As an experienced financial market analyst, I’ve seen my fair share of volatile markets, and the recent upswing in the crypto market is no exception. The sudden surge in Bitcoin (BTC) and Ethereum (ETH) prices, along with a subsequent market-wide recovery, brought both opportunities and risks for traders.

As a market analyst, I’ve observed that the recent surge in the cryptocurrency market put significant pressure on both long and short positions. However, it was the short sellers who suffered the most losses during this period.

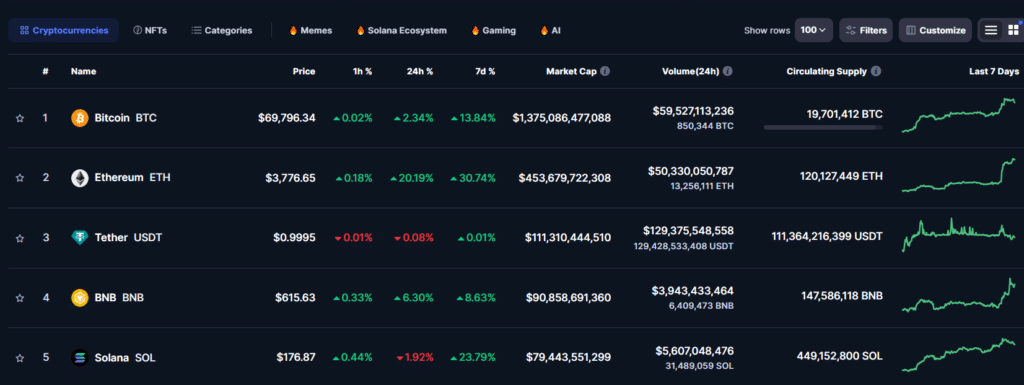

As a Bitcoin analyst, I’ve observed an impressive 13% surge in Bitcoin’s price over the past week. This significant rally propelled it above $70,000 for the first time since just before the halving event last month. According to the latest data from CoinMarketCap, Bitcoin now sits only about 5% below its all-time high (ATH) that was established back in March.

As a crypto investor, I’ve witnessed Ethereum (ETH), the second-largest digital currency by market cap, experience a remarkable surge of approximately 30% over the past week. This impressive growth has enabled ETH to reclaim its position with a market value of around $450 billion. With this strong momentum, Ethereum may soon challenge the $4,000 level in the coming days.

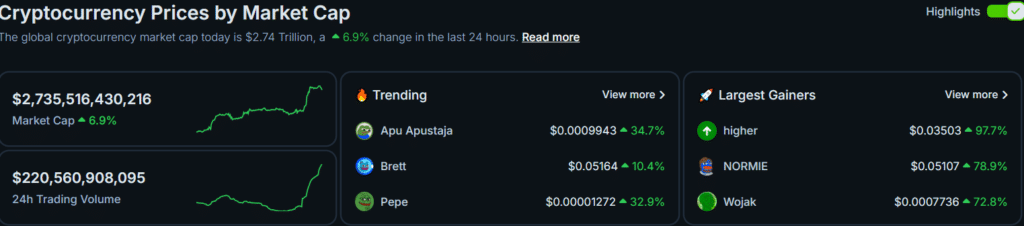

As a researcher, I’ve observed an impressive market-wide recuperation following the price surges. The cryptocurrency market capitalization skyrocketed by over 7% within a 24-hour span, reaching an astounding $2.7 trillion according to CoinGecko. Furthermore, trading volumes have more than doubled, hitting a significant figure at $220.5 billion.

The sudden market growth introduced instability, causing unease for investors who had wagered on rising or falling prices. In the financial world, speculators aiming for price escalation adopt a long stance, whereas those betting on price drops are referred to as having a short position.

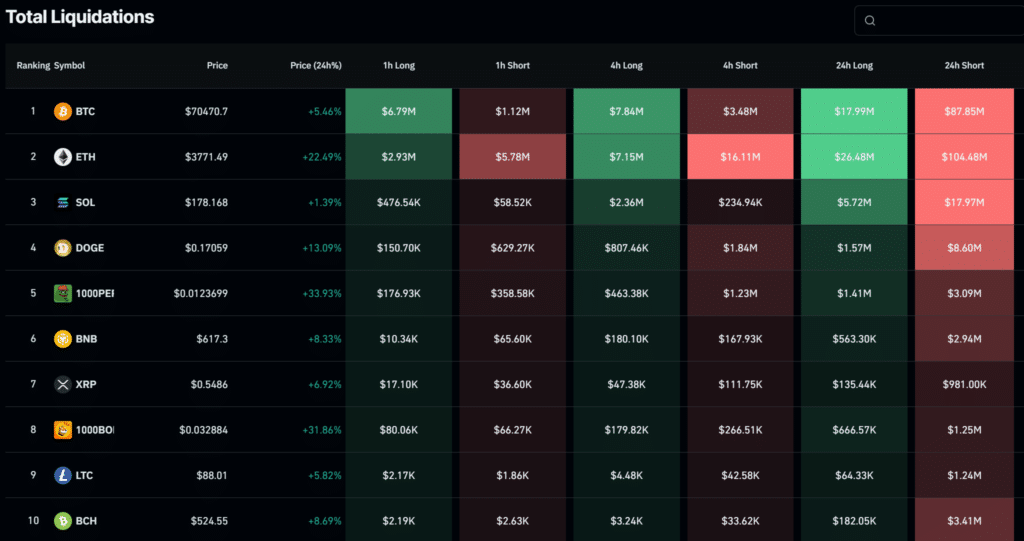

As a financial analyst, I’d interpret the data from CoinGlass on May 21st as follows: Approximately $380.5 million in leveraged trading positions were terminated, resulting in significant losses. Among these, short trades accounted for over $294.3 million, while around $97.2 million was attributed to liquidated long positions.

Over $104.9 million worth of Ether short positions were liquidated, making it the largest among any crypto asset. The second-largest was Bitcoin with $83.1 million in short trades liquidated, followed by Solana (SOL) with approximately $16.9 million.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-05-21 20:58