As a researcher with a background in finance and experience following the cryptocurrency market closely, I believe that Peter Schiff’s skepticism towards Bitcoin’s post-halving consolidation and the demand for spot BTC ETFs is misguided. While it is true that Bitcoin has traded sideways for over three months, and spot ETF investors have not seen significant gains during this period, the context of the market’s recent growth and institutional demand is crucial to understanding the current state of affairs.

As a financial analyst, I’ve observed that Bitcoin‘s consolidation following its halving event has sparked skepticism from well-known cryptocurrency critic Peter Schiff.

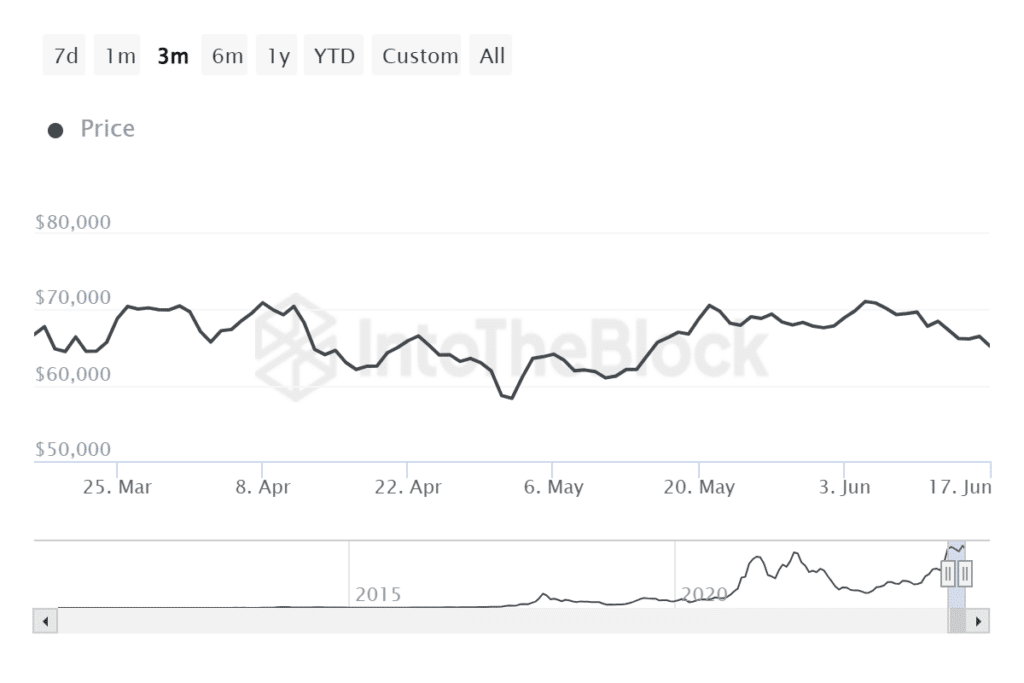

Expert in cryptocurrencies, Peter Schiff, voiced his skepticism towards the demand for a spot Bitcoin ETF, predicting that the driving factors behind it could soon lose their appeal. Contrary to the optimistic expectations and market trends thus far, Schiff pointed out that Bitcoin (BTC) has been stagnant for over three months with only insignificant returns for investors in spot Bitcoin ETFs. Despite a 55% growth in BTC’s value year-to-date, its flat performance and meager gains for ETF investors cast doubt on the long-term appeal of such investment vehicles.

Exchange-traded funds (ETFs) follow the value of Bitcoin (BTC) in the market. Essentially, these investment vehicles mirror the price movements of Bitcoin, allowing investors to gain potential profits from any increase in its value.

As a researcher studying Bitcoin’s price patterns, I acknowledge Schiff’s observation about its sideways movements. However, it is crucial to note that this observation might be incomplete without considering recent market developments. For instance, since the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, the cryptocurrency has experienced a significant surge of almost 70%. Thus, the sideways price action could be a temporary pause within an uptrend rather than a persistent trend.

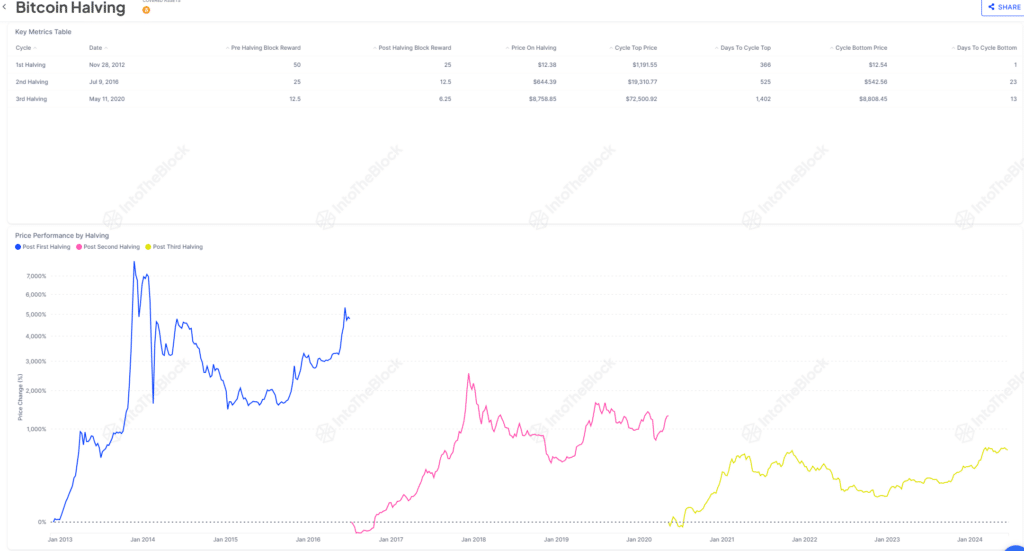

In simpler terms, Bitcoin’s current extended period of price stability after a halving event isn’t unprecedented. The digital currency entered a rapid growth phase following at least the previous two such occurrences.

Growing institutional Bitcoin demand

BlackRock and Fidelity’s Bitcoin ETFs, which are focused on buying and holding spot Bitcoins, had exceptional launches on Wall Street within the past 30 years. In a short period, these funds attracted more than $10 billion in assets under management (AUM) from investors. However, even with such massive demand, Peter Schiff questioned Bitcoin’s bullish case and its price trend. He wondered, “Who have been selling these Bitcoins to ETF investors, and what could be their motivations?”

During this period, Eric Balchunas, an expert at Bloomberg on Exchange-Traded Funds (ETFs), has frequently discussed the shift of investments from Bitcoin futures ETFs to spot Bitcoin funds. Additionally, due to the halving’s impact on mining dynamics, some crypto miners have sold off their Bitcoins to bolster their cash reserves.

I’ve repeated this before, and I’ll say it once more: the source of the call is within our own home, Holmes, not related to ETFs. Contrary to their recent buying frenzy, this price drop can be attributed to Bitcoin holders selling or to those using excessive leverage. Time after time, the flow of funds into ETFs results in…

— Eric Balchunas (@EricBalchunas) June 6, 2024

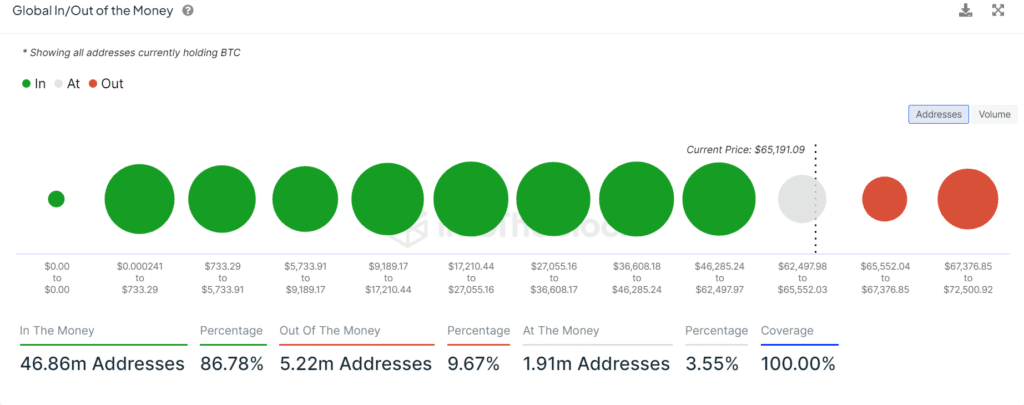

Bitcoins held on centralized exchanges reached a four-year minimum based on on-chain data. This indicates that investors are not disposing of their assets but rather clinging to them tightly, a practice often referred to as “hodling” within the cryptocurrency sector.

As a crypto investor, I can understand how frustrating it is to wait for the price action of our preferred assets. Schiff’s observation about potential ETF buyers growing tired and liquidating shares due to prolonged consolidation is valid, but let me share an alternative perspective.

As a researcher studying investment trends, I’ve observed that entities such as the Wisconsin Investment Board have allocated substantial sums, approximately hundreds of millions of dollars, into Bitcoin Spot Exchange-Traded Funds (ETFs). This investment strategy suggests a long-term perspective on the value of Bitcoin, given its consistent growth throughout the years.

Over the past year, Bitcoin experienced a remarkable surge, increasing by more than 145%. In contrast, the S&P 500 index has yielded approximately 85% returns during the last five years. This disparity strengthens the case for investing in Bitcoin as the leading cryptocurrency by market capitalization. Additionally, data from IntoTheBlock reveals that over 80% of Bitcoin purchasers have currently realized profits.

Experts like Balchunas have expressed the view that large institutions have yet to make a significant entry into the Bitcoin ETF marketplace. However, with a market value surpassing $40 billion and continuing to expand, crypto adoption is gaining momentum at an unprecedented pace. Analysts project that the global ETF market will nearly triple in size to reach a staggering $35 trillion by 2035. Given this context, the bullish argument for Bitcoin’s growth is more compelling than ever.

The fact that Bitcoin has become a topic on such mainstream television shows is a testament to the increased accessibility and widespread coverage of Bitcoin-related Exchange Traded Funds (ETFs), which have only been available for a short while – approximately half a year.

— Eric Balchunas (@EricBalchunas) June 3, 2024

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-06-17 20:59