As a seasoned researcher with years of experience in the volatile and dynamic world of cryptocurrencies, I can’t help but find myself intrigued by the latest moves of the PEPE whale. The recent $2.53 million dump seems to be a calculated risk, one that has unfortunately left them on the losing end this time around. However, their resilience and continued holdings of over 1 trillion PEPE tokens speak volumes about their faith in this meme coin’s potential.

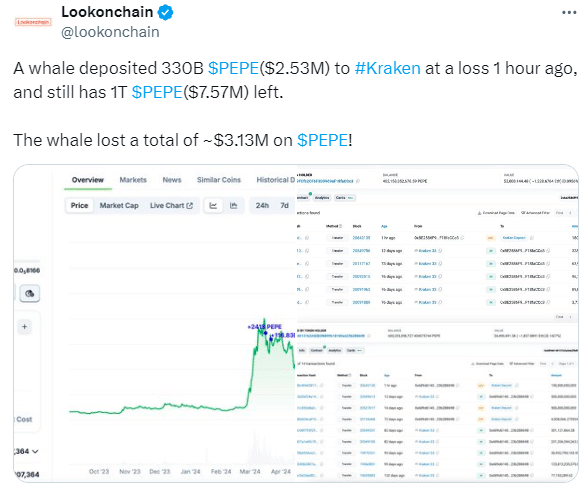

A significant investor of Pepe coins recently sold off approximately 2.53 million dollars’ worth of PEPE tokens, an amount they must account for due to the present low values in the cryptocurrency market. According to Lookonchain, this whale moved over 330 billion PEPE tokens to the Kraken exchange, leaving them with a remaining 1 trillion PEPE tokens valued at roughly 7.57 million dollars.

1. Recent behavior by the whale has sparked curiosity within the community. Initially, they put up 500 billion PEPE tokens for sale, and later bought 828 billion tokens at a lower cost.

This took their total stakes to 1.3 trillion PEPE, which is approximately $9.9 million. But even with these transactions, the whale ended up on the wrong side of the ledger with a loss of more than $3 million.

The significant market participants, often referred to as ‘whales’, have a substantial influence on the market. Their trades can sway the market’s direction, and making large deposits into platforms like Kraken, Binance, or Coinbase could potentially trigger additional selling waves.

Based on what crypto users report, the primary cause for the whale selling was the drop in the value of cryptocurrencies. However, this massive seller still holds a significant amount of PEPE tokens despite losing 95% of their original worth. Since meme coins like PEPE are highly volatile, their price fluctuations can be significantly impacted by market dynamics and general sentiment.

At present, PEPE‘s value stands at approximately 0.00000778 USD, showing an increase of just 1.41% over the past day, even as the broader market experiences a drop. Meanwhile, Bitcoin has dipped below $59,000 before briefly recovering, while Ethereum and Solana have both seen their prices decrease as well.

As an analyst, I’m observing a persistent pressure in the market, with major cryptocurrencies exhibiting downward trends – a clear sign of bearish sentiment. This ongoing instability suggests a challenging environment within the crypto sector.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-08-31 07:32