As a seasoned researcher with a keen interest in the dynamic world of cryptocurrencies, I find myself reflecting on the recent bankruptcy filing of Rhodium Enterprises in the Southern District of Texas. Having closely monitored the crypto market’s ups and downs over the past few years, I can’t help but notice a striking pattern emerging – it seems that every Bitcoin halving brings its own set of challenges for miners.

The firm has filed for bankruptcy in the Southern District of Texas.

A Bitcoin mining company based in the U.S., Rhodium Enterprises, is facing debts ranging from $50 million to $100 million. The total value of its assets is estimated to be between $100 million and $500 million. In the filing for bankruptcy protection, six subsidiaries are listed: Rhodium Encore, Jordan HPC, Rhodium JV, Rhodium 2.0, Rhodium 10MW, and Rhodium 30MW.

The ongoing struggles of the company are worsened due to a drop in earnings from Bitcoin mining operations, particularly post the recent halving event. This decrease in miner compensation, combined with increased electricity costs, has significantly diminished the profit margins for these miners.

Last July, Rhodium Enterprises missed their $54 million loan repayment. Previously, in 2021, they had managed to secure $78 million in loans for their subsidiaries. However, despite two proposed debt reorganization plans, disagreements among the stakeholders resulted in a failure to meet their obligations, leading to a default.

Table of Contents

How crypto companies file for Chapter 11

In the wake of the devastating demise of the Terra ecosystem, I’ve witnessed a torrent of financial struggles sweep across the cryptocurrency market. Notable entities like Celsius Network, Three Arrows Capital, Voyager Digital, FTX, and numerous other significant crypto firms have been forced to acknowledge their insolvency.

A significant number of these firms are going through a process in the United States, known as Chapter 11 bankruptcy. This legal step enables them to restructure their business operations while satisfying their financial obligations to creditors.

1. In Chapter 11, businesses have the option to reorganize their debts and keep running. For instance, mining firm Core Scientific, in 2022, filed for bankruptcy as a protective measure against creditors. However, by early 2024, they successfully emerged from bankruptcy.

The worst time to mine Bitcoin

Bitcoin mining has experienced tough stretches during the April halving and subsequent drop in its value (BTC). Experts from BlocksBridge Consulting suggest that for miners without access to low-cost electricity, cryptocurrency mining was on the brink of profitability. Despite a recovery in the Bitcoin price, the hash rate barely surpassed $40 per terahash per second ($/TH/s).

Based on expert analysis, self-mining operations could potentially result in a profit post-taxes, considering the increasing electricity expenses. The financial data from leading companies such as Marathon Digital (MARA), Core Scientific, and Riot suggest that their Bitcoin mining expenses for July surpassed $60,000 per coin.

📉 Struggling Bitcoin Miners Reach Critical Point Due to Exorbitant Costs Surpassing $60k in July

Explore #MinerWeekly for comprehensive insights and projected Q2 costs for $MARA, $RIOT, and $CORZ.

— BlocksBridge Consulting (@BlocksBridge_) August 8, 2024

Moreover, analysts at CryptoQuant suggest that the Hash Ribbons signal indicates a trend where larger miners are upgrading to more energy-efficient mining equipment and re-entering the market. These experts anticipate that miners will persist in their approach of diversifying investments, predicting that the value of the first cryptocurrency could surpass $70,000 and potentially rise even higher by the year’s end.

Explore the live data 👇

— CryptoQuant.com (@cryptoquant_com) August 19, 2024

Mining centralization

1. Rhodium’s bankruptcy served as an illustration, according to CryptoQuant analysts, of their prediction that miners would progressively exit the market. Smaller entities often require additional resources to acquire costly equipment, leading to the emergence of large-scale mining conglomerates in the market.

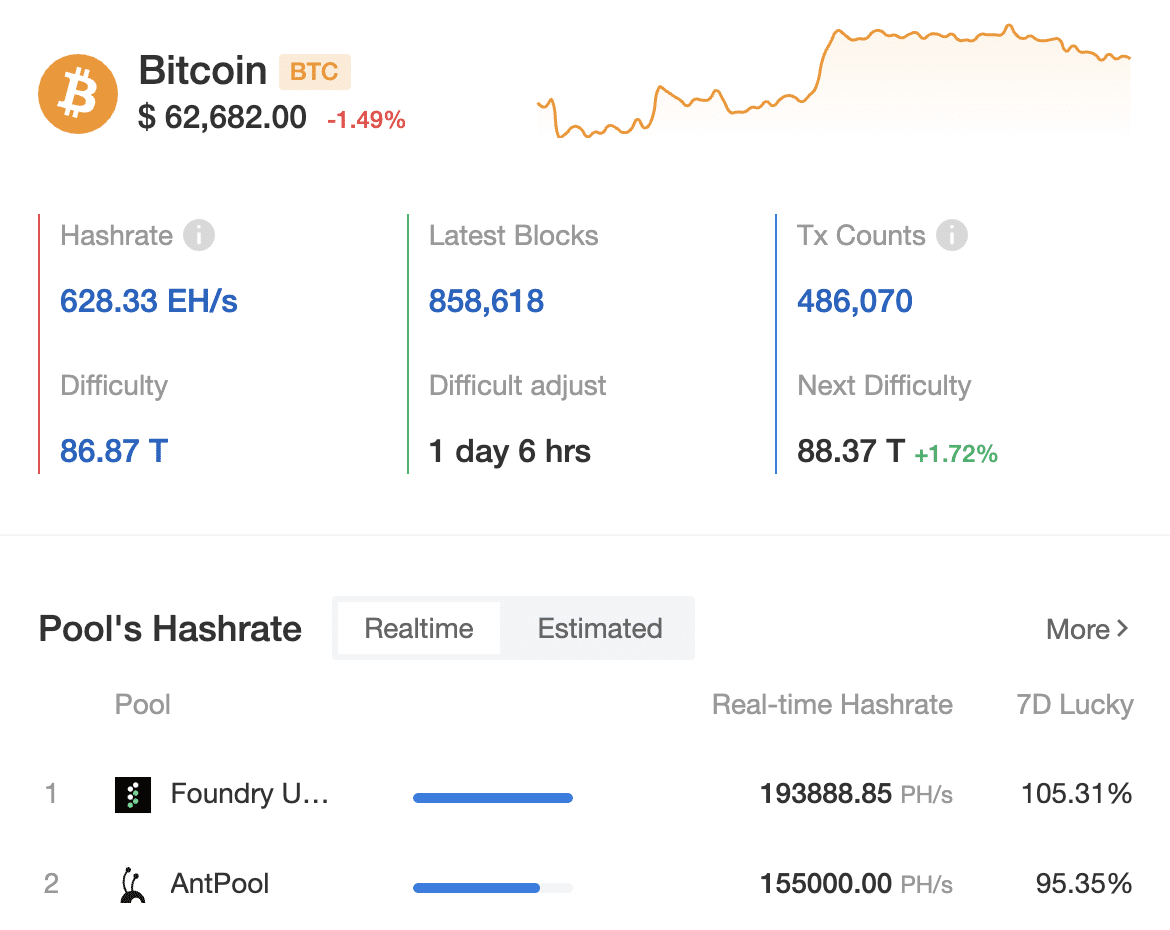

Additionally, data from BTC.com indicates that a pair of mining pools, Findry USA and AntPool, account for over half of the present Bitcoin’s computational power.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-27 17:42