As a seasoned financial analyst with over a decade of experience in the traditional financial markets and the crypto industry, I have closely followed the developments surrounding Tether (USDT) and Bitfinex. The latest lawsuit against these two entities, which alleges manipulation of Bitcoin’s price through unbacked USDT issuance and market manipulation schemes, is not a new topic for me.

A new legal complaint has been lodged against Tether, the stablecoin issuer, and Bitfinex, the cryptocurrency exchange.

Table of Contents

Tether and Bitfinex were once more sued by the plaintiffs for allegedly manipulating the value of Bitcoin (BTC) and other virtual assets through filed lawsuits.

Based on the plaintiffs’ argument, the defendants are accused of manipulating the price of virtual currencies by buying massive amounts of coins during specific periods. This deception gave a false sense of increased demand for cryptocurrencies, causing unsuspecting traders to follow suit and further drive up the coin prices.

I’ve uncovered some concerning information. According to the complaint, Tether reportedly issued large quantities of USDT to itself without any corresponding US dollar reserves – essentially creating new USDT out of thin air. This alleged deception, as stated in the complaint, resulted in significant financial harm to unsuspecting crypto commodity buyers, amounting to billions of dollars.

Court filing

Tether, as stated initially in the claim, had emitted approximately $3 billion in USDT tokens without sufficient backing over the course of several years. Bitfinex then utilized these unbacked tokens to buy cryptocurrencies during market declines, thereby stabilizing prices. Consequently, the overall value of the cryptocurrency market surged to a staggering $795 billion by year-end in 2017.

Proceedings against Tether and Bitfinex

Since 2019, the legal action against Tether and Bitfinex has been ongoing, yet no concrete outcomes have materialized. The situation appears to be at risk of collapsing, a development that the defendants attribute to the baseless allegations levied against them.

Based on what the company spokespersons stated, the accusers failed to present proof that Tether and Bitfinex artificially influenced cryptocurrency prices by acquiring digital assets using unbacked funds from their stablecoins.

In a recent class action lawsuit, five individuals who trade cryptocurrencies served as the complainants. These traders alleged that they had purchased the digital currency at artificially high prices, resulting in substantial financial losses for them.

In the argument presented by the defense attorneys, they pointed out that the accusations against their clients were not supported by concrete evidence. Furthermore, they argued that the plaintiffs had not effectively proven that the prices in question were artificially inflated due to any alleged manipulation.

As a seasoned investigative journalist with over two decades of experience delving into financial crimes, I can tell you that the list of allegations against this individual is as complex and intricate as they come. It’s not just about breaking some rules here and there; it’s a web of deceit and manipulation that goes beyond the surface.

Paolo Ardoino gets ready to annihilate

In a recent blog post, Bitfinex revealed that they are facing a new unfounded legal action, this time targeting both the exchange itself and Tether, its stablecoin issuer.

I’ve learned that the company has made it clear they won’t engage with the plaintiffs and will instead focus on defending their case in court. Furthermore, Bitfinex has stated that USDT stablecoins have never been implicated in market manipulation activities.

Paolo Ardoino, the exchange’s technical director, tweeted about the decision to “annihilate this.”

Can’t wait to annihilate this one too.

— Paolo Ardoino 🤖🍐 (@paoloardoino) November 24, 2019

Attracting Bittrex and Poloniex

In June 2020, parties bringing a $1.4 trillion legal action against Tether and Bitfinex alleged that cryptocurrency platforms Bittrex and Poloniex provided assistance to the defendants during the surge of Bitcoin’s price in 2017.

Using the cooperation of Bittrex, Inc. (Bittrex) and Poloniex LLC (Poloniex), Bitfinex and Tether allegedly employed fraudulently produced USDT to execute large-scale purchases of crypto commodities at strategic moments when their prices were plummeting.

Court filing

The plaintiffs argued that Bittrex and Poloniex played a direct role in the fraudulent activity by artificially generating the appearance of new liquidity in the bitcoin market using numerous prearranged buy orders.

Penalty for Tether and Bitfinex

In February 2021, Bitfinex and Tether reached a settlement with the New York City Attorney General’s Office (NYAG). As part of the agreement, the companies were required to pay a combined penalty of $18.5 million and submit quarterly reports detailing their operations.

According to Bitfinex and Tether’s general counsel Stuart Hoegner, the $18.5 million payment can be interpreted as an effort to resolve this issue amicably and concentrate on expanding their business. He added that Tether has proactively disclosed USDT collateral details to the New York Attorney General (NYAG) and intends to do so for the next two years.

The purpose of the settlement was to address the long-standing controversy surrounding the legitimacy of Tether’s reserves, which back USDT and has been a contentious issue within the cryptocurrency community. With Tether now obligated to disclose its reserve information, investors will be equipped with enhanced evaluation capabilities to assess whether the company is manipulating Bitcoin’s price by releasing new fiat-backed tokens.

Tether continues to lead despite lawsuits

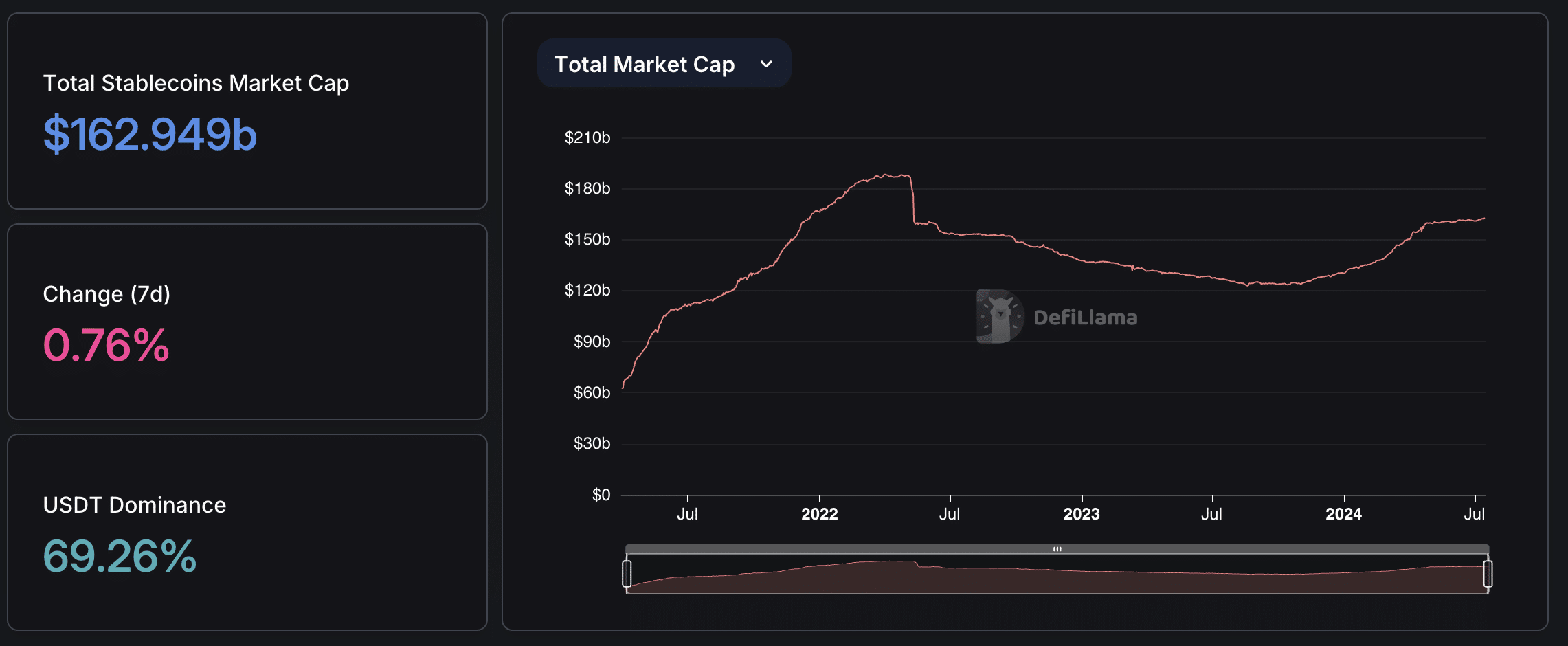

Despite many lawsuits, Tether remains the market leader in stablecoins by a wide margin.

Based on current figures, USDT’s market cap has surpassed previous records at an impressive $113 billion. Consequently, this digital currency holds approximately 70% of the total stablecoin market share.

The rising supply signifies that the digital currency market is amassing greater financial resources, subtly enhancing the company’s standing.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-07-16 18:54