As a crypto investor with a few years of experience under my belt, I’ve witnessed the shifting tides within the blockchain industry. The recent announcement from Pantera Capital about Solana’s growing potential over Ethereum has piqued my interest.

According to cryptocurrency investment firm Pantera Capital, Ethereum‘s dominance in blockchain development is being challenged by Solana, which has emerged as a serious rival in this field.

According to reports, investment firm Pantera Capital, which oversees vast amounts in crypto assets, is considering buying millions of dollars’ worth of Solana (SOL) from the distressed FTX exchange. This move underscores Pantera’s growing conviction in Solana’s potential over Ethereum for their investors.

In a recent newsletter published on June 18th, the venture capital firm based in Menlo Park announced that Ethereum’s leadership seems to be giving way to a more diverse market. They highlighted Solana as an emerging player that has made a notable rise within the last year.

“Solana’s emergence recalls Microsoft’s reign in the early desktop computing era, which was later challenged by Apple’s innovative vertical integration. Solana has become a formidable player in the race for shaping the future of blockchain technology.”

Pantera Capital

In the vein of Apple’s pioneering efforts in the initial phase of personal computing, Pantera drew comparisons between Solana and Apple. According to him, Solana’s unified approach mirrors Apple’s vertically integrated tactic with macOS. He explained that the singular architecture of Solana’s blockchain is guided by a product strategy aimed at enhancing every element within its own system.

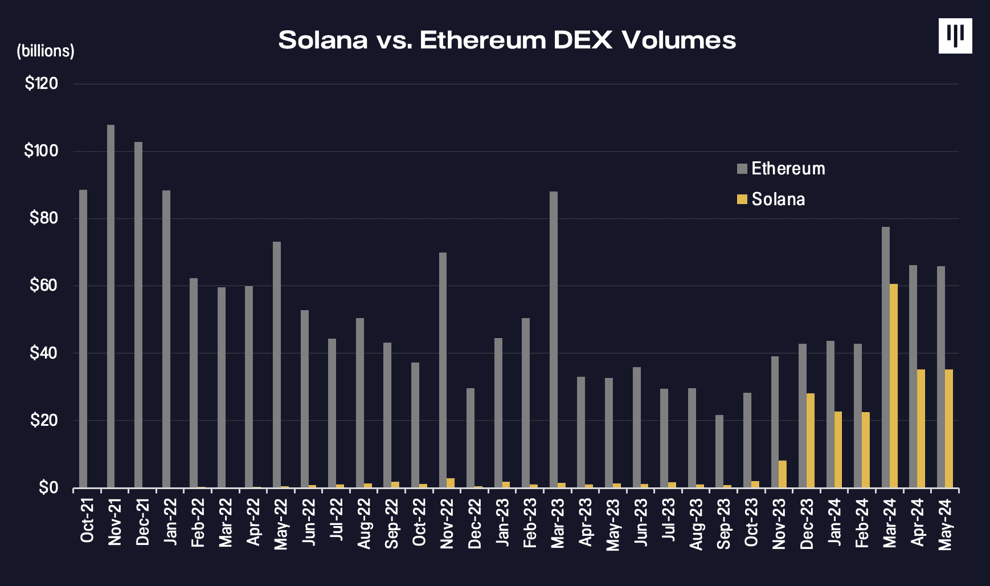

The venture capital firm points out that Solana’s “architectural advantages” allow for a diverse set of applications and user interfaces which could be harder to achieve on modular blockchains such as Ethereum and Cosmos. They highlight Solana’s “rapid, affordable transactions” as key factors contributing to these benefits.

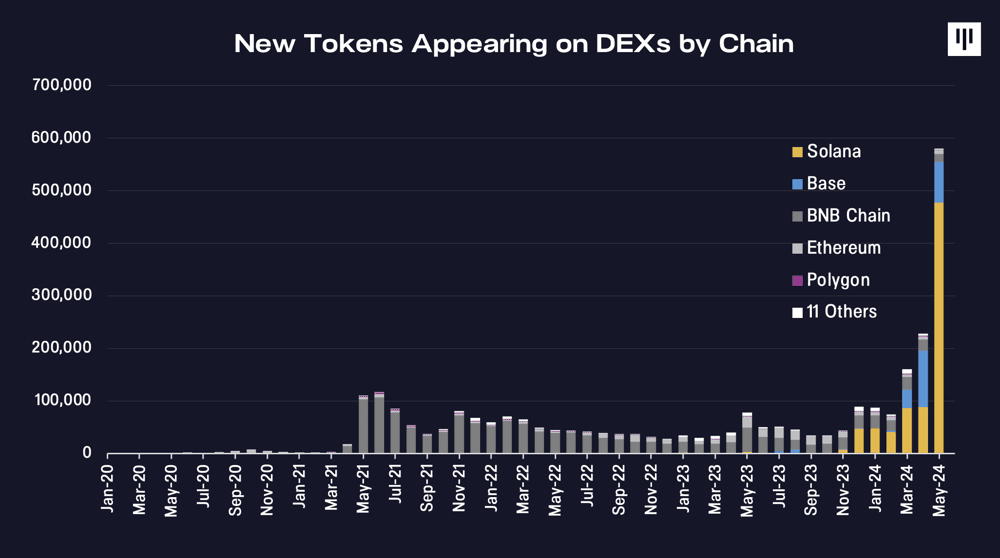

As a researcher studying the blockchain industry, I’ve observed that Solana’s architectural advantages have been a significant factor in its ability to attract a large portion of the growing demand within this space. These advantages are propelling Solana forward as a formidable competitor to Ethereum.

Pantera Capital

As a crypto investor, I’ve kept a close eye on market news and have noticed recent reports suggesting that my investment firm, Pantera Capital, was among the bidders for Solana (SOL) tokens during FTX’s bankruptcy proceedings earlier this year. The exact amount of tokens we acquired hasn’t been disclosed yet, but according to sources, it could be up to $250 million worth. This endorsement from Pantera Capital adds credibility and confidence to my Solana investment.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-19 11:54