As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen countless trends come and go. However, none have left me as disillusioned as the meteoric rise and fall of the pump.fun memecoin on the Solana blockchain.

2024 saw a swift growth spurt for the Solana blockchain within the memecoin sector, with pump.fun taking center stage. This platform attracted a vast crowd eager for instant gains. However, a thorough investigation by Crypto.news unveiled that while some early investors reaped profits, the majority of investors who followed ended up losing their investments when it came to investing in pump.fun tokens.

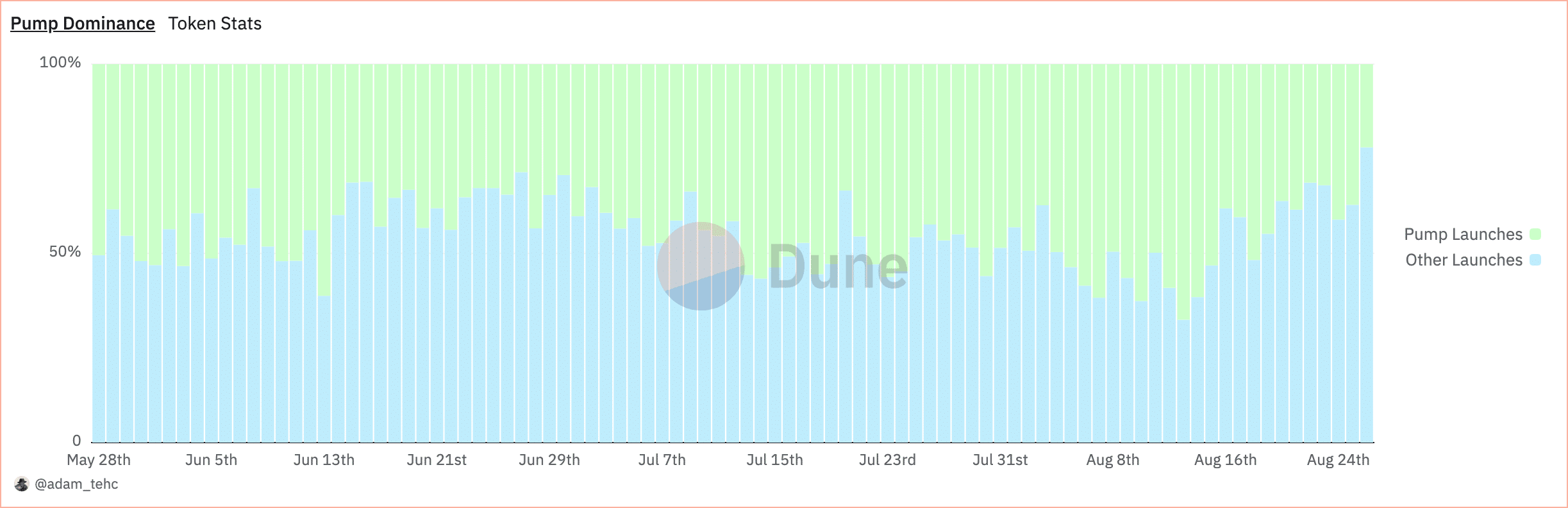

At the forefront of the memecoin landscape within Solana, Pump.fun controls approximately half of the market share. This dominance is due to its efficient approach to token launches, making them swift and user-friendly. Furthermore, it prioritizes a level playing field for the creation and trading of tokens, striving to eliminate issues such as presales or team allocations.

Pump.fun operates as follows:

- Users pick a meme coin they like.

- They buy the coin through a bonding curve.

- They can sell the coin anytime to either secure a profit or cut a loss.

- If the token’s market cap hits $69,000, $12,000 of liquidity is locked into Raydium, a decentralized exchange on Solana, and then burned.

We adapted ideas from experts like Adam_tehc, Hashed_official, and Evelyn233 by creating our unique queries and scripts. This enabled us to collect the data necessary for writing this article.

Since March 2024, approximately 300,000 tokens have been generated each month on the Solana platform due to their user-friendliness and growing popularity. However, a significant number of these tokens fail to reach a market capitalization of $69,000. In a six-month period, 33,683 tokens were successfully listed on Raydium, while a total of 1,883,578 tokens were deployed on pump.fun. This means that only 1.79% of the created tokens manage to reach their destination, or in other words, only about one out of every fifty-five tokens succeeds.

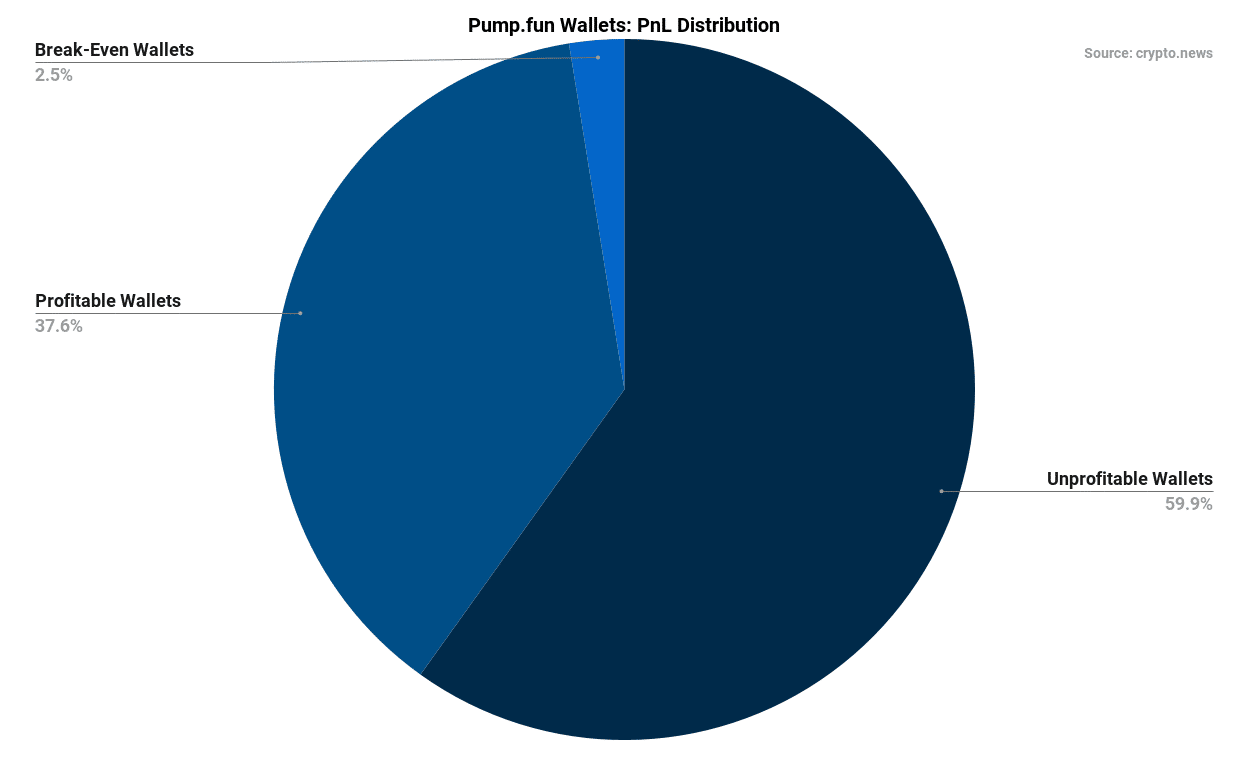

On the pump.fun platform, the statistical data reveals a more disheartening scenario. Out of the 29,601,462 total wallets engaged, the majority reported unfavorable results.

- 17,725,908 wallets (59.9%) recorded negative Profit and Loss (PNL). 89% of those wallets realized losses, locking in their negative returns by selling at a loss.

- On the other hand, 11,126,772 wallets (37.6%) reported positive PNL, with 98% of these realizing actual gains.

The distribution of profits further shows the low probability of winning through memecoin investments. To provide a clearer picture of the probabilities associated with different profit levels on pump.fun, here are some realistic comparisons:

- +$100 profit (6.47% chance): Less likely than being accepted into Harvard as an early applicant (7.8% in 2021).

- +$1,000 profit (0.76% chance): Similar to the probability of having twins, which is around 0.4%.

- +$10,000 profit (0.046% chance): Less likely than becoming a NASA astronaut (0.055%).

- +$100,000 profit (0.0033% chance): Less likely than being struck by lightning in a lifetime (about 0.00653%).

- +$1,000,000 profit (0.000540% chance): Comparable to the chance of being killed by a meteorite impact (approximately 0.0004%).

- +$10,000,000 profit (0.000132% chance): Similar to the odds of flipping a coin and getting the same side 20 times in a row.

Many people are eagerly seeking shortcuts to improve their financial standing, fueled by tales of ordinary folks raking in massive profits swiftly. However, it’s crucial to remember that the majority of such endeavors often result in losses, and in some cases, these can be disastrous. Instead of wagering on unverified digital tokens, investors should concentrate on established assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) – assets with a verifiable history of performance. While they may not transform $100 into a million overnight, these assets will help grow an individual’s wealth in a steady and sustainable manner. The primary objective of investing should always be to make money, not lose it. As soon as one lets go of the fantasy of instant wealth creation and accepts this reality, they’ll begin making decisions that truly boost their net worth. Any alternative course is a risky route to financial collapse.

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-08-27 00:12