As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent developments in blockchain gaming have caught my attention. The surge in daily active wallets and the dominance of networks like Ronin are undeniably impressive. However, the stark decline in investment in this sector leaves me a bit concerned about its long-term prospects.

In the third quarter of this year, blockchain games ruled the roost in the web3 world, accounting for a whopping 26% of all on-chain activities, as per the latest report from DappRadar. As an investor in cryptocurrencies, I’m keeping a close eye on this trend.

In the third quarter, approximately one out of every four transactions on the blockchain was related to Web3 gaming, driven by around 4.4 million active wallets each day. This represents a 21% growth in the number of unique daily active wallets compared to the previous quarter, as indicated by DappRadar’s data.

In the forefront, Ronin Network continued its reign, drawing in more than a million daily wallets – a 34% increase from Q2 – while Oasys and opBNB also experienced growth. Remarkably, Oasis surged by an impressive 4,711%, and opBNB went up by 480%. These two platforms have now proven themselves as the top-performing gaming blockchains in terms of performance.

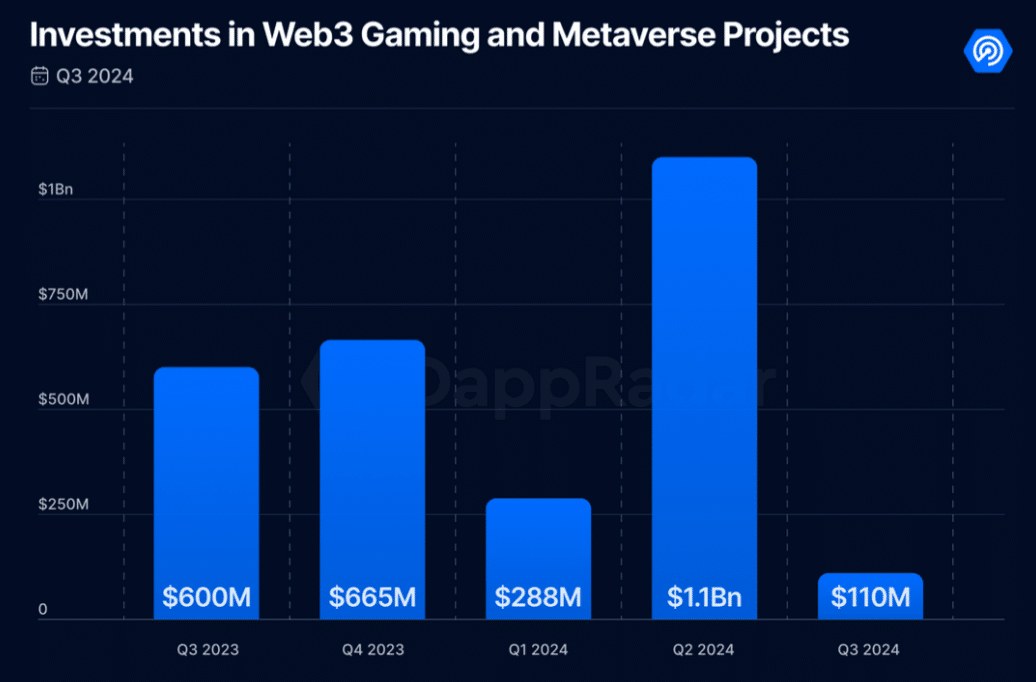

In contrast to the bustling on-chain transactions, recent data indicates a dramatic 90% decrease in investment in blockchain gaming compared to the preceding quarter, which has now dropped to approximately $110 million. It’s worth noting that around 79% of this capital has been directed towards infrastructure projects.

🔔 Latest Report from GlxyResearch 🚀

Cryptocurrency and Blockchain Venture Capital – Q3 2024

In the third quarter of 2024, venture capitalists allocated $2.4 billion (-20% compared to the previous quarter) towards startups specializing in cryptocurrencies and blockchain technology across 478 deals (-17% compared to the previous quarter).

— Gabe 博仁 Parker (@hiroto_btc) October 15, 2024

Data from cryptocurrency investment firm Galaxy Digital reveals that the amount of venture capital invested in the crypto market dropped by approximately 20% during Q3, with a total of $2.4 billion being distributed among 478 separate deals.

Approximately one-fourth of all deals made were in the area of Web3, NFTs, DAOs, Metaverses, and Gaming, representing 120 transactions. This is a 30% rise compared to the previous quarter, largely due to 48 gaming-related deals.

— Gabe 博仁 Parker (@hiroto_btc) October 15, 2024

According to Gabe Parker, an analyst at Galaxy Digital, there was a fivefold surge in funding for cryptocurrency companies specializing in artificial intelligence services from one quarter to the next. In contrast, those concentrating on non-fungible tokens, the metaverse, and gaming witnessed a 39% drop in venture capital investment – a decline that Parker characterized as the most significant quarter-over-quarter decrease in funding across all categories.

According to DappRadar’s blockchain analyst, Sara Gherghelas, while investments in web3 gaming saw a significant decrease compared to the previous quarter, she emphasized that these actions are establishing essential frameworks for future expansion. Simultaneously, the metaverse exhibited a mix of decreasing trading volumes and increasing sales, suggesting a consistent demand even as prices vary, according to Gherghelas.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-16 12:09