the continuous conflict in Gaza, it’s important to note that this dispute has grown far beyond its initial boundaries. Now, with Iran becoming a part of it, the animosity between Israel and Hezbollah is intensifying dramatically, stirring up concerns about a potential wider regional conflict.

On September 27, there was a significant shift as it was alleged that Hezbollah’s leader, Hassan Nasrallah, met with an unfortunate end in an Israeli air raid. Reports suggest that Nasrallah perished from asphyxiation after being confined within his hidden underground shelter, which was struck by approximately 80 tons of powerful bombs designed to penetrate fortified structures.

In Beirut, the same attack claimed the life of IRGC commander Abbas Nilforoshan, significantly weakening the power of Iran-supported militia groups in the region.

As an analyst, I find it striking how these tragic deaths have escalated tensions to new heights. In response, Iran decided to retaliate merely a few days later. On October 1st, they launched a massive missile assault against Israel, unleashing around 180 missiles – a level of intensity that surpassed the barrage we witnessed in April.

Although numerous missiles launched by Iran were thwarted by Israel’s defense systems, some managed to reach their intended targets, impacting military bases, eateries, and educational institutions. The Islamic Revolutionary Guard Corps of Iran reported an impressive 90% success rate for their attacks, employing hypersonic missiles as part of the operation.

In light of the increasing conflicts, you’d think markets would behave as they usually do in such situations. However, the latest trends suggest a contrary narrative.

In July, the assassination of Hamas leader Ismail Haniyeh caused a significant ripple effect, being felt not only in conventional financial markets but also in the digital currency world. As a result, the value of Bitcoin (BTC) noticeably declined.

As an analyst, I find it surprising that, in spite of the escalated tensions following Nasrallah’s demise and Iran’s missile strikes, the cryptocurrency market, notably Bitcoin, has shown an unusual resilience against the traditional sell-off panic during conflicts.

Why did the markets respond so dramatically in April and August, only to show strength against this recent escalation? Let’s delve further into the factors that have shifted and consider their potential implications as we move ahead.

From August’s sell-off to September’s rally

On July 31st, there was a significant change in the political landscape of the Middle East as the influential Hamas leader, Haniyeh, was tragically killed in Tehran.

Haniyeh has played a significant role within Hamas since its inception in 1987, holding positions of influence that included serving as Prime Minister of the Palestinian Authority. Tragically, he became the highest-ranking Hamas leader to be killed since the Israel-Hamas conflict commenced, leaving a profound impact on the organization and sparking heightened tension throughout the region.

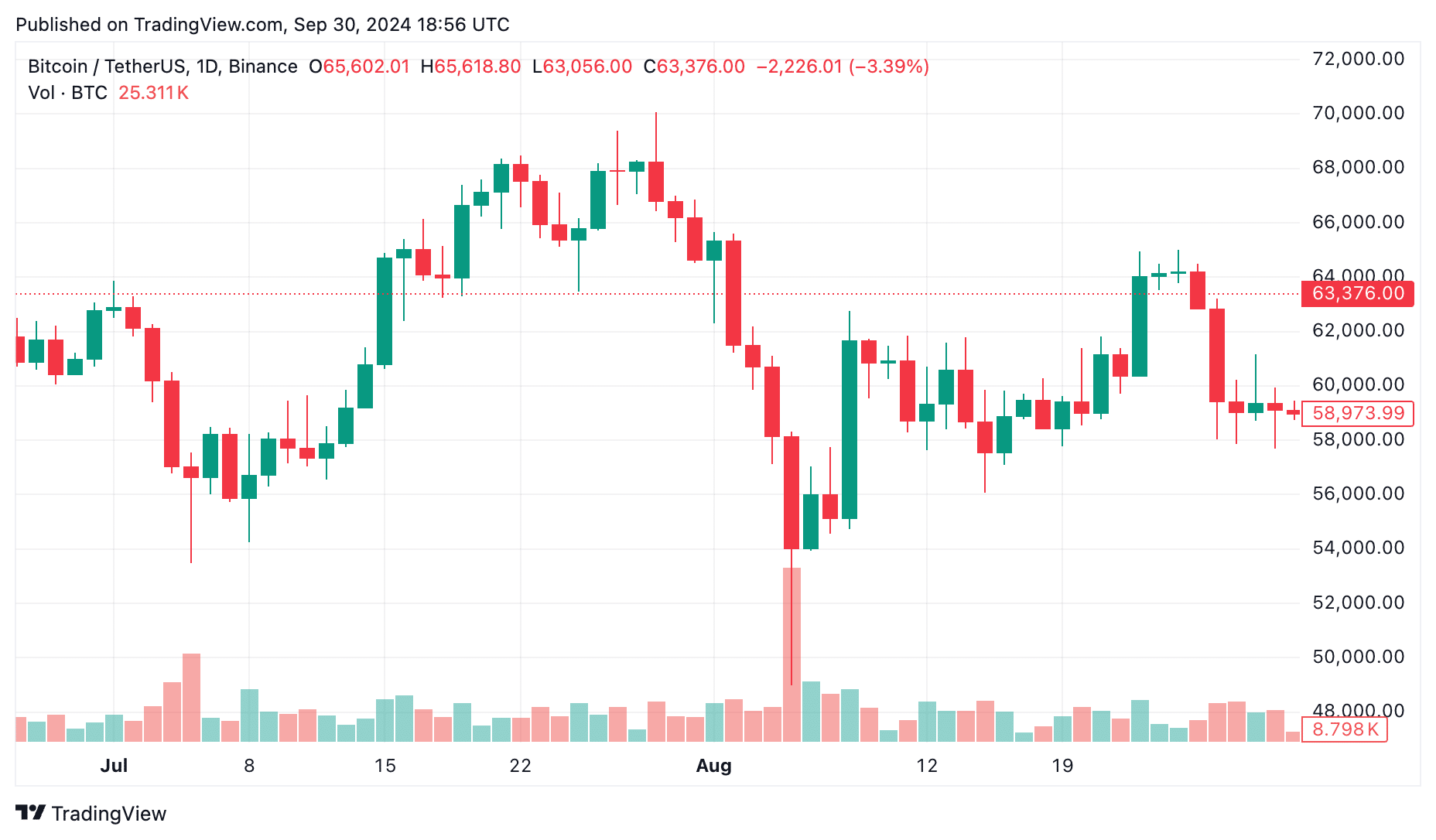

Upon the announcement, markets swiftly responded. Bitcoin, previously hovering around $66,500, experienced a significant drop, shedding nearly 10% of its worth in merely a few days. By August 4th, it had fallen to $60,500.

Over the course of four days, from July 31 to August 4, the NASDAQ experienced a significant drop, going from 17,600 points down to 16,200 – that’s an 8% decrease. Similarly, the S&P 500 saw a decline, moving from 5,500 points to 5,150, which is roughly a 6.5% drop. In simpler terms, both major stock markets took a substantial hit during this period.

Initially concerned, investors found the financial markets, which had been unsteady due to broader economic factors, becoming even more volatile. Meanwhile, cryptocurrencies began mirroring the risky behavior of tech stocks in the market.

At no better moment did this geopolitical event occur. Simultaneously, the worldwide economy was grappling with growing concerns about a recession. To make matters worse, the yen carry trade was unraveling, and there were rumors of stagflation looming on the horizon. All in all, the situation seemed quite bleak.

On August 5th, a day that would later be referred to as “Crypto Black Monday,” I witnessed yet another tumultuous turn for the crypto market. Major cryptocurrencies experienced a significant setback. For instance, Bitcoin plummeted to approximately $53,000, marking a substantial 20% decline from its peak values in late July.

It appears that both Ethereum (ETH) and Solana (SOL) found themselves in a similar descending trend, resulting in substantial losses for investors. The mounting concern among them stemmed from the possibility of an escalating conflict in the Middle East, which could further exacerbate economic downturn worries.

By the time we reach September 2024, the conflict has intensified once more. The formidable Hezbollah, a militant organization backed by Iran in Lebanon, has intensified its assaults against Israel.

On September 20th, Hezbollah fired multiple rockets towards northern regions of Israel, with cities like Haifa among their targets. This action increased the level of tension in the area.

Following this incident, Israel responded with approximately 400 air raids on Hezbollah’s bases in Lebanon, which represented the deadliest confrontation between them since the 2006 war between Israel and Hezbollah. This military action led to over 490 Lebanese casualties, greatly intensifying the ongoing conflict.

Subsequently, on October 1st, Iran intensified the tension by carrying out an extensive missile strike against Israel, moving the region towards a wider conflict.

Despite the severity of the escalating conflict, the crypto markets have responded differently this time. Rather than experiencing a stark downturn, Bitcoin has remained relatively stable, dropping only a few percentage points.

On October 2nd, I find Bitcoin (BTC) trading roughly at $61,800, representing a dip of nearly 3% in the past 24 hours. Interestingly, despite this minor setback, BTC remains above the crucial $60,000 support threshold. Conversely, Ethereum (ETH) has experienced a steeper descent, dropping by more than 6%, and currently trading around $2,480.

Liquidity and central bank policies shield crypto

One key difference between the two periods is the broader macroeconomic environment. Back in August, global markets were still grappling with a storm of negative data.

Previously, China’s economic recovery following the pandemic appeared to be slowing down, while the U.S. Federal Reserve maintained a strict monetary policy without any indication of relaxation. As a result, funds were becoming increasingly scarce in all sectors.

Then came a surprise in August — the Bank of Japan (BoJ) raised interest rates for the first time since 2007. This decision sent shockwaves through global markets.

As an analyst, I’ve noticed that some investors have been leveraging Japan’s low-interest rates by borrowing inexpensive yen and investing these funds into assets with higher returns, a practice known as the ‘yen carry trade.’ However, when the Bank of Japan raised interest rates, the expense of borrowing yen became more costly, compelling investors to liquidate their positions.

Due to this development, people swiftly sold off their riskier investments, such as cryptocurrencies, leading to a sharp decline in prices. Cryptos like Bitcoin, Ethereum, and others found themselves in a downward spiral as the market’s liquidity drained away.

By October, things appear to have changed significantly. On September 18, the Federal Reserve took an unexpected action by reducing interest rates by 0.5%, thereby replenishing the global financial market with essential liquidity.

Simultaneously, China is implementing various economic boost strategies to rekindle its slowing expansion.

Historically, cryptocurrencies often thrive when market liquidity is abundant, and that’s the case right now. The current increase in Bitcoin’s value, along with Ethereum’s ascent, can largely be attributed to the Federal Reserve adopting a more flexible monetary policy approach.

However, it’s not just liquidity that matters; there are other factors as well. For instance, concerns over a potential global economic downturn have lessened recently. The U.S. employment figures have exceeded expectations, and while inflation remains an issue, it seems to be showing signs of slowing down.

This development has significantly reduced concerns about a difficult economic downturn in the U.S., thereby boosting investors’ faith in holding riskier investments such as cryptocurrencies.

A significant distinction between August and October lies in the perspective of institutional investors towards Bitcoin. Following the Fed’s announcement, there has been a surge in investments into spot Bitcoin ETFs, with only occasional withdrawals.

The total assets under management of all spot BTC ETFs have surged, now standing at over $50 billion. So, during times of political turmoil, like the ongoing conflicts in the Middle East, Bitcoin actually attracts inflows rather than triggers panic selling.

However, it’s worth noting that the rally we’re seeing now doesn’t mean the underlying problems are solved.

Despite recent efforts, China’s economy hasn’t fully picked up momentum, and the United States isn’t completely out of economic trouble either, as the risk of a mild recession persists. While the Federal Reserve’s interest rate reduction has offered temporary respite, underlying structural problems remain unsolved.

Why markets have stayed calm amid rising geopolitical tensions

Despite the rising tension between Israel and Hezbollah, it’s quite intriguing that financial markets appear unaffected or even unfazed by the intensifying conflict.

In an effort to get a clearer picture of the uncommon response from this market, our team at Crypto News sought opinions from leading professionals within the industry. Their perspectives suggest that investors today are adopting a different strategy when it comes to dealing with geopolitical risks in the year 2024.

Anna Kuzmina, the founder of What the Money, posits that the seeming disregard could originate from the deluge of international news, making investors view this specific circumstance as less influential compared to other global conflicts and crises.

It’s possible that the ongoing Middle East conflict has less influence on cryptocurrency and stock markets compared to past events, because there is just so much geopolitical news out there right now. This could be because investors view the conflict as localized or they might be more concerned about inflation rates and interest levels.

Moreover, Kuzmina pointed out that investor behavior has significantly changed through the years. Previously, geopolitical conflicts frequently triggered intense market responses. However, it appears that both worldwide and local markets are now more resilient, as they can generally handle such disturbances without showing undue alarm.

In addition to the ongoing discussion, Daria Morgen, who holds the position of Head of Research at Changelly, presented an alternative viewpoint. She pointed out that investors in the crypto sector, having navigated through extended periods of market instability, tend to perceive geopolitical risks with a unique outlook.

As a seasoned crypto investor, I’ve learned to evaluate geopolitical risks in a unique way compared to traditional stock market investors. Over time, I’ve developed a greater resilience to market volatility, a trait honed through the trials of the recent bear market and the unpredictable price swings that are characteristic of this dynamic space.

Morning highlighted the ongoing aspect of cryptocurrency trading as a significant point. In contrast to conventional financial markets that operate within fixed trading hours, the non-stop operation of cryptos provides investors with greater freedom to review and adjust their investments at their own pace, avoiding hasty, panic-induced choices.

As a researcher, I’ve observed that they have developed resilience in the face of market volatility. Although the current conflict is significant, it does not appear to be triggering widespread panic… or at least not as of yet.

In contrast to crypto traders who usually display patience, those in traditional stock markets tend to adopt a protective approach, frequently moving their investments towards less risky assets as geopolitical uncertainties emerge.

In the morning, Morgen expresses a perspective that aligns with mine, emphasizing that the decentralized characteristic of cryptocurrencies is significant. This attribute provides a degree of shielding against the tremors that typically disrupt conventional financial structures.

“Investors in cryptocurrency view digital assets as a protective measure against uncertainties in conventional markets. The decentralized structure of cryptocurrencies provides some level of immunity from global political concerns.

In simpler terms, Morgen emphasizes that although international political disputes may influence financial markets, most investors tend to prioritize immediate economic matters that have a direct effect on their investment portfolios.

Economic issues such as inflation and interest rates currently hold greater attention than ongoing conflicts, with investors tending to respond more significantly to global events that carry immediate, tangible economic implications.

Kuzmina concurs, pointing out that in our current data-rich world, investors are growing more discerning, choosing only specific news events as triggers for market fluctuations.

Investors are constantly inundated with information every day. Consequently, they have grown choosy, filtering out irrelevant details unless it has a direct effect on their profit margins.

In my analysis, I find that the cryptocurrency market appears to be more resilient within the current global political landscape. However, it’s essential to remember that these markets are not immune to shifts in regulatory policies. Such changes can potentially upset the newly established equilibrium.

What to expect next?

The Middle East continues to be a powder keg, and although financial markets have stayed relatively peaceful for now, it does not mean we’re in for clear skies moving forward.

Currently, the main point to remember is to remain vigilant. While the tranquility may indicate a developing market, it’s essential to keep in mind that situations can shift rapidly.

Paying close attention to international news, central bank decisions, and overall market mood will be vital over the next few weeks and months.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-02 14:44