As a seasoned crypto investor who has weathered numerous market cycles and trends, I must admit that the recent surge of Pepe (PEPE) has caught my attention. The coinciding rebound of other meme coins like Shiba Inu, Dogwifhat, and Mog Coin, coupled with the positive economic indicators from the Federal Reserve and China, presents a compelling case for optimism.

After experiencing a remarkable resurgence, Pepe – one of the top three meme coins – reached its peak in over a month, coinciding with a decrease in balances stored on centralized exchange platforms.

Exchange outflows are rising

Pepe token (PEPE) soared up to $0.0000091, boosting its market value beyond $3.8 billion. This surge in price mirrored the robust resurgence of other meme-based cryptocurrencies such as Shiba Inu (SHIB), Dogewhatsit (WIF), and Mog Coin, all experiencing a rise over 10%.

In just 24 hours up to September 26th, the total market capitalization of all meme coins being monitored by CoinGecko experienced a nearly 7% increase, surpassing $50 billion.

The primary cause for this recent surge can be attributed to the substantial interest rate reduction made by the Federal Reserve last week, coupled with indications of further cuts in the near future. Furthermore, China, one of the world’s largest economies, unveiled its most significant stimulus package since 2020. According to Bloomberg, there are also considerations for a $142 billion investment to invigorate their economy.

A favorable situation arises as PEPE, the Chinese variant, prepares to make a significant breakout, and China is planning to increase its market liquidity significantly. In simpler terms, the conditions are ripe for the Chinese PEPE token to gain prominence. The $PEIPEI token is all set to surge ahead with full force.— CRG (@MacroCRG) September 26, 2024

It appears that there’s evidence suggesting a return of investors to Pepe. As Nansen reports, Pepe experienced outflows amounting to $4.2 million on September 26, which is six times greater than usual. Moreover, over the past seven days, the total supply on exchanges has decreased by 0.35%.

An increase in the withdrawal of coins from centralized exchanges indicates that more investors are taking control of their cryptocurrency assets by transferring them into personal wallets.

Pepe’s jump occurred simultaneously with an increase in the number of open futures contracts, peaking at $129 million – a figure not seen since August 2, as reported by CoinGlass.

Pepe price is nearing key resistance

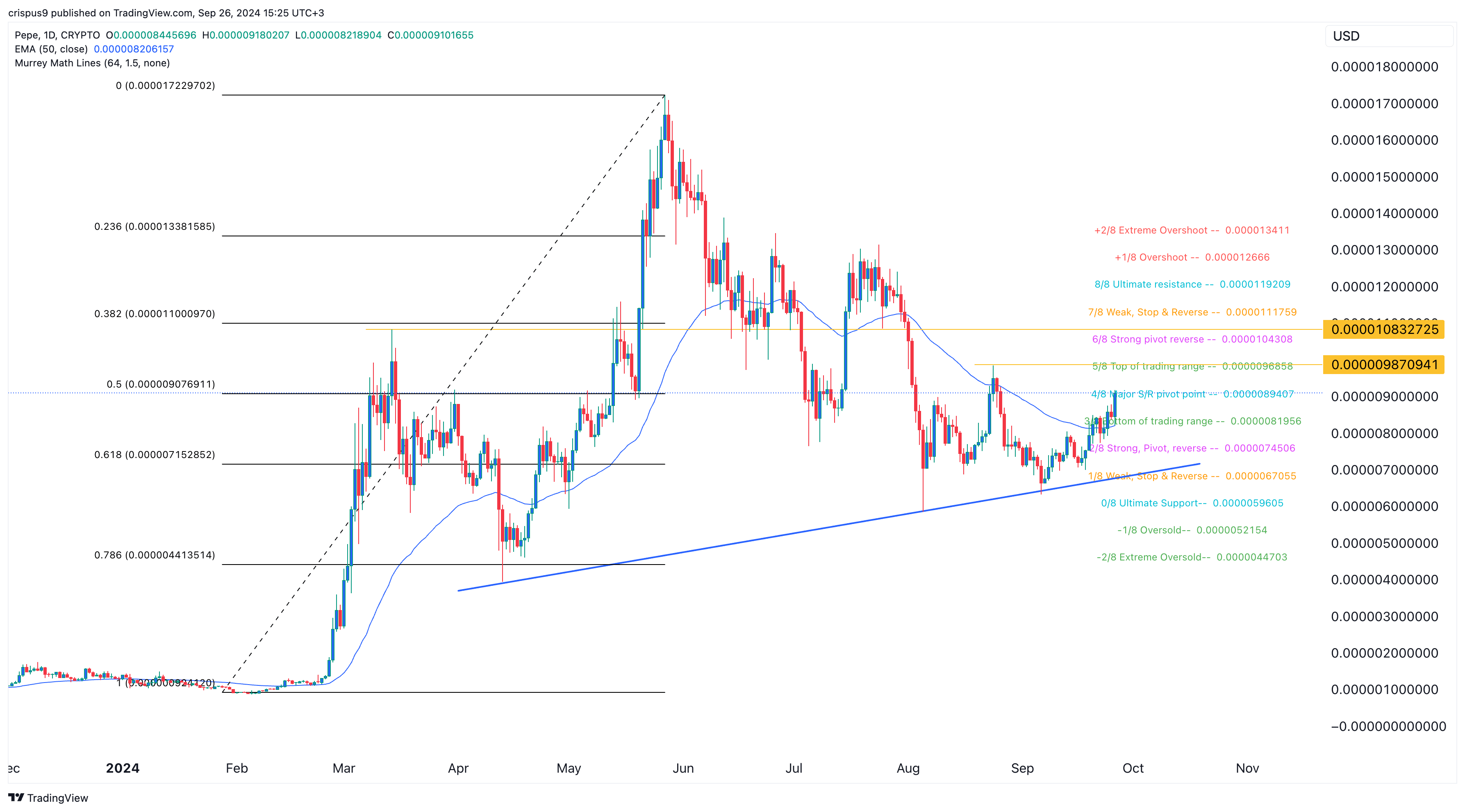

On a daily basis, Pepe recovered after touching its ascending support line (which connects the lowest point since April), then surged over the 50-day moving average and revisited the 50% Fibonacci Retracement level at $0.0000090.

Pepe additionally positioned himself near the significant level of the Murray Math Lines, which is at $0.0000090, as well as within the boundaries indicated by the Ichimoku Cloud.

The price is anticipated to reach a new peak at approximately 0.00000987 USD on August 4th, which marks the highest swing and also the upper limit of Murrey’s trading range. If it surpasses this level, it could potentially move towards its next goal of 0.0000108 USD, a price level that was previously reached in March.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-26 16:22