As a seasoned crypto investor with a decade of experience under my belt, I’ve seen my fair share of market highs and lows. The recent stall in the rally of most cryptocurrencies has been a familiar sight, but the bear market that Optimism (OP) finds itself in is particularly disheartening.

The optimism token has been stuck in a prolonged downturn during a time when most cryptocurrencies’ upward momentum halted.

On October 10th, the prominent layer-2 token, often referred to as Optimism, was being traded at $1.5140 – a decrease of 70% from its peak price this year.

One explanation for why Optimism has taken a step back this year could be due to the persistent decline in its market presence within the industry.

In important sectors such as decentralized finance, it has been surpassed by blockchain networks like Avalanche (AVAX) and Sui (SUI), which operate at the base or “layer 1”. Similarly, it’s been outpaced by widely-used layer 2 solutions like Base and Arbitrum.

The combined worth of optimism in the Decentralized Finance (DeFi) sector has decreased to approximately $627 million, falling from its peak this year at $1.04 billion. Furthermore, the circulation of stablecoins within its system has dropped from its year-to-date maximum of $1.35 billion to the current level of $1.17 billion.

Additionally, it’s worth noting that its significance in the Decentralized Exchange (DEX) index sector seems to be decreasing. In fact, over the same period, the weekly trading volume dropped by 24% to reach approximately $503 million. On the other hand, Sui and Base have experienced a surge in their volumes, with Sui’s volume increasing by 51% and Base’s volume rising by 5%.

After the developers revealed their fifth airdrop, the value of OP decreased as they distributed 10 million OP tokens to a total pool of 54 million.

Currently, there are approximately 500 million OP tokens left for potential future airdrops. This implies that the current token holders might experience additional dilution in the future.

🔵 Embrace the Superchain and enjoy its perks!

— Optimism (@Optimism) October 9, 2024

As an analyst, I’m observing that the majority of this dilution will stem from Optimism, a cryptocurrency with a circulating supply of 1.25 billion tokens and a maximum supply of 4.29 billion. According to Defi Llama, they unlocked approximately 49.19 million tokens in September, with the final unlock set for 2026.

Additionally, it’s worth noting that the amount of Optimism traded in the futures market has decreased as well. The data indicates a significant drop in open interest to around $104 million on October 10th, which is a decrease from the highest point this year at $327 million.

Optimism token is at risk of more downside

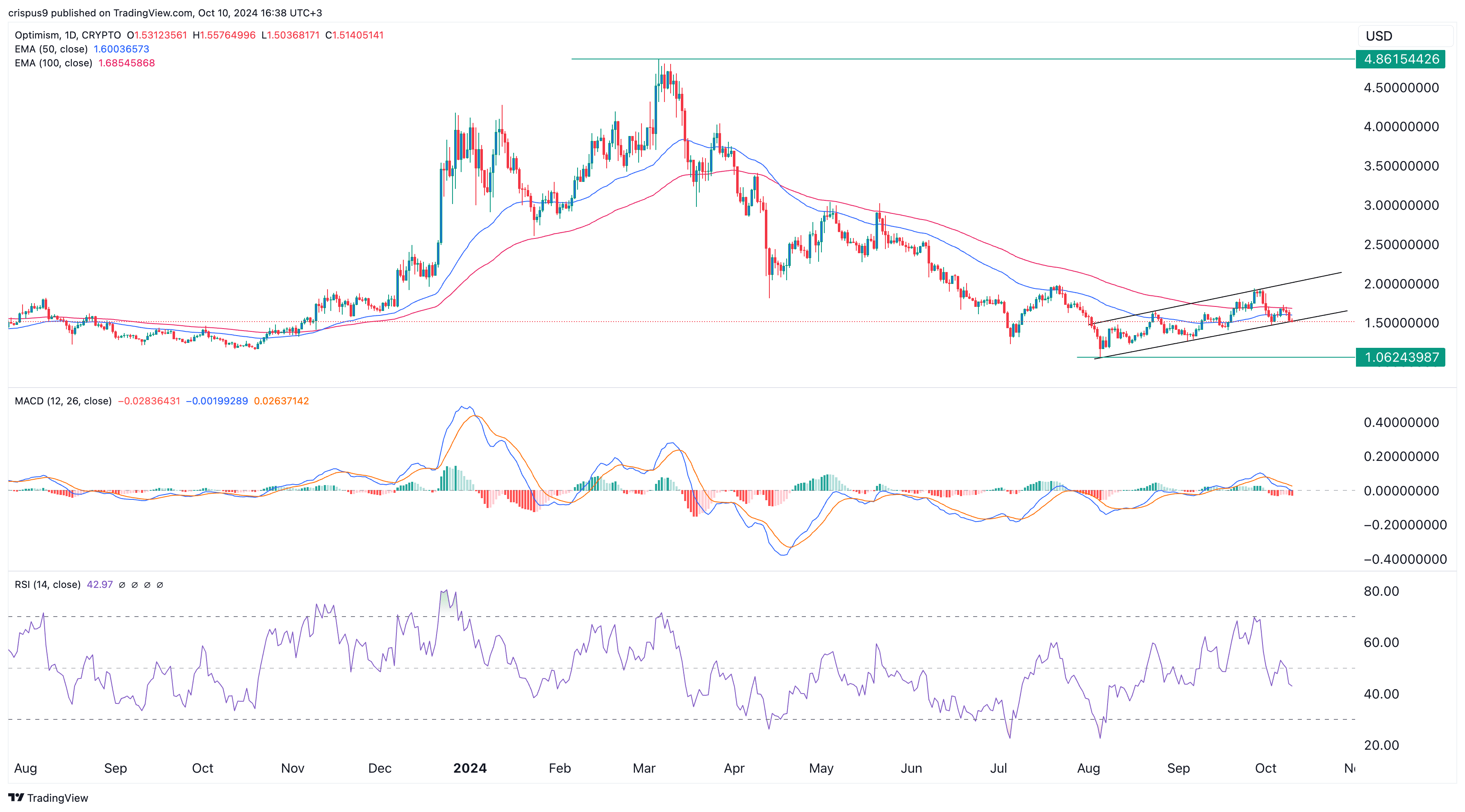

On the daily chart, the OP token has been in a strong downtrend since peaking at $4.86 in March.

The asset’s value continues to stay lower than its 50-day and 100-day Exponential Moving Averages. Furthermore, the Relative Strength Index (RSI), a tool for measuring momentum, indicates a decline.

Optimism has also formed a bearish flag pattern, suggesting the potential for a bearish breakout. If this occurs, it could drop and retest the support at $1.06, its lowest point in August.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-10 17:18