As a seasoned analyst with over two decades of experience in global financial markets, I have seen many market cycles come and go, from the dot-com bubble to the housing crisis, and now, the rise (and occasional fall) of cryptocurrencies like Bitcoin and Ethereum.

As an analyst, I’m observing a significant downturn in the markets for both Bitcoin and Ethereum. This bearish trend seems to be influenced by two key factors: firstly, the gradual unwinding of the Japanese Yen carry trade, and secondly, the ongoing presidential elections in the United States. These events appear to be impacting investor sentiment, potentially causing a decrease in demand for these cryptocurrencies.

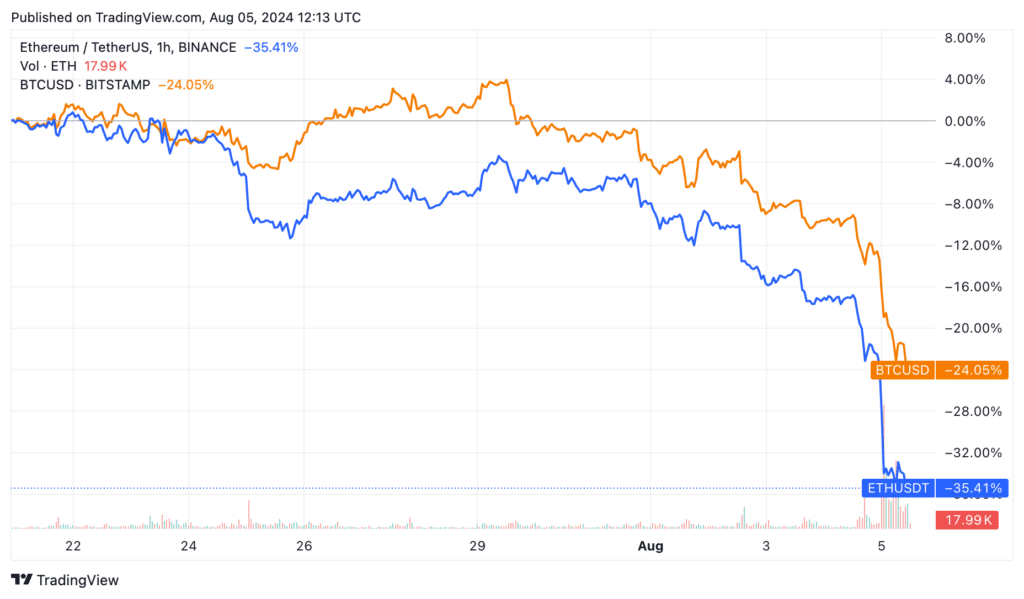

As an analyst, I’ve observed a significant downturn in the cryptocurrency market over the past few days. In the last 24 hours, Ethereum (ETH) has plunged by more than 22%. Over the last week, this drop has escalated to a staggering 32%. Interestingly, Bitcoin (BTC) followed a similar trend, dipping by 16% within the past day and 26% in the last seven days. This indicates a broader market correction rather than a specific issue with these particular cryptocurrencies.

Japanese yen carry trade

One significant factor contributing to the continued crypto market decline is the gradual unwinding of the Japanese yen carry trade, following Japan’s central bank’s decision to raise interest rates by 0.25% last week.

Making this choice was significant because Japan typically keeps its interest rates relatively low. More specifically, it was the latest country to withdraw from the practice of negative interest rates.

As someone who has navigated through various financial crises and market fluctuations over the years, I can attest to the importance of making informed decisions when it comes to monetary policy. In light of recent developments, it is clear that the decision at hand was indeed a critical one, as other central banks are contemplating rate cuts. The Bank of England, European Central Bank, and Swiss National Banks have already reduced their interest rates, while the Federal Reserve has signaled its intention to do so in September. This trend towards lower rates is not something that should be taken lightly, as it can have significant implications for the economy, investments, and personal finances alike. In my experience, staying abreast of such developments and making strategic decisions based on a comprehensive understanding of the global economic landscape is essential to weathering financial storms and achieving long-term financial success.

As a seasoned crypto investor, I’m adjusting my strategy due to the winding down of a long-standing carry trade. This trading approach involves borrowing funds from nations with low interest rates and investing them in countries offering higher returns. For years, I’ve found this strategy particularly profitable by borrowing from Japan and investing in the US. However, recent changes have necessitated a shift in my investment tactics.

The prices of Bitcoin, Ethereum, and various other alternative coins fell following indications that Kamala Harris has a greater likelihood of defeating Donald Trump in the upcoming election. Although Polymarket gives Trump a 53% chance of winning, his lead over Harris has diminished significantly in a $500 million wager. On PredictIt, Kamala Harris is projected to emerge victorious against Trump.

Additionally, they’ve decreased due to persistent political problems in the Middle East, increasing possibilities of an economic downturn in the U.S., and poor market indicators.

Peter Schiff blasts Ethereum and Bitcoin ETFs

As a crypto investor, I’ve been keeping an eye on the warnings from Peter Schiff, a renowned crypto skeptic and gold advocate, who recently forecasted potential liquidity issues for Bitcoin and Ethereum Exchange-Traded Funds (ETFs) coming up on Monday.

From my perspective as an analyst, I posit that Exchange-Traded Funds (ETFs) must factor in any losses accrued over the weekend and on Mondays. Consequently, if ETF investors choose to offload their holdings, this could lead to a flood of liquidations overwhelming the spot market.

#Bitcoin has dropped below $58,000. If it falls to its lowest point in July by the opening of the U.S. Stock Market tomorrow, Bitcoin Exchange-Traded Funds (ETFs) could see a significant drop, over 15%. This would place them 30% lower than their highs in January. Such a substantial loss might prompt widespread ETF liquidations. If that happens, prepare for what could resemble a ‘Crypto Black Monday.’

— Peter Schiff (@PeterSchiff) August 4, 2024

As a crypto enthusiast, I’ve always found it fascinating to see Peter Schiff’s perspective on Bitcoin and Ethereum. He’s been vocal about his belief that these digital assets are essentially worthless. Yet, the numbers tell a different story. When we look at historical performance, it’s clear that both Bitcoin and Ethereum have significantly outshone gold – an asset he highly favors. It’s food for thought, isn’t it?

Although there’s been a continuous decline in selling (sell-off), Bitcoin has seen a 21% increase this year, outperforming gold which has only grown by 15%. Over the past five years, Bitcoin has experienced a remarkable growth of 360%, compared to gold which has increased less than 80%.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-05 15:50