As a seasoned analyst with years of experience navigating the volatile cryptocurrency market, I find myself intrigued by ORDI‘s recent performance. Despite the bearish conditions that have plagued the market, ORDI has managed to secure the top gainer spot, posting double-digit gains in the past 24 hours. This is reminiscent of a phoenix rising from the ashes, a sight not uncommon in this dynamic industry.

Despite a generally bearish market climate, ORDI managed to take the lead as the top gainer, recording significant increases exceeding 10%.

As a researcher, I’m excited to note that ORDI has seen a significant 17.76% increase over the past 24 hours, making it the top performer among the leading 100 cryptocurrencies. This surge comes after a phase of consolidation, suggesting a possible change in market sentiment, which I find intriguing and worth further exploration.

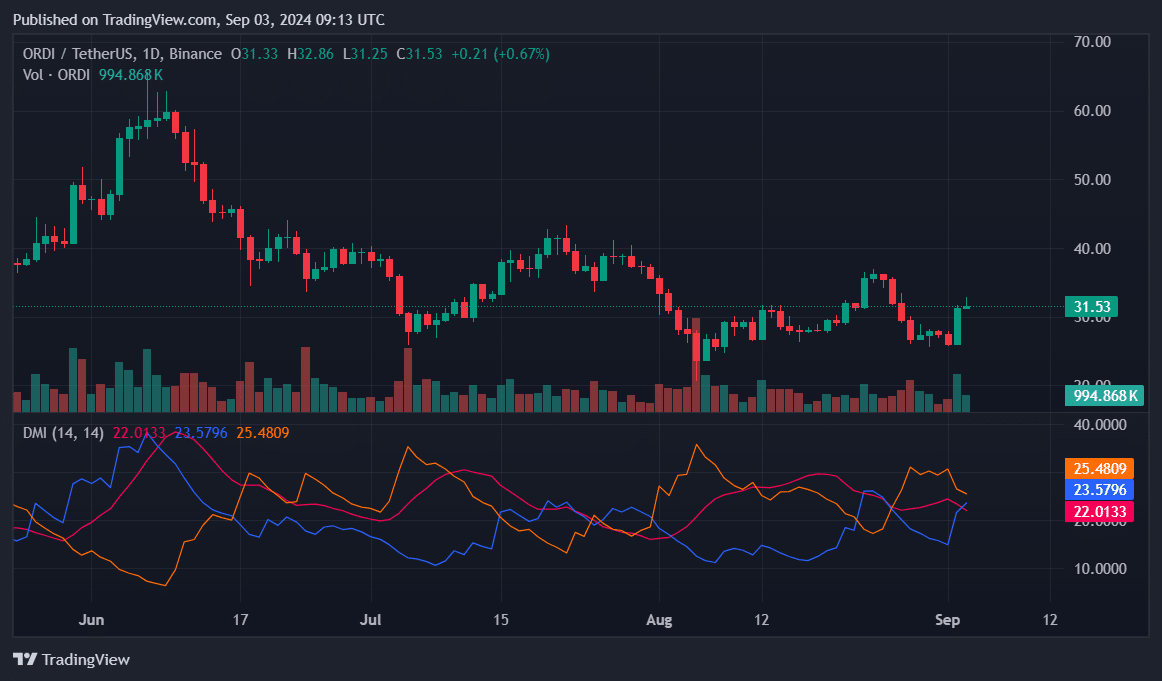

Between August 29 and September 1, the ORDI stock has been moving sideways, confined between a high of $28 and a low of $25. This horizontal movement followed a significant drop from its peak of $36.96 on August 24. Over this span, ORDI experienced a decrease in value amounting to approximately 28.78%, breaching multiple support levels above the $30 mark.

Nevertheless, it appears things are shifting. Recently, the surge has elevated ORDI above the significant $30 threshold, which is now serving as a foundation.

At this moment, ORDI is being traded for $31.53. This rebound is significant because it’s the first time in almost a week that ORDI has surpassed the $30 mark again.

Glancing at the trade volume chart shows a rise in activity compared to the previous day, indicating a surge of investor attention. It could be due to the assumption that ORDI‘s recent drop may have been excessive, leading to optimism about its recovery.

As a crypto investor, I’ve noticed an interesting development in the market: The Directional Movement Index (DMI) is showing a significant surge in the +DI line. This suggests that the bulls are gaining strength and boosting the bullish trend. On the flip side, the -DI line is decreasing, which implies that the selling pressure is weakening.

The index indicating the strength of a trend, called the Average Directional Index, is decreasing too, suggesting that the strong downward trend we’ve been experiencing since August 24 may be starting to weaken.

Although there’s been a significant rise recently, market analyst Yuriy believes that the period for long-term investments has ended, implying that the current upward trend may not last over the coming days.

1. Overnight, the digital currency surged close to 20%.

— Yuriy 🔶 BikoTrading | OrderFlow Trader (@Yuriy_Biko) September 3, 2024

This is largely due to a lack of support from the broader market.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-03 13:18