As a researcher with extensive background in both finance and economics, I find Mzwanele Manyi’s perspective on Bitcoin intriguing, given South Africa’s current economic situation. His proposal to leverage Bitcoin as a means to clear the country’s debt and achieve financial independence is thought-provoking, especially considering the potential benefits of Bitcoin’s stability, capped supply, and long-term price growth.

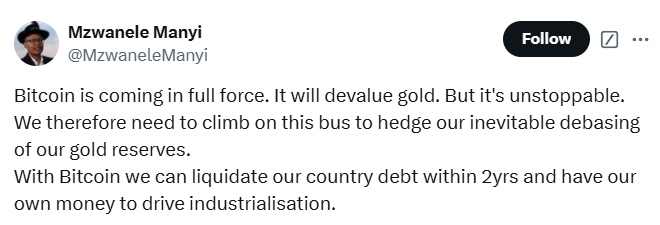

More simply, Mzwanele Manyi, a South African entrepreneur and politician, recently shared his thoughts about Bitcoin’s possible impact on various national economies.

As a crypto investor, I’ve been intrigued by the strategy X outlined in his post, which he believes could wipe out South Africa’s debt within two years and grant the nation financial independence to foster its industrial growth. To me, this approach seems promising, particularly as it could leverage Bitcoin as a safeguard for the country’s wealth. Given the potential devaluation of South Africa’s gold reserves, I view Bitcoin as an essential tool that could shield the nation’s riches and contribute to its long-term prosperity.

South Africa is grappling with a substantial amount of debt that it owes, which has been steadily increasing over the years. The nation finds it challenging to fulfill its financial commitments due to this debt load. Excessive debt can curtail government expenditure and negatively impact the economy, as a large portion of the income is utilized for repaying loan interest.

Manyi posits that Bitcoin may offer a reliable form of value storage. Unlike traditional currencies (fiat), Bitcoin has a fixed maximum supply of 21 million coins, potentially safeguarding it from inflation and the erosion of its value due to depreciation.

Investing in Bitcoin today might bring long-term profitability for South Africa, potentially aiding in debt repayment. Moreover, as proposed by Manyi, embracing Bitcoin could offer South Africa enhanced financial independence, decreasing dependence on conventional financial structures and foreign debts.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-25 00:36