As an analyst with over two decades of experience in the tech industry, I’ve seen my fair share of ups and downs in the market. The recent events surrounding Nvidia are quite intriguing, to say the least.

On a single day, the tech behemoth, Nvidia, suffered an unprecedented loss, with its market value plummeting over $280 billion. The question arises: what sparked this significant drop?

Based on Bloomberg reports, the U.S. Department of Justice has served subpoenas to Nvidia and multiple other firms as part of a broader antitrust investigation. Until recently, the department was only sending out non-compulsory questionnaires, but now it appears they’re taking stronger measures in their probe

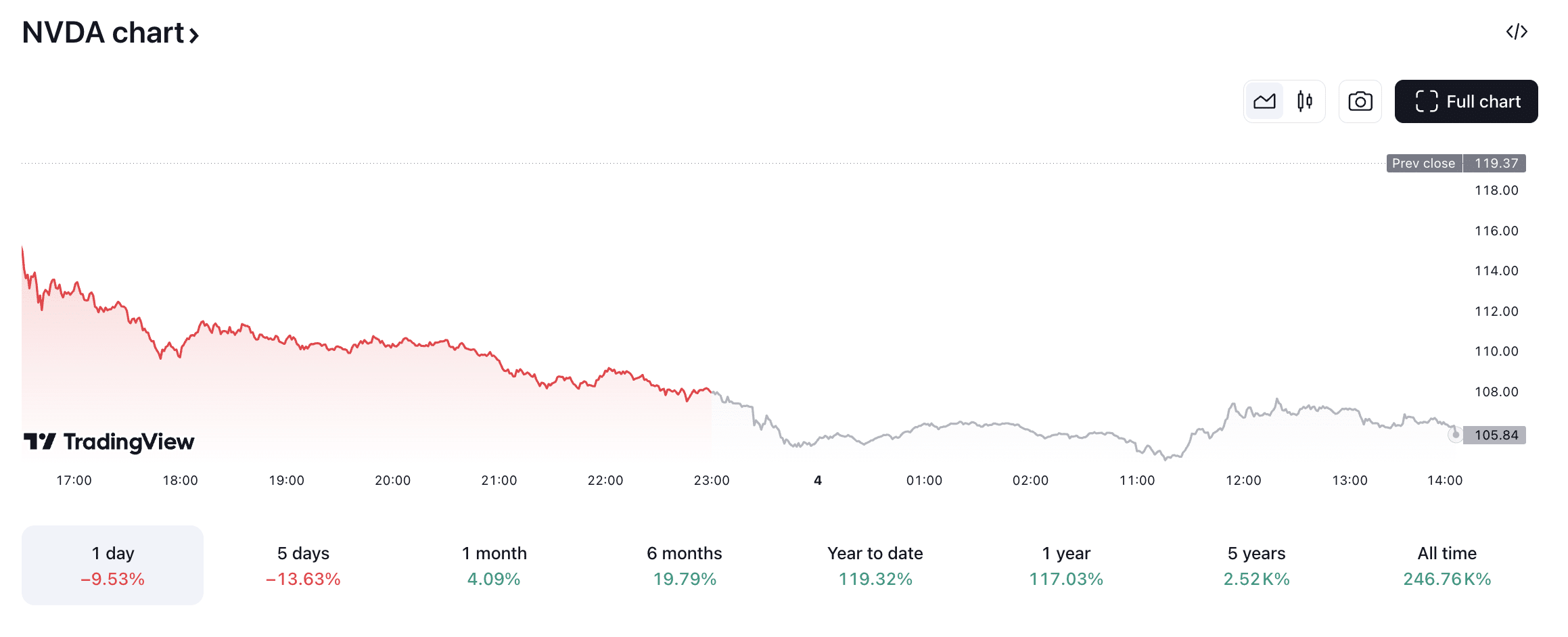

On September 3, when the market closed, Nvidia’s shares experienced a significant dip following the news, decreasing by 9.5% to $108. Post-market hours, there was an additional 2% drop, bringing the share price down to $105

What is going around Nvidia subpoena and why is Nvidia down

Regarding Nvidia, antitrust officials have expressed worries because it appears the company may be creating obstacles for clients wishing to transition to other chip manufacturers and AI service providers, and potentially imposing penalties on customers who do not solely rely on its AI services

In the course of their investigation, the Justice Department reached out to other tech firms such as Microsoft, a significant shareholder in Nvidia, to obtain more details

Contrarily to the claims, Nvidia firmly refutes all accusations. In a statement issued to Bloomberg, Nvidia’s representatives highlighted that the company stands out based on its own merits, as demonstrated by our test results and the customer value derived from choosing any solution that best fits their needs

How the Nvidia investigation has affected the crypto market

Nvidia has swiftly become the globe’s leading manufacturer of computer chips, particularly those suited for artificial intelligence applications. Despite not having a direct connection with cryptocurrencies, the AI token market often reacts to wider industry news

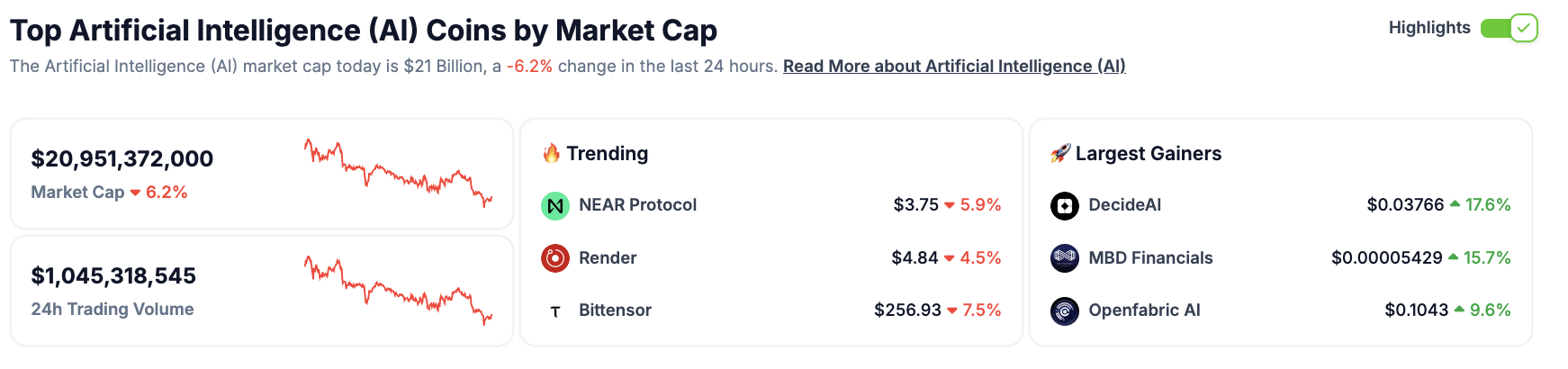

Consequently, as per CoinGecko’s reports, during Nvidia’s struggles, the market cap of AI-related tokens has dropped by over 6%. Similarly, the prices of the top five tokens within this sector have also decreased

Among artificial intelligence-related cryptocurrencies, the most significant decrease was observed in Carbon Browser’s CSIX token, plummeting by 14% to reach $0.01693. Following closely was NEURALAI’s NEURAL token, experiencing a 14% decline and settling at $2.45

Financial report and Nvidia buyback had a negative impact on crypto

Between August 27 and 28, approximately 5% of tokens associated with artificial intelligence experienced a decline. This drop took place just before the release of Nvidia’s revenue report, following the approval of a $50 billion stock repurchase plan by Nvidia’s board of directors

Consequently, the value of NEAR Protocol (NEAR) decreased by 4.45%, Artificial Superintelligence Alliance (FET) dropped by 2.1%, and Injective (INJ) declined by 7.87%. The total market capitalization for this sector fell to $23.9 billion, representing a decrease of 6%

Normally, just before Nvidia releases its report, the prices of AI-related tokens tend to rise. For instance, in March 2024, these coins increased by approximately 25% prior to their conference. But this time, instead of rising, they dropped

What analysts say

As a researcher, I find myself reflecting on the recent financial report released by Nvidia. According to analysts at QCP Capital, this report has sparked a wave of pessimism among investors, leading to a downward trend in the stock market and even impacting the cryptocurrency markets negatively

Following the release of Nvidia’s earnings report for the past quarter, there was a surge in the volatility of the top cryptocurrency, but it eventually started to decrease. According to QCP Capital, this fluctuation might be due to investors anticipating more outstanding performances from the pioneer in AI chips

As we approach the final three months of the year, is it likely that we’ll experience further declines? Given the lack of significant events on the horizon, we expect the prices to fluctuate within their current range as we transition into September

Experts predict that the dip in both stock and cryptocurrency markets won’t last long. Given that the U.S. Federal Reserve is preparing to start reducing interest rates, an abundance of liquidity should ultimately boost the value of risky investments

What’s next for Nvidia

The decline in Nvidia’s stock can be attributed to concerns about global economic conditions and potential recession in the United States, as well as investigations by the U.S. Department of Justice regarding suspicions that Nvidia may have misused its powerful position within the semiconductor market

As a market analyst, I’m expressing my concerns about potential monopolistic practices by Nvidia. It appears they might be creating obstacles for businesses when it comes to switching to other AI and semiconductor suppliers. Furthermore, there are allegations that they levy penalties on customers who opt not to exclusively rely on their AI services. This could potentially stifle competition in the market

In the age of artificial intelligence advancement, Nvidia continues to be a major player, holding 70-95% of the microchip market share. This dominance exerts considerable influence on the AI cryptocurrency or token market

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2024-09-04 18:16