As an experienced financial analyst, I believe that the recent downturn in Nasdaq 100 futures and Nvidia’s shares is a reminder of the risks associated with tech stocks’ exorbitant valuations. While the tech sector has driven much of the market’s growth in recent years, investors are becoming increasingly cautious, leading to sell-offs like we saw on Monday.

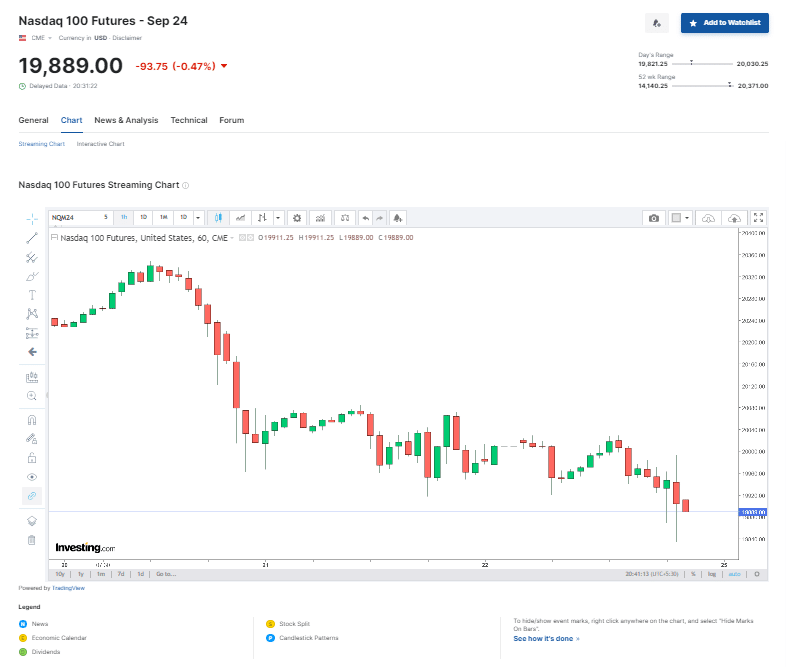

The NASDAQ 100 future contracts declined on Monday due to three consecutive days of losses for Nvidia Corporation. Tech stocks’ expensive valuations left investors disenchanted, resulting in this downturn.

The Nasdaq 100 index contracts experienced a 0.4% decrease, whereas S&P 500 future contracts remained unchanged. Nvidia’s stock price fell by 3%, causing its market capitalization to dip below both Apple Inc. and Microsoft Corp. in value.

European financial markets showed significant fluctuations. France’s Eurofins Scientific SE suffered a steep decline of approximately 20% after receiving unfavorable analysis from Muddy Waters Research, led by Carson Block.

The Stoxx 600 Index rose by 0.5% primarily due to gains in car share companies, following reports that China and the EU were initiating talks on potential tariffs for imports of electric vehicles. Meanwhile, Shein, a UK-based online fashion retailer, submitted an application for a stock market debut in London.

As a political analyst, I’m observing heightened risks in the political landscape with France’s parliamentary elections approaching this Sunday. According to recent polls, the far-right National Rally is poised to make significant gains. Simultaneously, in the United States, we’re just two days away from the first presidential debate on Tuesday between Joe Biden and the Republican nominee, Donald Trump.

In spite of the current situation, global stock markets remain optimistic due to anticipation of economic growth. The upcoming US core PCE measurement on Friday could signal decreasing inflation rates, possibly leading to a reduction in interest rates as early as September. According to present market predictions, there is approximately a 65% likelihood of such an occurrence.

At MUFG Bank Ltd., strategist Lee Hardman expressed the belief that there would be evidence showing a deceleration in inflation. This is a prospect that the Federal Reserve would likely find favorable. If we continue to see softer inflation figures throughout the summer, it could potentially lead the Fed to reduce interest rates in September.

The Bloomberg dollar index experienced a 0.2% decrease after a five-week upward trend. The yen exhibited significant fluctuations around the 160-mark, with Vice Finance Minister Masato Kanda’s announcement sparking intervention preparedness from authorities to support it around the clock if required.

German chemicals firm Covestro AG experienced a significant surge of over 7%, following reports of potential acquisition negotiations with Abu Dhabi National Oil Company, valued at around €12 billion. The value of Bitcoin took a hit, dipping by nearly 3% to approximately $61,200. This downturn was attributed to withdrawals from US ETFs and growing apprehensions regarding the Federal Reserve’s capacity to lower interest rates.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2024-06-24 18:29