As a researcher with a background in finance and a personal interest in emerging markets, I find the growing adoption of cryptocurrencies by American family offices to be an intriguing development. The numbers speak for themselves: more than half of these wealthy families are planning to increase their investments or have already started exploring the crypto market. This trend is further fueled by the recent approval of Bitcoin ETFs by the SEC, which is set to integrate cryptocurrencies into the mainstream investing environment.

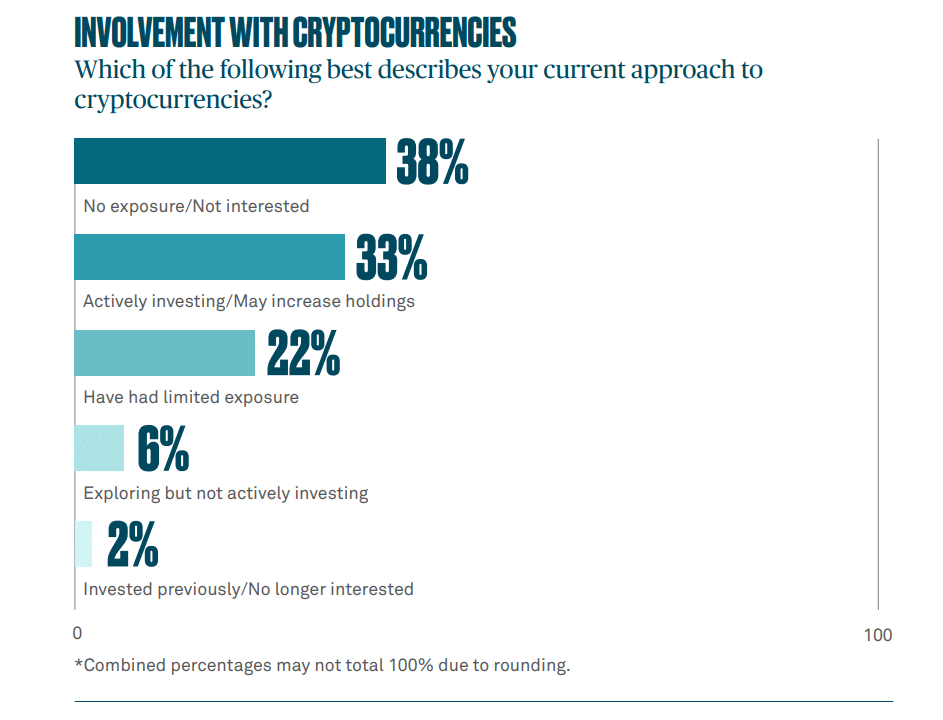

Approximately 55% of American family offices are either planning to boost their cryptocurrency holdings or have already dabbled in this digital asset class, as indicated by a report from BNY Mellon.

Approximately one third of family offices in the United States are currently investing in cryptocurrencies, and there’s a strong possibility they will upsurge their investments, according to a report published by BNY Mellon. This finding underscores the burgeoning appetite for digital assets among affluent American families.

A report emerges following the SEC’s early January approval of the first Bitcoin ETFs on the U.S. markets, paving the way for cryptocurrency investments to enter mainstream finance. According to BNY Mellon’s research, approximately one-third of family office experts have already invested in crypto and are considering increasing their holdings.

As a researcher, I’ve discovered that approximately 38% of the survey participants don’t have any current engagement or enthusiasm towards cryptocurrencies. The other 30% exhibited varying degrees of involvement in this domain. Some were just starting to learn about it while others had limited experience without actively investing.

Families offices, true to their innovative spirit, are seizing new possibilities and expanding into emerging markets. A significant portion, approximately 5%, of their investment portfolios is now dedicated to cryptocurrencies – a once unimaginable allocation.

BNY Mellon

As a crypto investor, I’ve noticed that the reasons for family offices delving into cryptocurrencies are varied. For me, one significant motivation is staying informed about emerging investment trends and possibilities. Another compelling factor is the influence of current leadership or the next generation within these family offices, who may be eager to explore this exciting new asset class.

Although there’s considerable interest, the report highlighted the vague regulatory landscape as a major hindrance to investment. However, nearly two-thirds (55%) of family offices indicated a positive stance towards public market Exchange-Traded Funds (ETFs) holding cryptocurrencies. Similarly, around half (54%) of these offices favored transacting directly on digital currency exchanges.

Read More

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-06-06 11:56