As an experienced analyst, I believe that Oasis Network’s (ROSE) price surge on Monday was a result of increasing trading and transaction volumes. The network processed over 386,000 transactions on Sunday, a significant increase from the previous week. Additionally, the total volume traded on Monday exceeded $31 million, up from $18 million the day before. These data points explain why ROSE was one of the best-performing major cryptocurrencies despite Bitcoin’s stagnation and the overall market cap drop.

As a crypto investor, I’m thrilled to share that the price of Oasis Network (ROSE) experienced a significant surge on Monday. The uptrend was accompanied by an increase in trading and transaction volumes. Reaching a high of $0.12, ROSE hit its peak price since April 12th. At its best on Monday, ROSE saw a nearly 50% climb from its lowest point in May.

Trading and transaction volumes rising

The trading volume at Oasis Network has significantly increased in the recent past. As reported by CoinGecko, the total transaction value reached approximately $31 million on Monday, surpassing the $18 million recorded on Sunday.

Over the last five days, the daily trading volume on average exceeded 27 million dollars, marking a significant jump from the prior five-day period when the average stood at 15 million dollars.

As an analyst, I’ve noticed an intriguing development based on the data from Oasis Scan. Specifically, there was a significant increase in network activity on Sunday, with a total of 386,000 transactions processed. This figure surpasses the number of transactions processed on May 26th by over 23,000. The trend is undeniably robust.

Two notable data points shed light on why ROSE stood out among major cryptocurrencies on Monday, despite Bitcoin holding steady near $69,500 and a 0.23% decrease in the combined market capitalization of all coins to approximately $2.5 trillion.

As a network analysis expert, I’d describe it this way: I’ve been observing the blockchain landscape, and Oasis Network stands out as a notable contender aiming to disrupt Ethereum‘s reign among developers. What sets Oasis apart is its unique architecture – it separates the consensus and compute layers, enabling more scalability and customizability for projects built on the network.

Oasis faces a significant journey before it can rival the leading chains such as Ethereum, Solana, and BNB Chain, with current TVLs for Oasis Sapphire and Oasis Emerald being relatively small at $6.18 million and $1.28 million respectively.

Oasis Network price forecast

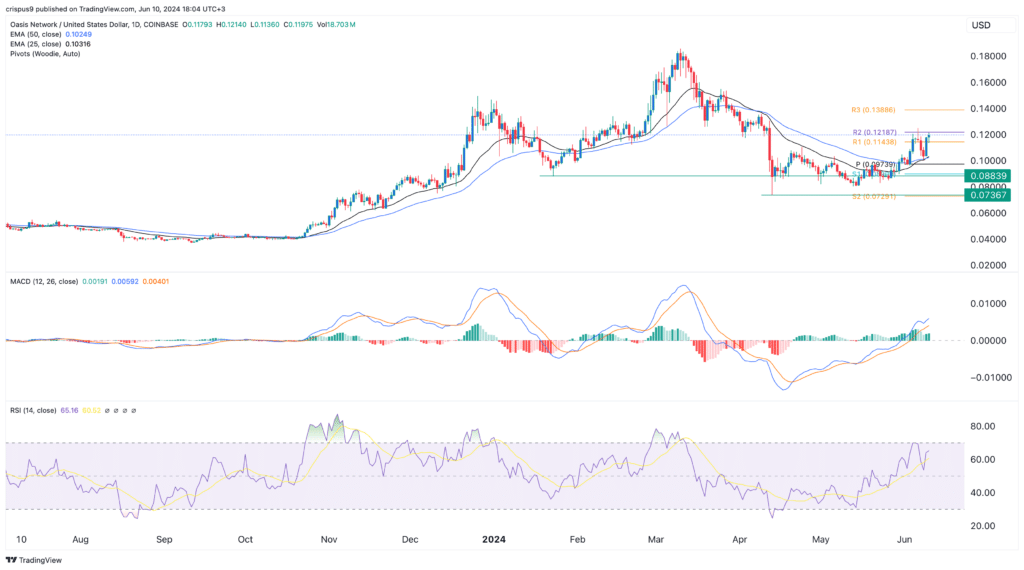

As a researcher studying the cryptocurrency market, I’ve observed that the ROSE token price took a downturn in April and reached a low of $0.0736. However, since then, it has experienced a significant rebound, surging by nearly 50%. This price movement has propelled the token above the first resistance level set by the Woodie pivot point.

As a researcher studying market trends, I’ve noticed an intriguing development in the financial data I’m analyzing. Specifically, I’ve observed that the 25-day and 50-day Exponential Moving Averages (EMAs) have recently crossed paths, forming what’s known as a bullish crossover pattern. This is an often-noted sign among traders, indicating potential for upward price movements. Additionally, I’ve seen both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) oscillators displaying positive readings, which can be interpreted as indicators of increasing momentum in the market.

Based on the analysis, the easiest route for the price to follow is upward, reaching the third resistance level at $0.1388. This represents a 16% rise from the present position.

The anticipated factor that could influence ROSE‘s price next is the Federal Reserve’s decision due on Wednesday. If the Fed adopts a dovish stance, keeping interest rates unchanged and hinting at rate reductions later in the year, this situation would likely boost Oasis Network further.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-10 20:15