As a seasoned crypto investor with over a decade of experience navigating the ever-changing tides of the digital asset market, I have learned to remain patient and adaptable in the face of volatility. While it’s disheartening to see Polkadot (DOT) underperform this year compared to its peers like Bitcoin and Solana, I remain optimistic for a strong comeback due to my faith in the project’s potential.

This year, Polkadot‘s price hasn’t kept pace with big-league cryptos such as Bitcoin and Solana. However, an expert predicts a robust recovery for Polkadot in the near future.

This year, Polkadot (DOT) has seen a significant decrease of approximately 65%, which has lowered its market value to around $6.2 billion. Consequently, it has slipped down the rankings and is now considered the 16th largest cryptocurrency within the crypto industry.

As a crypto investor, I’ve noticed that the journey of Polkadot seems to be echoing that of Cardano (ADA), a significant player in the ‘ghost chain’ world. Regrettably, the value of ADA has plummeted by approximately 60% from its year-to-date peak.

It’s quite plausible that the current market behavior is due to the fact that Cardano and Polkadot might be lagging behind projects like Solana, Sui, and Base in terms of progress.

Glancing at the surroundings of Polkadot’s network reveals that it is comparatively less populated than other blockchains. For instance, Moonwell, a project that debuted on Polkadot in 2022, didn’t gain much attention until it moved to Base, where its locked total value has reached an all-time high.

It appears that other key participants within the Polkadot ecosystem, such as Moonbeam, Acala, Phala Network, and Astar, have not achieved the level of growth that was originally anticipated.

Contrastingly, Solana has emerged as a significant force within the blockchain sector. It supports meme coins valued at more than $12 billion, along with numerous game and non-fungible token initiatives.

Coinbase’s layer-2 network, known as Base, has climbed its way into the top tier of the decentralized finance sector.

Nonetheless, well-known cryptocurrency analyst Ali Charts anticipates a swift rebound for the price of Polkadot, based on his analysis of its chart trends.

There’s no rush to invest in every project; many promising ones remain undiscovered. For instance, Polkadot ($DOT) seems ready for a breakthrough!

— Ali (@ali_charts) October 30, 2024

A potential catalyst could be a new proposal known as the Westend, which would reduce DOT’s inflation from 10% to 8%, with 15% of these funds allocated to the treasury.

The Westend test network has been successfully updated, aligning with the parameters supported by the Polkadot community in Proposal #1139 of the Wish-for-Change Referendum. Over the recent period, the system has operated as anticipated, resulting in a decrease of inflation rewards from approximately 10% to around 8% on an annual basis, and a fixed…

— Jonas (@GehrleinJonas) October 29, 2024

Polkdot technicals are sending mixed signals

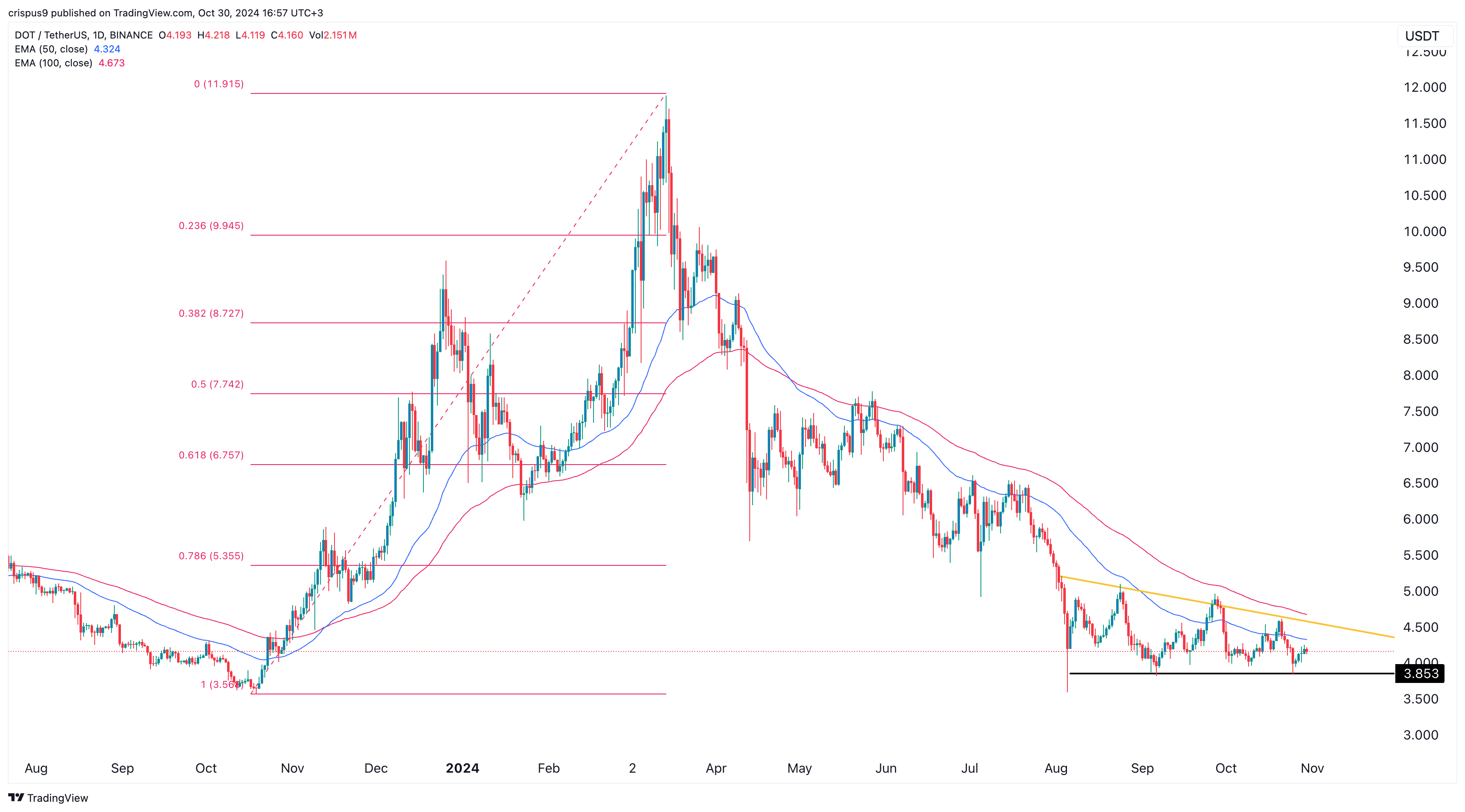

Over the past few weeks, the price of Polkadot’s token has moved mostly horizontally. It’s stayed just over the crucial support level at $3.853, a threshold it hasn’t dipped beneath since September.

As an analyst, I’ve observed that the Daily Overview Tracker (DOT) is presently dipping beneath both its 50-day and 100-day moving averages. This suggests a momentary dominance by the ‘bears’, or those who believe prices will continue to fall.

Additional gains will be verified if the price surpasses the downward sloping line, which links the highest peaks experienced since August 14th.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-30 17:30