As a seasoned analyst with over two decades of experience in both traditional and digital markets, I have seen countless bull and bear cycles. The recent decline of Moonwell (WELL) might be disheartening for some, but it presents an opportunity that should not be overlooked.

On the Blockchain’s Base platform, Moonwell – the third-largest decentralized lending network – has seen a significant drop, undoing the progress it made in October.

The price of Moonwell (WELL) tokens dipped to $0.07113, which is its lowest since October 25 and represents a 36% decrease from its all-time high. This drop has elevated the token’s market capitalization to over $226 million. Notably, despite this recent decline, the value of Moonwell remains an impressive 677% higher than its lowest point in July of this year.

Moonwell is a prominent lending platform which first debuted within the Polkadot (DOT) network’s ecosystem, receiving a moderate welcome from its initial introduction.

This year, growth spiked significantly as the platform, initially built on Coinbase’s blockchain network called Base, was extended by developers for another project similar to AAVE (AAVE). Since its debut, this newcomer has experienced a substantial rise in assets within its network. Notably, the total value locked within Base’s DeFi networks soared to an impressive $116 million.

Developers report that Moonwell has collected approximately $800,000 in fees on Base and Optimism since October, indicating a robust increase in user activity. This positive trajectory may persist in the coming weeks.

🌜📊🌛 Last month saw a significant boost for Moonwell, earning around $800,000 in fees from both @Base and @Optimism.

In just the past week, Moonwell has raked in an impressive $185K in fees on @Base, making it the top-earning lending app on the platform.

— Moonwell (@MoonwellDeFi) November 4, 2024

As an analyst, I’ve observed a striking parallel between the expansion of Moonwell and the meteoric rise of Base, a relatively unknown player that has ascended to be the sixth-largest chain in our industry. Interestingly, it has also climbed to the third-largest position among blockchains supporting decentralized exchanges.

According to certain experts, this current dip might offer a great opportunity for investment. In a recent article titled “The Weekend Shift”, it was predicted that the WELL token could reach an impressive $1.50 by year-end, which represents a staggering 1,775% increase.

Moonwell price has strong technicals

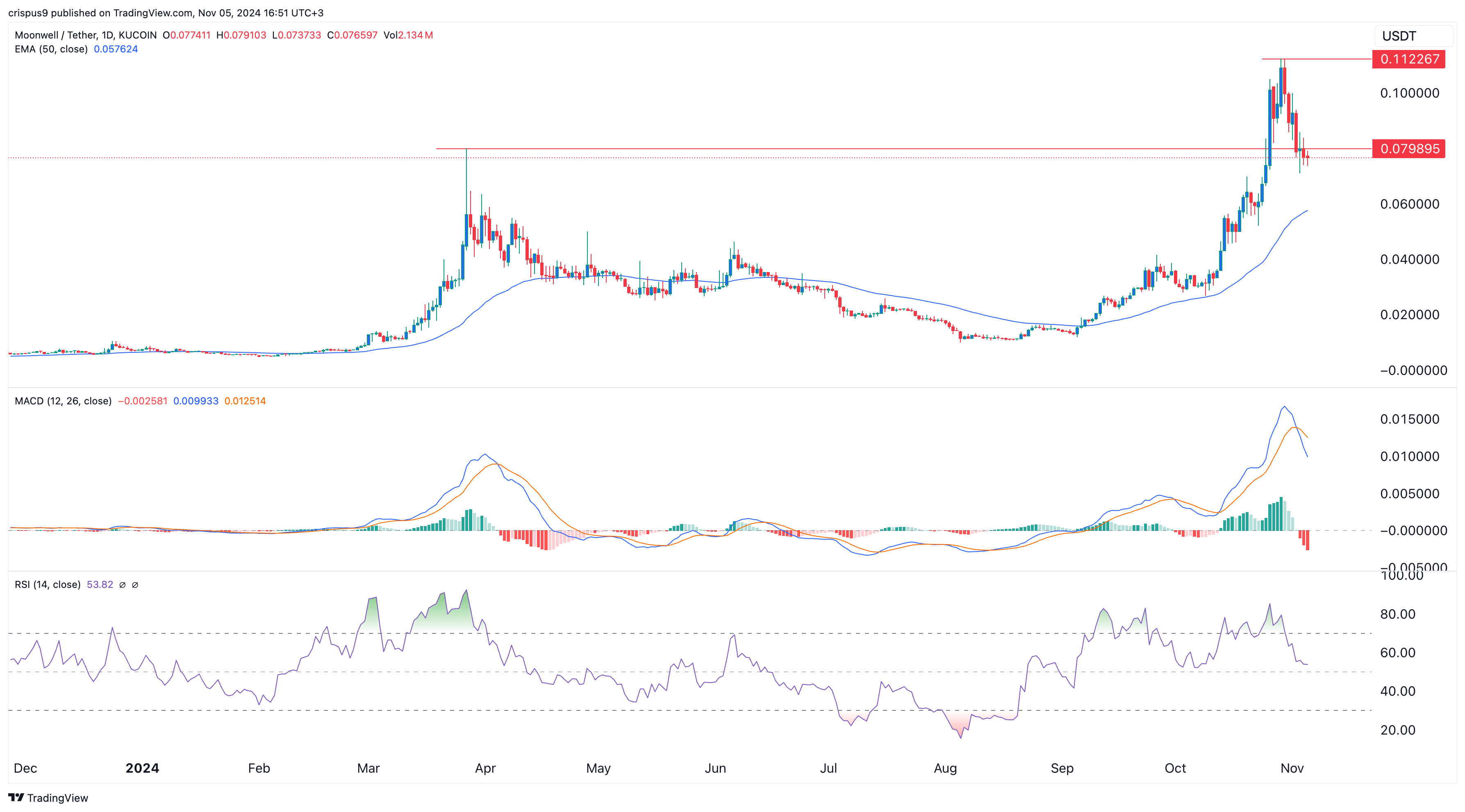

As an analyst, I’ve noticed a notable surge in the Moonwell token, reaching a peak of $0.1122. However, following this rise, there appears to be a downward trend as investors seem to have cashed out their profits. Currently, the token has dipped slightly below the significant support level it established on March 24 at $0.080, which also marks the upper boundary of the cup and handle pattern.

In simpler terms, the two lines of the Moving Average Convergence Divergence (MACD) are now crossing in a way that indicates a potential market downturn, but the Relative Strength Index (RSI) is getting close to 50, which is considered neutral. Importantly, the price is still sitting above its 50-day moving average.

From my perspective as an analyst, I see a potential recovery for the WELL token due to its formation of a ‘break and retest’ pattern, often signaling bullish continuation. If this pattern holds, WELL could regain momentum and test the $0.1122 resistance level again. However, should it break below the 50-day moving average at $0.0576, it might indicate a further descent.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-05 17:28