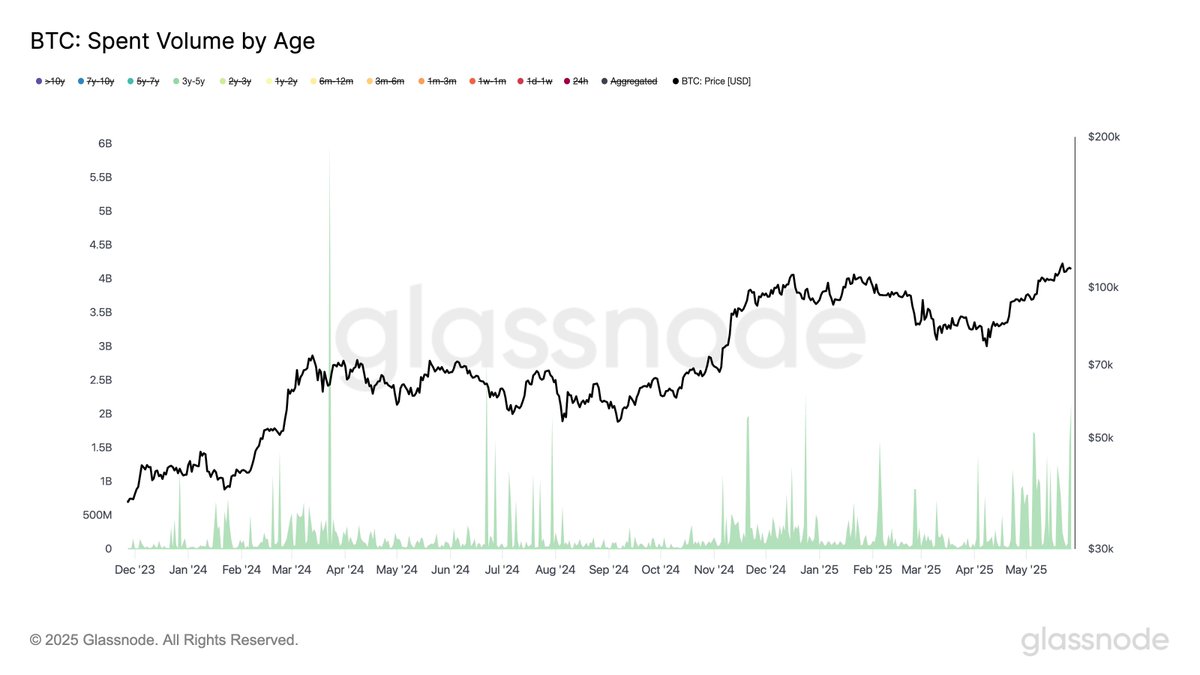

Ah, the delightful dance of the Bitcoin holders! It appears that our venerable 3–5 year cohort has taken the lead, prancing forth with a staggering $2.16 billion in outflow. One must wonder if they’ve finally decided to treat themselves to a lavish dinner or perhaps a new pair of shoes! 🍷👠

Following closely, like a well-trained puppy, is the 2–3 year group, wagging its tail with $1.41 billion, while the wallets of the 1–2 year holders, bless their hearts, managed a modest $450 million. May’s escapades mark the fifth-largest spike in the spending spree of the 1–5 year cohort this cycle. Bravo! 🎉

How May Compares to Previous Peaks

Let us indulge in a comparison of this month’s extravagant $BTC spending with the illustrious peaks of yore:

- October 2024: $9.25B (the 1–2 year cohort, ever so dominant)

- March 2024: $6.11B (the 2–3 year cohort, leading the charge)

- February 2025: $5.42B (the 2–3 year holders, ever so reliable)

- November 2024: $4.39B (the 3–5 year cohort, taking a bow)

- May 2025: $4.02B (the 3–5 year cohort, still in the limelight)

Though May’s figures may not reach the dizzying heights of previous peaks, they herald the return of older coins to the market, a phenomenon that historically dances hand-in-hand with rising volatility and the potential for macro inflection points. How thrilling! 🎭

What It Could Mean for the Market

Ah, the spending of long-dormant wallets! A sure sign that our seasoned holders are either indulging in a bit of profit-taking or perhaps rebalancing their portfolios as BTC flirts with key price levels. According to the ever-reliable Glassnode, these movements often precede or coincide with major market shifts. How very dramatic! 🎭

At present, Bitcoin’s price is on an upward trajectory, tantalizingly close to the $110K–$115K region. Increased distribution by our long-term holders at these heights could very well signal a phase of profit realization, especially given the overlap with prior cycle highs. How poetic! 📈

Yet, the data reveals that total activity remains well below the all-time high of $9.25B from October 2024, suggesting there may still be room for further upside before a full rotation out of older hands occurs. The suspense is positively riveting! 🎢

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-28 11:49