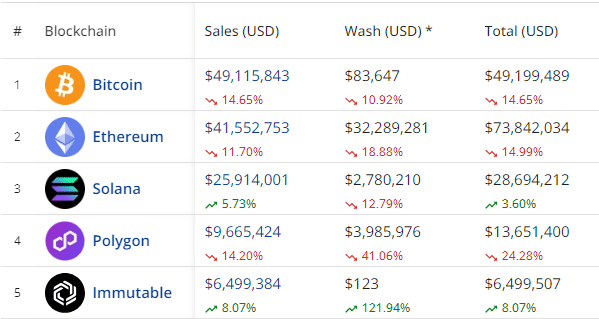

As an experienced analyst, I’ve been closely monitoring the NFT market for quite some time. The latest data from Cryptoslam.io indicates a significant decline in NFT sales across various blockchains and collections. Sales of Bitcoin-based NFTs fell by 14.65%, Ethereum-based NFTs declined by 11.7%, and Solana’s NFTs saw a modest increase of only 5.73%.

The past week saw a decline of 11.16% in NFT sales when compared to the preceding week.

The data from cryptoslam.io reveals that this week’s overall sales amounted to $144.33 million, and Bitcoin NFTs accounted for over $49 million in sales. Yet, the sale of digital collectibles on Bitcoin (BTC) experienced a decline of 14.65% compared to previous weeks.

NFT sales on Ethereum (ETH) amounted to approximately $41.55 million, marking a decrease of 11.7% compared to the previous week’s figures. Solana (SOL) ranked third in sales with nearly $26 million earned, registering a moderate increase of 5.73% during this week.

As a cryptocurrency and NFT market analysis, I can share that during the last seven days, the Polygon (MATIC) network recorded the fourth-largest NFT sales volume, totaling approximately $9.66 million.

As a crypto investor, I’ve noticed that the price of a particular NFT I was interested in has taken a 14.2% hit since last week when it was being traded on the blockchain.

Five leading blockchains in terms of sales volume were summarized, with Immutable (IMX) achieving notable sales amounting to $6.49 million.

As a researcher analyzing the data, I noticed that Immutable stood out amongst the top five networks with an over 8% surge in sales volume during the specified timeframe.

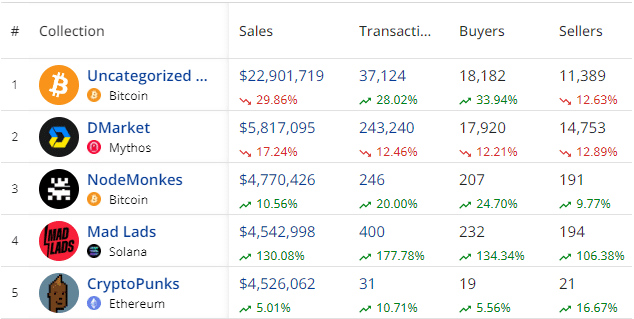

NFT collections

As a researcher studying the latest trends in the Bitcoin market, I’ve discovered that this past week, the Uncategorized Ordinals from the Bitcoin blockchain were our best-selling items, generating approximately $22.9 million in revenue. However, sales for the collectibles took a significant hit, decreasing by almost 30% compared to the previous week.

As an analyst, I’d put it this way: The Dmarket collection by Mythos saw a decline of 17.24%, amounting to $5.817 million in earnings during the period under review.

From the opposite perspective, sales for the Nodemonkes collection on the Bitcoin blockchain experienced a noteworthy growth of 10.56%, resulting in a total of $4.77 million generated from 246 individual transactions.

As an analyst, I’ve observed some noteworthy collections this past week. Among them were Mad Lads on Solana, CryptoPunks, Degods, and Solana Monkey Business. The sales volume for Mad Lads stood out the most, with a total of $4.5 million being transacted – marking a significant 130% increase compared to the previous week.

As an analyst, I’ve discovered that the most valuable NFT transaction during the past week was the sale of Cryptopunk #3619, which went for a hefty price tag of $627,991.

Specifically, a transaction on Solana’s Boogle #064 resulted in a change of ownership worth approximately $192,124. Meanwhile, Mushroom #95 on the Bitcoin network saw a similar event resulting in around $135,096 in value being transferred.

The consistent decline in sales week after week indicates a cautious sentiment among collectors.

I analyzed the data from Cryptoslam and found that approximately 145,000 individuals engaged in buying cryptocurrencies last week. This represents a significant decrease of around 86% compared to the previous week.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-11 19:28