For the first time ever in cryptocurrency history, more than 20% of trading transactions took place on decentralized platforms instead of centralized ones, in a shift towards peer-to-peer exchanges.

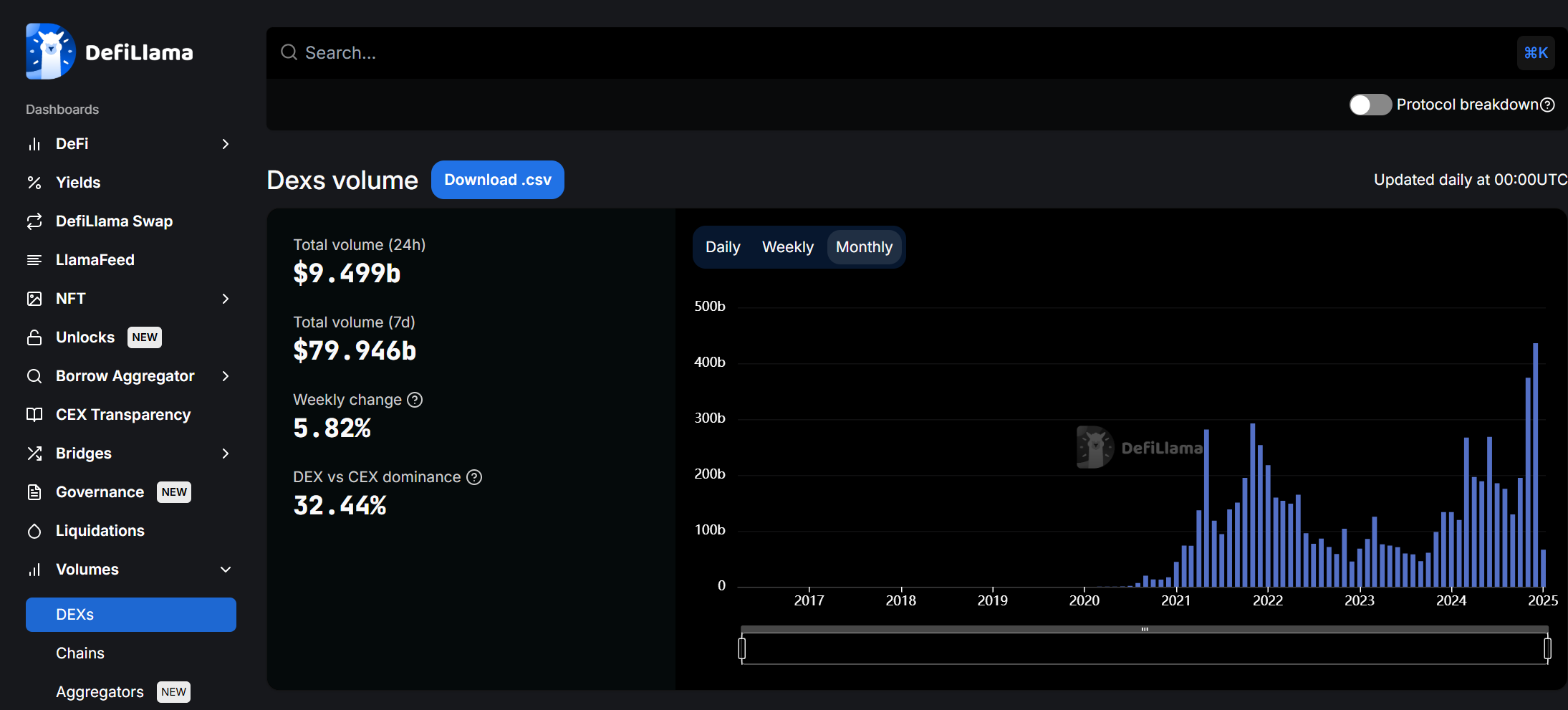

To find the ratio between trades on decentralized (DEX) and centralized exchanges (CEX), we simply divide the total volume of transactions on DEX for a month by the same figure from CEX, then express the result as a percentage.

Information from The Block and DefiLlama indicates that the Decentralized Exchange (DEX) to Centralized Exchange (CEX) proportion surpassed the 20% threshold this week. Nevertheless, it’s essential to note that this figure is derived from incomplete data for January, and it may alter before February.

In simple terms, the proportion of transactions happening on Decentralized Exchanges (DEX) compared to Centralized Exchanges (CEX) has reached its peak since May 2023, which was around when this ratio stood at 14%. This notable increase occurred during a broader market recovery that followed the difficulties faced in 2022.

Does the DEX to CEX % signal a crypto shift?

Approaching the 20% milestone might indicate a possible change in trading patterns, with 2025 marking a significant stage. Many experts believe this could be indicative of an increasing preference towards decentralized trading platforms.

Platforms such as Pump.fun, which streamline the process of releasing tokens, have sparked investor interest in lower-capital virtual assets due to their attractive incentives. Upon release, these assets are usually traded initially on Decentralized Exchanges (DEXs).

These primary digital asset platforms such as Binance, Coinbase, and Kraken operate similarly to traditional web2 services, offering access to various cryptocurrencies. But it’s worth noting that they tend to be more deliberate when adding new coins, sometimes taking several weeks or even months before incorporating them in limited quantities.

Decentralized platforms, like Uniswap, remain crucial for cryptocurrency trading due to their alignment with the principles of decentralization and their ability to facilitate new token launches without limitations. Data recorded on blockchains reveals that these decentralized exchanges have collectively processed almost $10 billion in trades since the beginning of this year.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-07 19:06