As an experienced analyst, I believe that Pepe’s price recovery is a positive sign for the meme coin as it has coincided with the stabilization of the crypto industry and the rebound of other meme coins. The fact that Bitcoin has struggled to extend its losses below the crucial support at $60,000 has also helped Pepe’s price action.

For the second day in a row, Pepe’s price surged as the crypto market showed signs of stabilization and traders detected bullish patterns. The token reached a high of $0.000012, representing a significant increase of around 25% from its lowest point this month. As a result, Pepe’s market capitalization has nearly hit the $5 billion mark due to this recovery.

Pepe’s price movement aligned with the surge of other meme coins on the market. For instance, Popcat, a meme coin based on Solana, experienced a rise of over 65%, while Tooker Kurlson, Jeo Boden, and Mog Coin all saw gains exceeding 30%.

As an analyst, I would interpret the recent rebound in Bitcoin‘s price as a potential response to the cryptocurrency’s inability to break below the significant support level of $60,000. The coin was priced at $61,125 on Tuesday, with investors seemingly taking advantage of the dip in the market to purchase more Bitcoins.

The token’s price has stabilized as it comes to light that the percentage of whale ownership has remained constant this month. As per CoinMarketCap’s data, whales controlled approximately 203 trillion PEPE tokens on Tuesday, which marks a peak since May 31st. An increase in whale holdings is generally interpreted as a good indicator for a cryptocurrency. Additionally, the number of Pepe token holders has increased to over 247,000 based on Etherscan’s information.

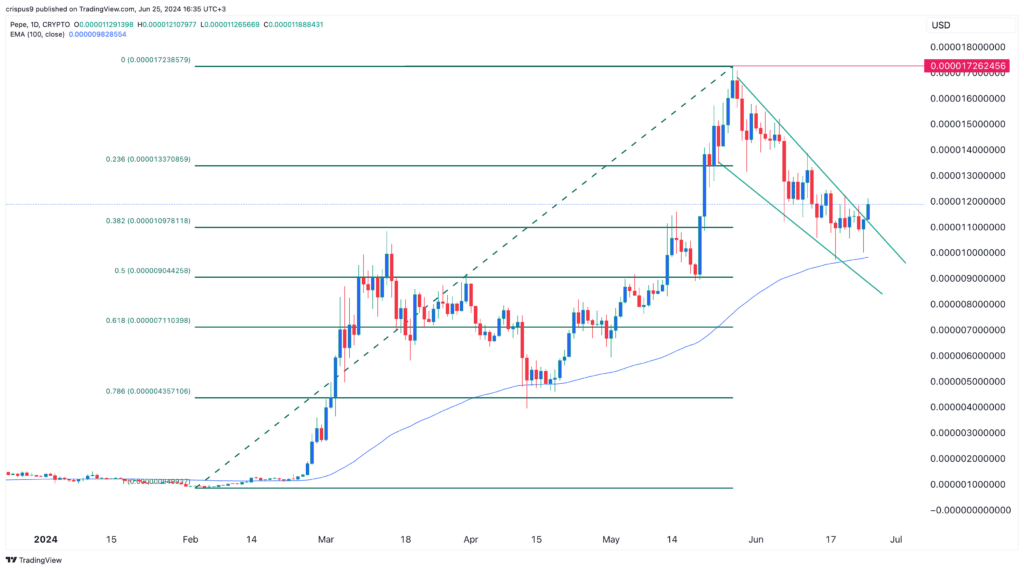

Pepe price chart

As a researcher studying the cryptocurrency market, I’ve noticed some bullish patterns emerging for Pepe recently. For one, the token has consistently stayed above its 100-day Exponential Moving Average (EMA) as demonstrated in the graph. This is an indicator that the buying pressure from bulls has been stronger than the selling pressure from bears, suggesting potential price growth.

As a researcher studying Pepe’s price movements, I’ve noticed an intriguing development in its chart pattern. Specifically, it has recently taken the shape of a falling wedge, which is generally interpreted as a bullish sign among traders. On Tuesday, the token managed to break above the upper trendline of this wedge formation, potentially indicating a shift in market sentiment towards a more optimistic outlook for Pepe’s price trajectory.

Strap in 🚀$PEPE — Crypto Michael (@MichaelXBT) June 21, 2024

Pepe’s hammer pattern and rising open interest

Furthermore, a hammer candlestick pattern emerged, marked by a small real body and a substantial lower wick. Typically, this configuration precedes a price recovery, particularly when trading volume increases significantly. According to CoinGecko’s data, the daily Pepe trading volume across all exchanges exceeded $865 million – a notable surge from Monday’s figure of $454 million.

As a researcher studying financial markets, I’ve noticed an intriguing development in the futures market. The open interest has surpassed $134 million, which is its highest point since June 17th. Open interest is a significant indicator that reflects the number of outstanding contracts held by traders engaged in active positions.

Pepe’s open interest has risen

Pepe has risen above the 38.2% Fibonacci Retracement mark, indicating a potential continuation of gains. However, it’s crucial to note that this could be just a temporary recovery in an otherwise downtrending market, known as a “dead cat bounce.”

Read More

- Brent Oil Forecast

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- USD JPY PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- EUR CNY PREDICTION

2024-06-25 17:00