As a seasoned crypto investor with over a decade of experience in this dynamic market, I find the recent trend of increased Bitcoin outflows from exchanges intriguing and potentially promising. Having weathered numerous bull and bear markets, I have learned to read between the lines when it comes to on-chain data.

As a researcher, I’ve observed an uptick in Bitcoin transfers leaving cryptocurrency exchanges, suggesting that there might be accumulation happening.

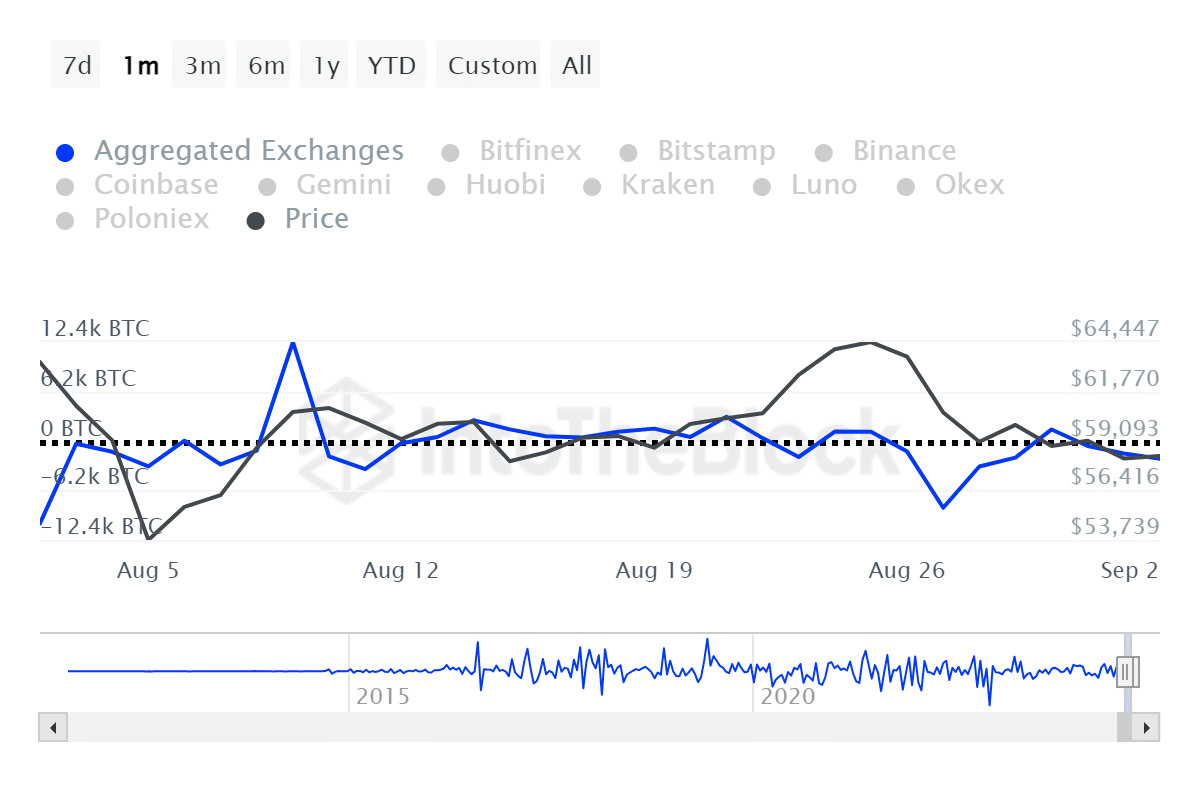

Based on information from IntoTheBlock, a significant amount of approximately 16,500 Bitcoins, valued at more than $1 billion, has been withdrawn from centralized cryptocurrency exchanges during the last week. Interestingly, about 2,200 BTC were removed from these platforms in just the past day.

ITB data shows that most of the net outflows happened on Aug. 27.

On August 27th, as reported by crypto.news, Binance – the leading cryptocurrency trading platform in terms of volume – experienced a total withdrawal of approximately 48,000 Bitcoins, equating to around $3.7 billion when considering both Bitcoin and Ethereum (ETH) withdrawals over a 30-day period.

It appears that investors are amassing this asset more, as indicated by the rise in overall withdrawals, even though there were pessimistic predictions about September’s market conditions.

According to ITB’s data, significant Bitcoin wallets, owning at least 0.1% of the total supply, transferred approximately 1,123 Bitcoins, equivalent to more than $66.2 million, during the last two days.

According to a recent article published by Crypto News on August 29th, the amount of Bitcoin held on cryptocurrency exchanges has fallen to approximately 2.38 million coins, reaching its lowest point in 2024. This trend suggests that the process of accumulating Bitcoin might be underway.

Investors frequently shifting their assets into personal, self-managed wallets typically indicates optimistic outlooks. Historically, Bitcoin’s price has tended to decrease in September. However, historical data reveals that October has consistently shown strong monthly growth for the past eleven years.

In simpler terms, Bitcoin initially showed signs of falling this month, but it has since risen by 2.1% in the last day. At the moment of writing, Bitcoin is being traded at approximately $58,900 and has a market capitalization of around $1.16 trillion. Additionally, the daily trading volume for this asset is currently close to $25 billion.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- EUR CNY PREDICTION

- Brent Oil Forecast

- USD MXN PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Roblox: Project Egoist codes (June 2025)

2024-09-03 10:14