As a researcher with a background in cryptocurrency and finance, I find the recent market rally to be an intriguing development. The sudden surge in price, driven by increased demand for Bitcoin and Ethereum, was both surprising and significant.

An analyst from Nansen offered insights on the latest cryptocurrency market surge, which eliminated approximately $300 million worth of short positions, significantly boosting prices.

On May 21th, as we previously mentioned, the total value of the cryptocurrency market experienced a significant surge of hundreds of billions within hours. This sudden growth was triggered by heightened interest in Bitcoin (BTC), with 11 US Bitcoin ETFs recording over $950 million in inflows.

As a crypto investor following the market trends closely, I’ve noticed an intriguing observation from Nansen’s analysis: the sudden surge in market sentiment following the approval of spot Ethereum (ETH) Exchange-Traded Funds (ETFs) came as an unexpected yet significant factor.

“The unexpectedly positive market reaction followed the announcement that the ETH ETF was fully priced in by investors,” the analyst noted.

Multiple organizations have revised their 19b-4 filing submissions, outlining proposed rule modifications. Additionally, it’s been reported that the U.S. Securities and Exchange Commission (SEC) has contacted securities providers concerning registration statements using form S-1s once initial approvals have been granted. However, this advancement might be a slow and steady process.

Yep, a lot of variables here, not least is the politics, but this will take some time.

— Scott Johnsson (@SGJohnsson) May 22, 2024

Analysts have emphasized the significance of on-chain improvements and Wall Street’s acceptance of cryptocurrencies, but they also pointed out the positive shifts in macroeconomic circumstances. For instance, short-term U.S. interest rates dropped by approximately 0.4% within a month due to the Federal Reserve’s actions aimed at controlling inflation.

As a crypto investor, I’ve been closely monitoring Nansen’s risk management indicators. Recently, these indicators switched to “risk-on” mode somewhere between May 18 and May 19. This change suggests that higher token levels are on the horizon. At the moment, it seems we are experiencing an upward trend in crypto prices.

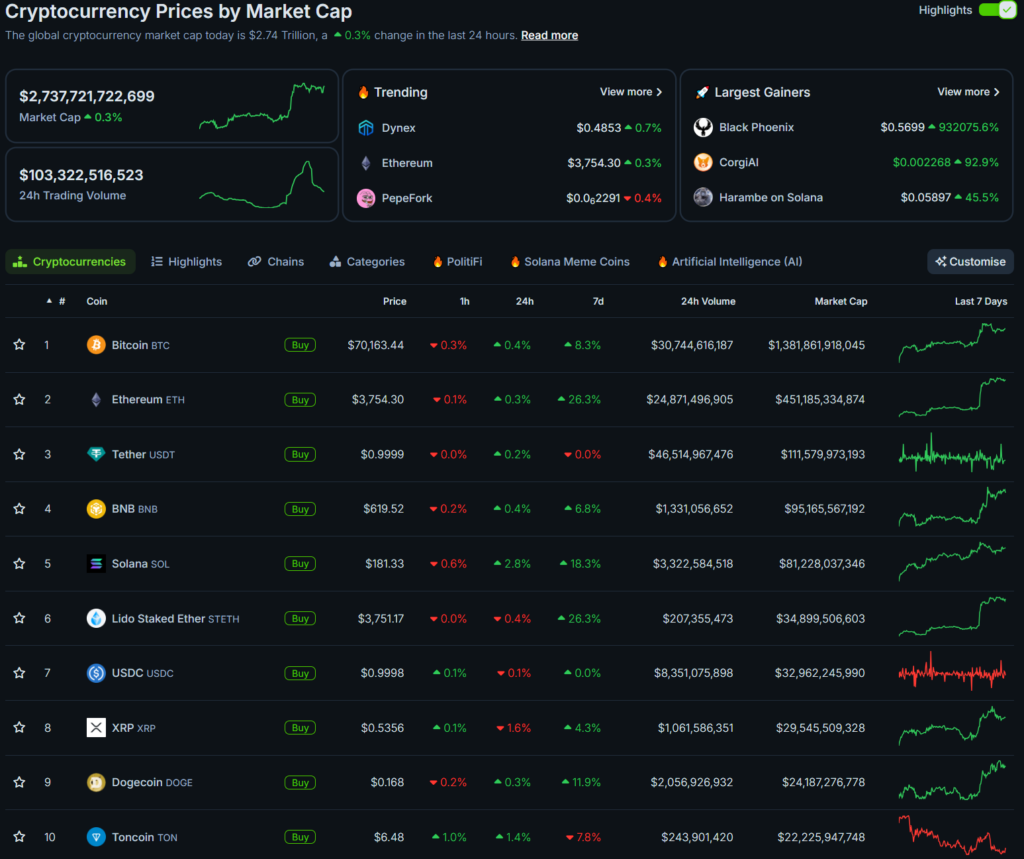

At the moment of publication, the cryptocurrency markets had calmed down following a turbulent two-day period that saw Bitcoin reach over $70,000 and Ethereum go above $3,700. The overall crypto market capitalization stayed near $2.7 trillion according to CoinGecko, while daily trading volumes noticeably decreased compared to the day before.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2024-05-22 20:46