As an analyst with over two decades of experience navigating financial markets, I’ve seen my fair share of market fluctuations and dead cat bounces. The recent rally in Nvidia stock and various altcoins like Dogecoin, JasmyCoin, Render Token, and Bitcoin could indeed be a dead cat bounce, but it’s crucial to remember that even dead cats can claw their way back up the wall once in a while.

On Monday, August 5th, the value of Nvidia shares began to recover, offering a glimmer of optimism for investors across various asset classes, suggesting a potential chance to invest at a lower price (buy-the-dip opportunity).

Is this all a big dead cat bounce?

On August 5, Nvidia shares dipped to a minimum of $90.69, but shrewd investors spotted a potential purchase opportunity as the stock swiftly rose back above $100 mark. This rapid recovery took place despite the Dow Jones plummeting by more than 1,000 points, and both the S&P 500 and the Nasdaq 100 index encountering their first-ever intraday decline of 1,000 points each.

As a researcher, I’ve observed an intriguing parallel between NVDA’s resurgence and the comeback of several prominent altcoins, ranging from the well-known to the lesser-known. For instance, Dogecoin (DOGE) surged to $0.093, representing a significant 16% increase from its lowest point. Similarly, JasmyCoin (JASMY), a popular Japanese cryptocurrency, climbed up to $0.021, marking a substantial 35% rise over its daily low.

Render Token (RNDR), a leading AI cryptocurrency, rose by 25% from this week’s low.

Bitcoin (BTC) recovered some of its earlier drops and was currently being traded at around $54,500. Ethereum (ETH), on the other hand, climbed up to approximately $2,440. However, there’s uncertainty about whether these increases will persist due to the heightened risk in the financial sector. It’s possible that this rebound might just be a temporary bounce-back, known as a “dead cat bounce,” where an asset experiencing a steep decline suddenly recovers momentarily before continuing its downward trend.

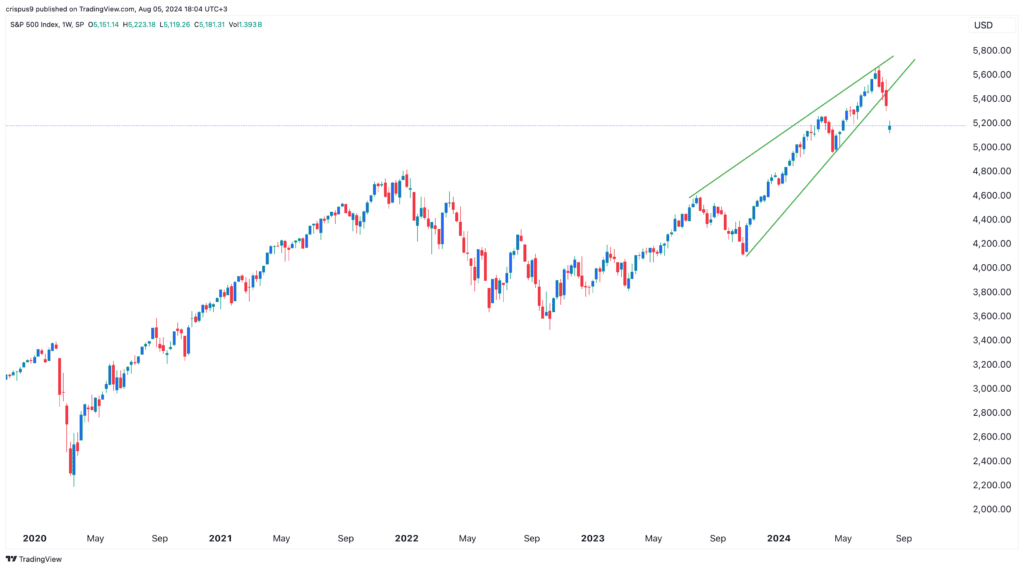

Another way of expressing this could be: There’s also a concern that the S&P 500 index has developed a potentially dangerous upward slanting chart pattern known as a rising wedge on its weekly graph. Historically, such patterns often result in further drops, and indeed, we’ve already witnessed this trend.

In simpler terms, the performance of tech stocks such as Nvidia and digital currencies like Render and Jasmy share some common patterns. This correlation may be why these alternative coins increased during the US morning trading hours. Investors seemed to capitalize on a price decrease, purchasing more when these tokens were oversold. On a daily scale, the Relative Strength Index (RSI) for Render dropped to 26, while it fell slightly lower for Jasmy and Dogecoin at 24 and 27 respectively. This suggests that the market may have considered these tokens overpriced and ripe for buying at a discount.

The bullish case for NVDA and altcoins

On the positive side, some potential catalysts could push Nvidia and cryptocurrencies higher. The main catalyst is that the US is moving to a recession, according to Goldman Sachs and the Sahm Rule.

If the information is accurate, it’s probable that the Federal Reserve will reduce interest rates significantly during their September gathering, with some experts like Professor Jeremy Siegel advocating for a substantial reduction of 0.75 percentage points (or 75 basis points).

The likelihood of a 0.5% interest rate reduction by the Federal Reserve in September dramatically increased, going from virtually negligible to approximately 80%, as traders boosted their collective belief in not only the magnitude but also the swiftness of a Fed’s rate-cutting phase. It is quite plausible that…

— Mohamed A. El-Erian (@elerianm) August 4, 2024

During the unprecedented Covid-19 pandemic, I observed a fascinating trend in the financial markets: risky assets like cryptocurrencies flourished when the Federal Reserve reduced interest rates significantly. This intriguing correlation became apparent as global stocks and digital currencies surged, despite the ongoing pandemic’s adverse effects on the world economy.

Another encouraging aspect for both stocks and cryptocurrencies is that earnings have remained robust, even with setbacks from Tesla and Intel. With more than three-quarters of S&P 500 companies reporting their results, the combined revenue growth has reached a peak of 11.5% – the highest since Q4’21.

As a dedicated researcher, I eagerly anticipate the upcoming financial disclosure by Nvidia on August 28th. According to analyst predictions, this release will reveal an uptick in the company’s revenue, with the figure potentially rising from $26 billion in Q1 to approximately $28 billion. This projected growth is a significant milestone that I am closely watching.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-05 20:42