As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself intrigued by the recent surge of Nervos Network (CKB). Having closely observed the market trends and understood the nuances that drive these digital assets, I can’t help but feel a sense of deja vu.

On the memorable day of September 13th, I experienced a significant surge in the value of my Nervos Network tokens. Reaching an astounding peak of $0.018, this price point marked the highest it had been since June 7th, a fact that left me quite pleased with my crypto portfolio.

The Nervos Network (CKB), a secondary layer network, experienced an upward surge as investors speculated increased buying from South Korean traders following its listing on the Upbit exchange.

These traders can now buy the token using U.S. dollars, South Korean won, or Tether (USDT).

안내 메세지: Newtwork CKB Trading Guidance on Upbit— Upbit Korea (@Official_Upbit) September 13, 2024

According to information from CoinMarketCap, it appears that South Korean traders have been quite active, potentially causing the price increase. The trading pair for CKB/South Korean Won saw a massive 24-hour volume exceeding $170 million on Upbit. Binance came in second place with over $122 million in trades.

The values of cryptocurrencies frequently experience significant increases following their addition to well-known platforms such as Binance, Coinbase, or OKX for trading.

Consequently, these profits typically don’t last long and can result in a substantial decline once the initial excitement subsides. To illustrate this point, consider Alpaca (ALPACA), which experienced a surge of more than 150% after being listed on WhiteBit in August. However, it has since fallen by over 44% from its highest point.

The Nervos Network functions as a layer-2, proof-of-work project designed to bolster Bitcoin (BTC). This is accomplished by integrating programmability and scalability features into it. The key mechanism behind this is the RGB++ protocol.

Similar to how networks like Arbitrum, Polygon, and Base enhance the Ethereum (ETH) network, Nervos aspires to amplify the capabilities of Bitcoin by serving as a layer-2 solution. Some applications within its ecosystem, as stated on their website, include JoyID – a passwordless digital wallet, Huehub – an initial orderbook exchange, and Omiga – a protocol for inscription.

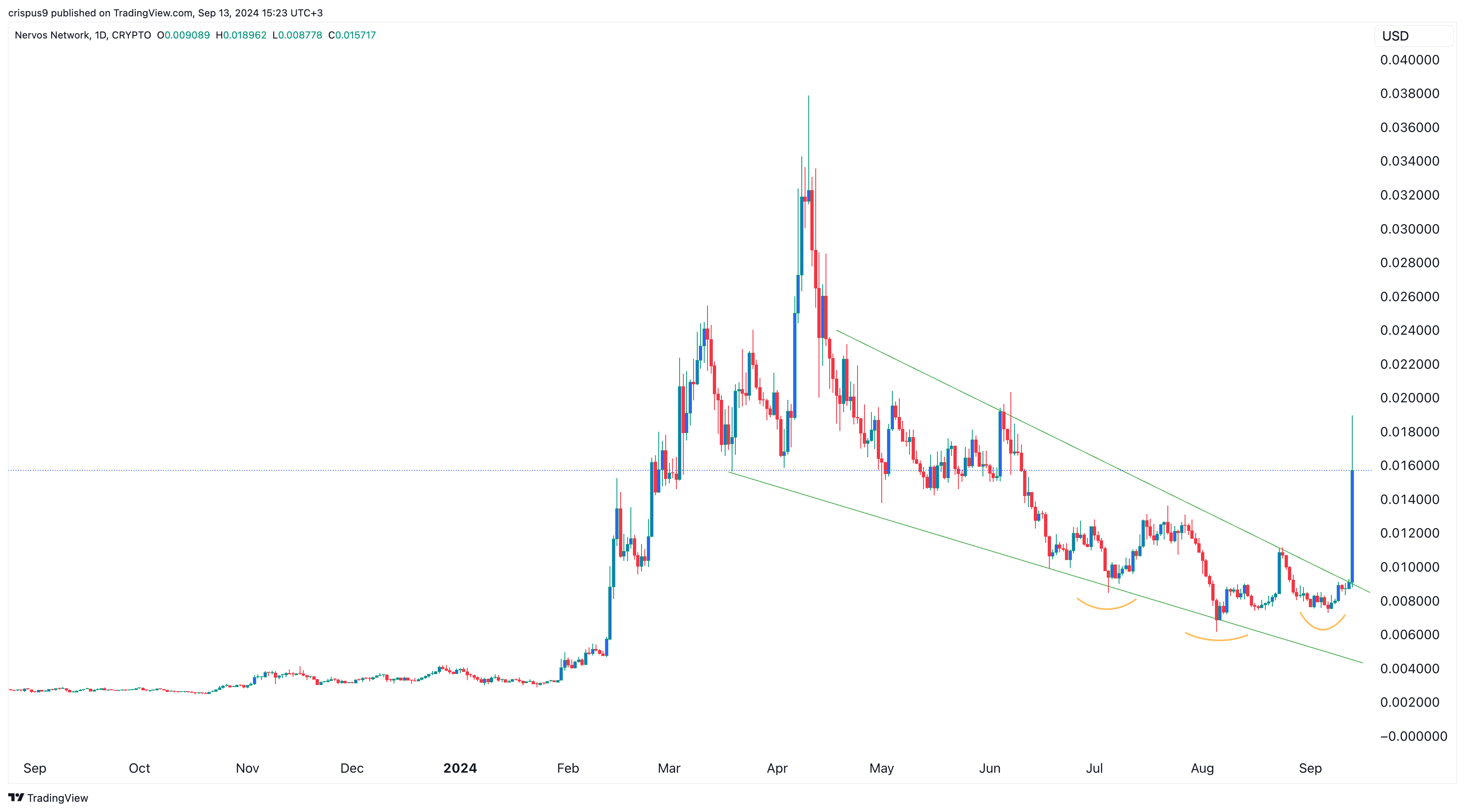

Nervos Network formed a falling wedge

On a day-to-day basis, the CKB token exhibited a “mystical candle,” surging to hit $0.018 as its peak. This rise followed the formation of a falling wedge chart configuration, a frequently used bullish indicator. Moreover, it also displayed an inverted head and shoulders chart pattern.

Generally speaking, these “God candle” events – sudden increases in price – often don’t last long. For instance, the KITTY and GME tokens experienced a significant surge following Roaring Kitty’s comeback on X last week. However, they have since dropped by more than 20% this week.

It’s possible that the Nervos Network may pull back and re-evaluate around the price point of $0.01, which represents a decline of approximately 40% from its current value.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-13 15:56