As a crypto investor with experience in the volatile world of digital assets, I’m closely watching the developments surrounding the Lummis-Gillibrand Payment Stablecoin Act. The potential benefits for American consumers are promising, especially when it comes to the mass adoption of stablecoins for faster and cheaper cross-border transactions, particularly in the remittances sector. However, there are concerns regarding certain provisions, such as the proposed ban on algorithmic stablecoins, which raise constitutional questions.

Some aspects of the Payment Stablecoin Act could bring advantages to American consumers, according to its supporters. However, detractors argue that certain provisions may conflict with the Constitution.

As a crypto investor, I’m thrilled to see the dynamic duo of Republican Cynthia Lummis and Democrat Kirsten Gillibrand taking the lead in the bipartisan effort to bring regulatory clarity to digital assets in the United States Congress. Their collaborative approach is a promising step towards creating a more stable and predictable environment for crypto investments.

The focus of their recent legislative initiatives has shifted towards regulating stablecoins. They believe it’s crucial to establish clear guidelines to safeguard consumers and preserve the US dollar‘s primacy in the growing digital payment landscape.

As a crypto investor, I can tell you that one of the most noteworthy suggestions in the Lummis-Gillibrand Payment Stablecoin Act is the potential ban on algorithmic stablecoins within the United States. This means that coins without real-world asset backing might not be able to launch here. This is a strong indication of the aftermath of Terraform Labs’ UST incident in 2022, where the coin experienced a devastating death spiral and lost its connection to the dollar’s value.

Some advocacy organizations, led by Coin Center, have expressed apprehension towards this specific proposal. Although Coin Center is known to be critical of UST, they contend that a complete ban on algorithmic stablecoins would not only be poor policy but also potentially unconstitutional. Jerry Brito, the executive director of Coin Center, elaborated on this viewpoint.

As a crypto investor, I believe in the potential of decentralized finance (DeFi) and the role of stablecoins within it. One intriguing concept is that of ‘algorithmic stablecoins.’ Unlike centralized alternatives, such as Terra, these coins operate without issuers or promoters making any promises. Instead, their value is maintained through complex algorithms.

Jerry Brito

The Payment Stablecoin Act contains provisions that generate more queries than solutions. For instance, it fails to provide a definitive classification for certain digital assets like MakerDAO’s decentralized token, DAI. This ambiguity is significant.

Circle, the Massachusetts-based company that issues USDC, the world’s second-largest stablecoin with a market cap of $33 billion, may encounter challenges due to the Payment Stablecoin Act. This legislation would limit trust companies to issuing stablecoins worth up to $10 billion. Since Circle currently exceeds this limit, it would be compelled to transform into a regulated depository institution to continue its operations within the jurisdiction of this act.

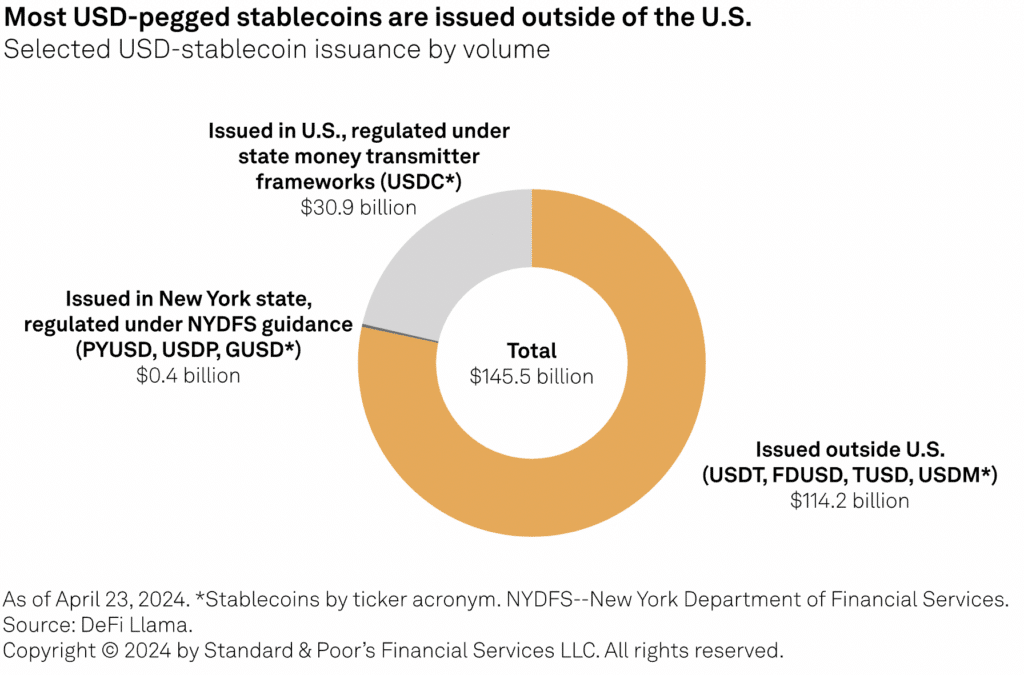

Politicians from different camps make valid points by stating that USD-backed stablecoins originating from other countries are essentially shaping the rules for the US dollar. However, it remains uncertain how these regulations could be enforced on a dominant player like Tether, with a market capitalization of $110 billion, which operates offshore. According to S&P Global’s research, around 80% of the $145 billion USD-pegged stablecoin market is accounted for by coins issued outside the United States.

Promising measures

Elements of the Payment Stablecoin Act have the potential to be beneficial for American consumers.

One positive aspect of new legislation that facilitates the widespread use of stablecoin payments is its acceptance. As Lummis and Gillibrand point out, traditional methods for cross-border transactions can take as long as 10 days to complete and include substantial fees. However, the utilization of stablecoins enables swift settlement within a short timeframe at significantly reduced costs.

Remittances, which represent the funds sent by foreign workers back to their families, hold significant potential for transformation. According to the World Bank’s data, this sector reached an estimated value of $669 billion in 2023. However, a considerable portion of these funds, approximately 6.2%, is consumed as transaction fees. This equates to a substantial amount of $41 billion that could have positively impacted local economies instead.

If enacted, these proposals would establish measures to guarantee that every stablecoin is fully collateralized with an equivalent amount of US dollars in reserve. Additionally, they would provide FDIC deposit insurance coverage for stablecoin holders, which presently secures bank clients up to $250,000 per account.

Lummis and Gillibrand propose that these measures could help prevent the possibility of de-dollarization as significant economies globally endeavor to establish their financial systems – reinforcing American values and making the dollar the foundation currency for the $4.5 trillion international economy. In addition, analysts Mohamed Damak and Andrew O’Neill from S&P Global suggest that the bill’s passage could result in banks launching their own stablecoins.

One intriguing query at present revolves around the Payments Stablecoin Act’s potential passage and the methods involved. Notably, the international law firm Akin issued a cautionary statement.

With the spotlight on the approaching election and congressional business taking a backseat, prospects for advancing the bill through Capitol Hill are quite restricted.

Akin

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-05-06 15:20