As an analyst with extensive experience in the cryptocurrency market, I’ve carefully reviewed Binance Research’s latest report on the crypto market for June 2024. The report reveals a decline in market capitalization by 11.4% over the month, with nine out of ten assets ending the month negatively.

Binance Research revealed a report on the cryptocurrency market for June 2024.

Table of Contents

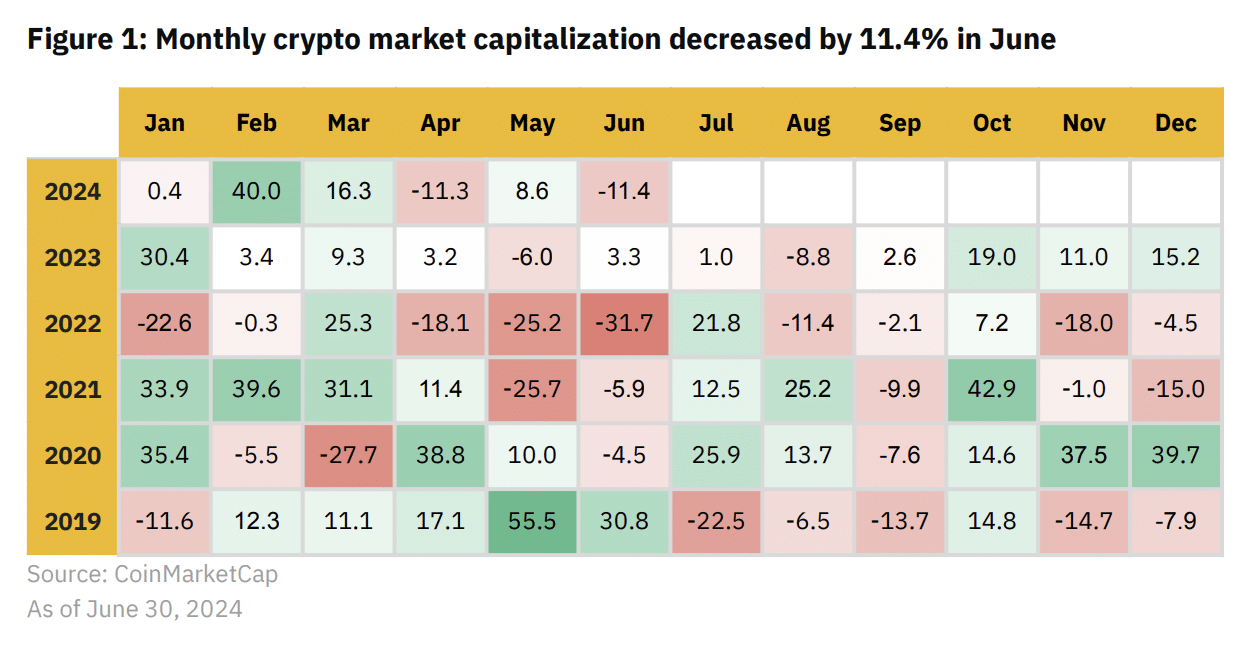

Based on current studies, the market value decreased by 11.4% in the last month. Yet, this downward trend is common for June; the cryptocurrency market has ended the month positively just two times over the past five years.

Nine out of ten top assets by market value finished the month with losses. Experts attribute this downturn to recent reports of Bitcoin payouts from Mt. Gox and the transfer of Bitcoins (BTC) from the U.S. and German governments to centralized exchanges.

Dive into the crypto market

Growth Leaders

One of the few tokens that has grown is Toncoin (TON). The asset grew by 17.5%, reaching a historical high of $8.24. Binance Research attributed this growth to the success of The Open League program and support of the ecosystem through grants. In addition, the number of active daily addresses on the network reached a record high of almost 578,000.

As a researcher studying the decentralized finance (DeFi) ecosystem, I’ve observed that The Open Network (TON) has achieved significant growth in terms of attracting Total Value Locked (TVL) inflows across various sectors. Specifically, sectors like Telegram mini-apps and games, decentralized finance, non-fungible tokens (NFTs), and memecoins have witnessed noteworthy influxes of TVL into TON.

As a researcher analyzing the data, I discovered that TON experienced yet another impressive surge, recording a 109% rise in Total Value Locked (TVL) from one month to the next. This growth spree pushed TVL to an all-time high of US$685.9 million.

Binance Research report

Airdrops

The report also notes the occurrence of airdrops. In the month of June, these airdrops were executed via several initiatives such as LayerZero, ZKsync, Blast, and Eigenlayer for distributing the tokens.

Approximately 803,000 addresses on LayerZero were flagged as possible Sybil wallets, having received just 15% of the initial distribution. The remaining 85%, which amounted to approximately 1.28 million eligible addresses, received the remaining allocation.

The LayerZero Foundation introduced a “Proof-of-Donation” validation process, garnering varied responses from the public.

Binance Research report

The NFT sector continues to face difficult times

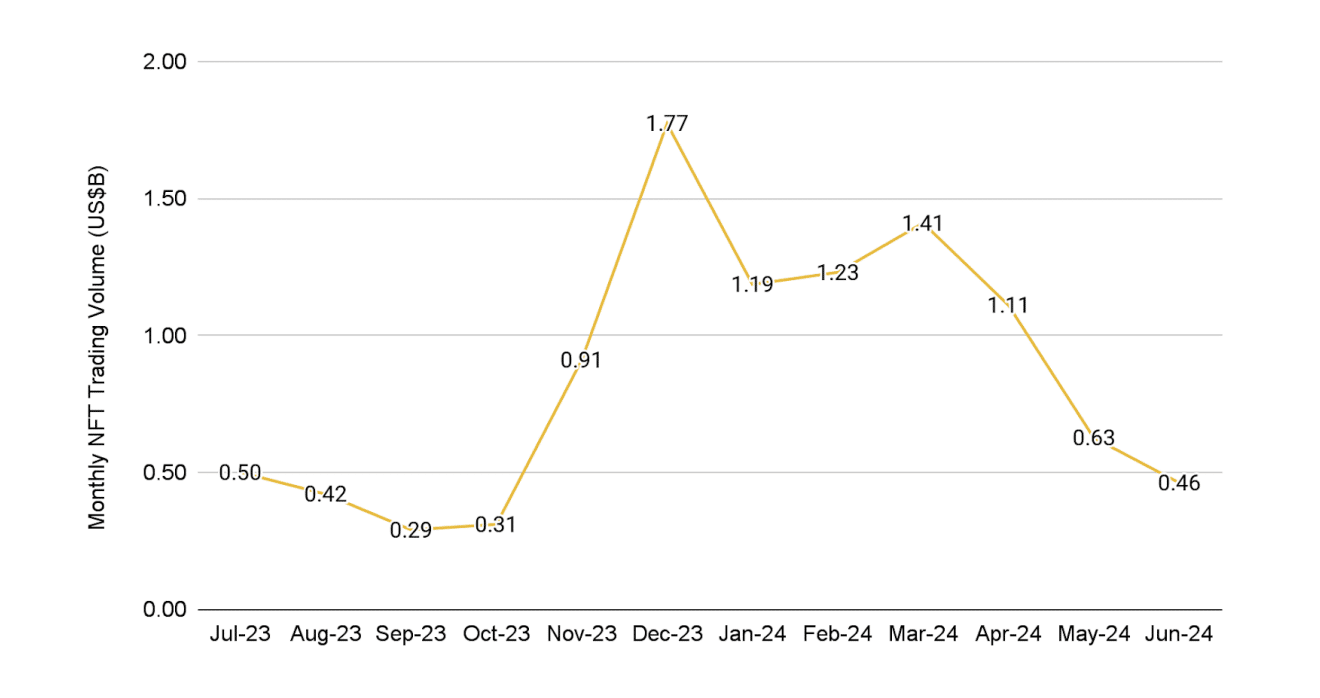

The NFT sector also showed no growth. Sales totaled $46 million, down 26.2% from May.

The DMarket NFT marketplace, which is part of the Mythos in-game item platform, topped all others in monthly sales, raking in a total of $18.9 million. CryptoPunks came in second place with sales of $16.1 million during the same period. Notably, popular NFT collections like Bitcoin Puppets and NodeMonkeys saw significant drops in sales, with Bitcoin Puppets down 40.6% and NodeMonkes declining by 41%.

The sales volume of NFTs on the top chains has significantly dropped. Specifically, there was a 48.2% decrease in NFT sales for Bitcoin and a 50.2% decrease for Ethereum. This decline suggests that the initial excitement surrounding Bitcoin’s NFT market may be fading.

Binance Research report

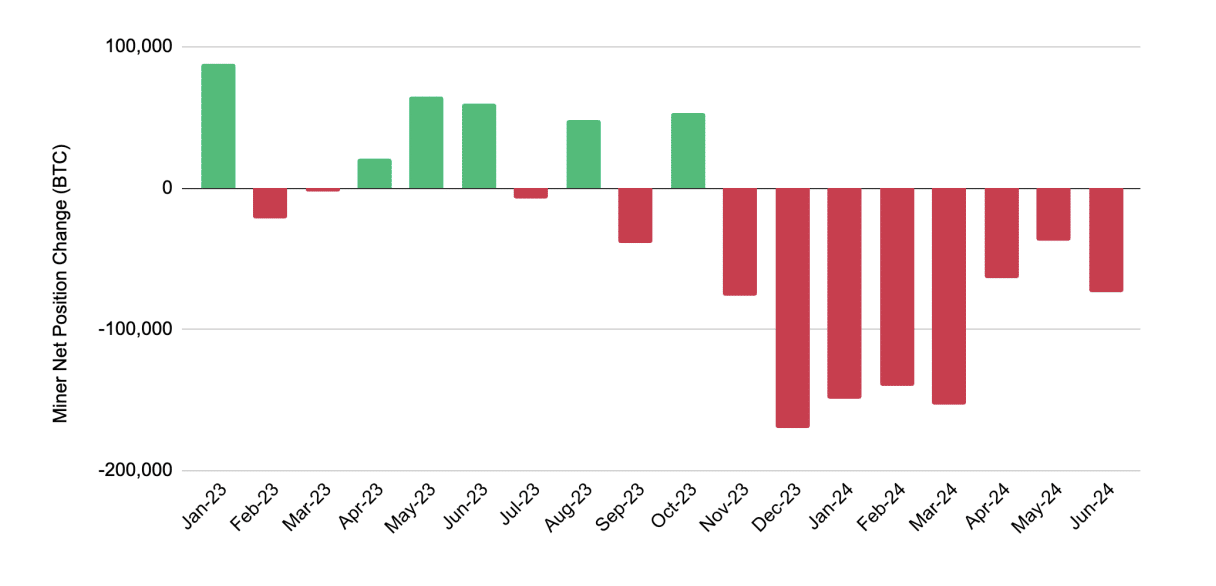

Miners are selling bitcoins

Miners have been offloading Bitcoin consistently since November 2023, marking the longest streak of net sales since the cryptocurrency’s inception in 2009. Consequently, the amount of Bitcoin held by miners has hit its lowest point in the past 14 years. Experts link this trend to the Bitcoin halving event.

As a crypto investor, I can tell you that the block rewards serve as a significant source of income for most miners. However, due to various circumstances, some miners are compelled to sell their cryptocurrencies to meet their basic needs and ensure their survival.

Binance Research report

What happened in the crypto market in May?

Around a month prior, Binance Research released a report predicting crypto market growth in May 2024. Previous assessments indicated a recovery with a 8.6% rise in market capitalization. The crypto market also ended on an upward trend for the third consecutive time. However, before this, there had been downward trends from 2021 to 2023.

Furthermore, every cryptocurrency asset in the top ten by market capitalization closed out the month with gains. The front-runner in this group was Solana (SOL), experiencing a robust increase of 33.9%. Ethereum (ETH) follows closely behind, while Toncoin occupies the third position.

In the last week of April 2024, the NFT market recorded a decrease, with total sales amounting to $0.63 billion – marking a 41% drop in comparison to the previous month.

What to expect in July

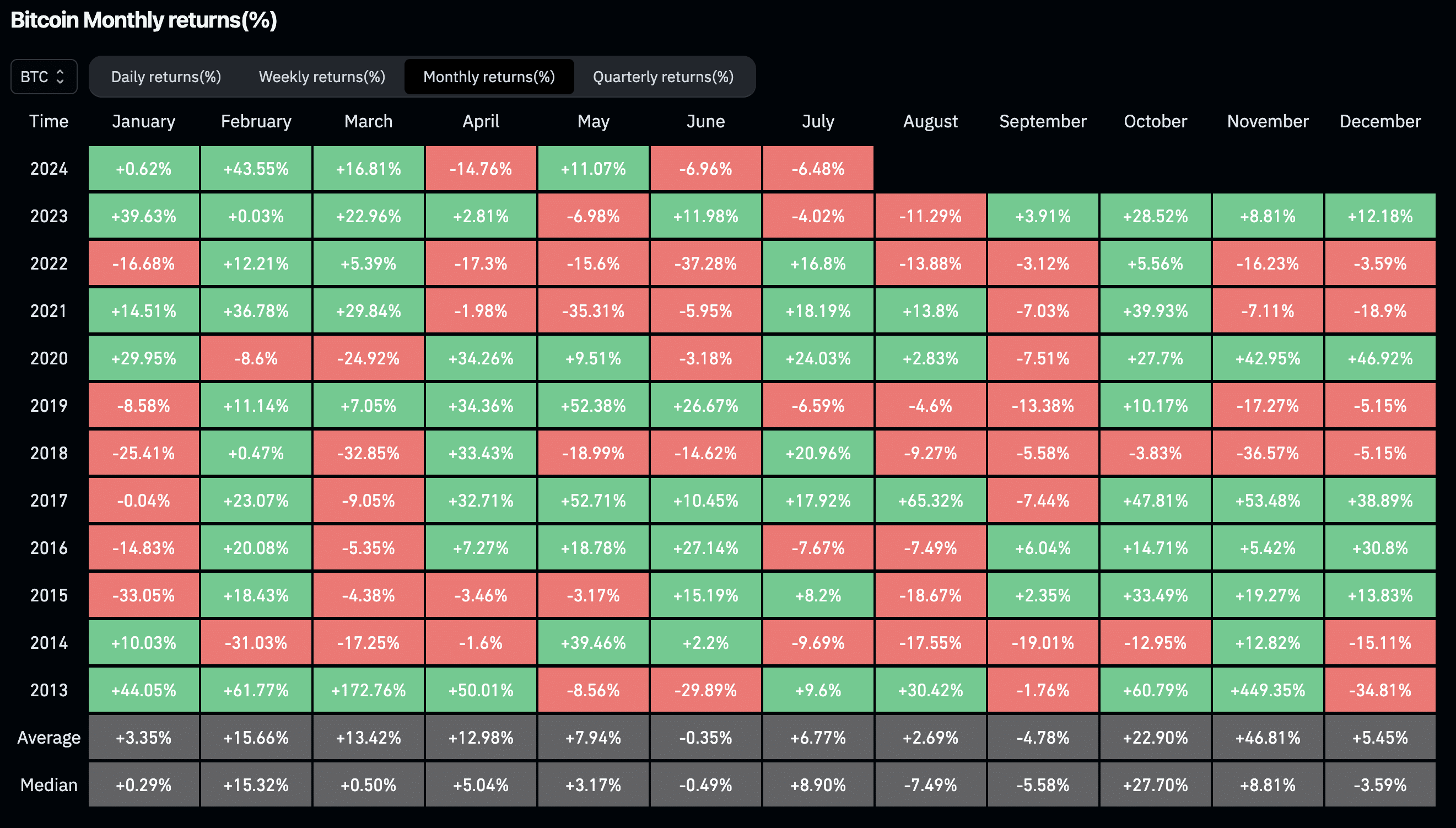

In June 2024, Bitcoin experienced a decrease of 7%, marking the second consecutive month with negative price action this year. The first occurrence was in April, where the cryptocurrency suffered significant losses close to 15%. Conversely, BTC displayed growth during other months, registering gains ranging from 1% to a notable high of 44%.

Based on historical trends observed from Coinglass, I’ve found that the crypto market tends to experience growth in July, with an average increase of approximately 7.3% over the past years. My analysis dating back to 2013 reveals seven profitable months, where gains reached as high as 24%. Conversely, there were only five instances where losses exceeded 10%.

As a researcher studying the crypto market, I’ve identified two notable occurrences scheduled for the second month of summer that have garnered widespread attention. The first event is the long-awaited payments to Mt. Gox clients, who have been anticipating this moment for a decade. However, this development has caused unease within the community due to potential price fluctuations arising from these sales.

As a researcher studying the crypto market, I’m excited about the potential launch of spot Ethereum Exchange-Traded Funds (ETFs). The approval of these ETFs could significantly boost growth in the crypto sector. In fact, on July 8th, several companies submitted updated applications for these Ethereum-backed ETFs to the Securities and Exchange Commission (SEC).

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-10 18:41