As a seasoned crypto investor with a knack for recognizing trends and patterns, I find the recent surge in Polygon (MATIC) on-chain activity quite intriguing. Despite the current bearish sentiment that has sent MATIC tumbling, the spike in daily active addresses and dormant coin movement hints at a potential reversal for MATIC.

As an analyst, I’ve observed an uptick in on-chain activity for Polygon, even amidst the broader bearish trend in the cryptocurrency market that has caused MATIC to decline significantly.

Despite the ongoing challenges facing the Polygon (MATIC) price due to the current slump affecting Bitcoin (BTC) and the larger cryptocurrency market, analysts point out that increased on-chain activity could signal a possible turnaround for MATIC.

It appears that recent data indicates an increase in the number of daily active addresses and the movement of dormant coins within the Polygon network.

Polygon on-chain activity spikes

According to Santiment, there’s been a substantial increase in active MATIC coins on Polygon. They attribute this to the Age Consumed metric, which is used to monitor the activity of dormant tokens. This metric does so by quantifying the number of older coins being transferred between different addresses.

Age of Moved Data refers to a computation that takes the number of moving coins and multiplies it by the time elapsed since their last transaction.

It’s worth mentioning that there was a significant rise in the number of daily active addresses on the Polygon network, with a total of 3,369 addresses being active on-chain. This surge corresponds to an elevated Age Consumed metric, as reported by Santiment. Remarkably, this day’s count of active addresses was the second-highest recorded in the year.

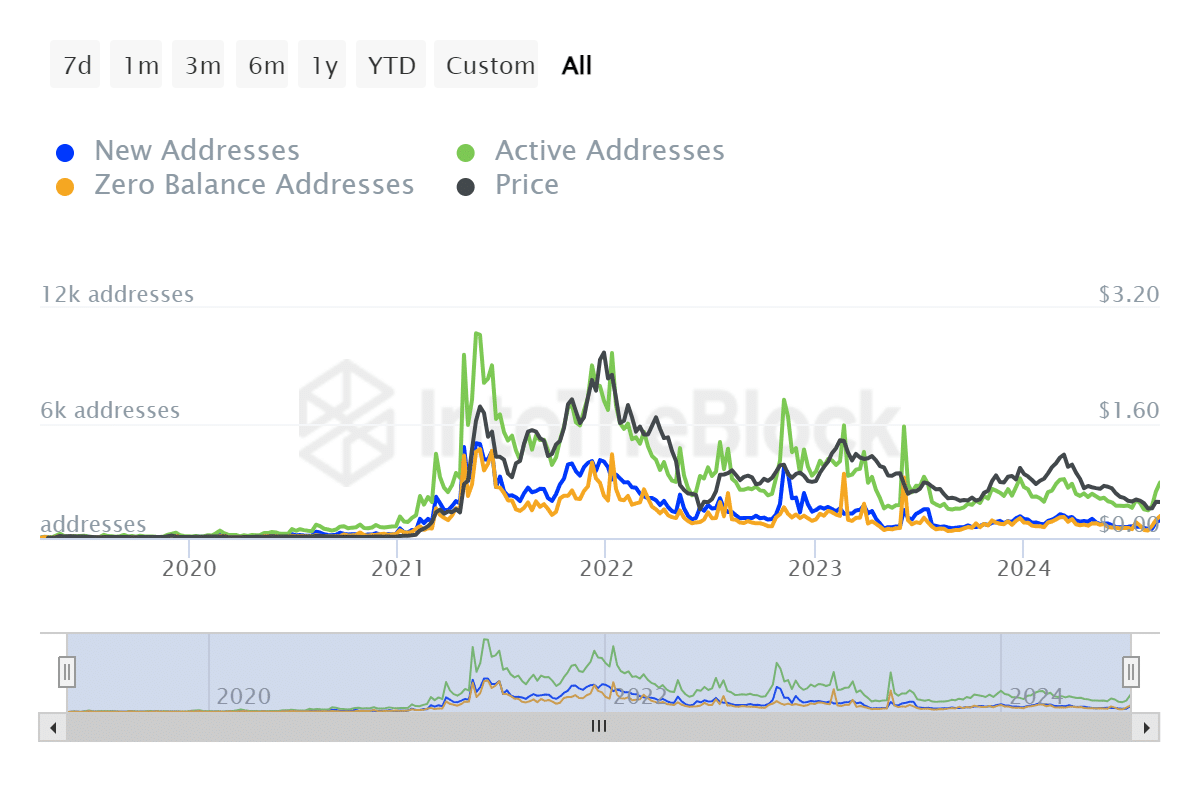

According to IntoTheBlock’s data, we’ve seen an increase in the number of active wallets starting from August 26, reaching over a thousand new ones on August 27 alone.

What does this mean?

An elevated Age Consumed statistic frequently signals a shift in long-term holder’s opinion, which tends to correspond with significant price fluctuations for the associated token.

Polygon has been one of the networks experiencing a decline since the crypto market retraced back in March. Yet, an increase in on-chain activity could potentially indicate an upcoming reversal for MATIC. Increases in active addresses and dormant coins often serve as precursors to such events.

Santiment wrote on X.

For Polygon, the quantity of Age Consumed surged to a staggering 69 billion MATIC tokens when its altcoin value plummeted during the recent cryptocurrency vulnerability. The highest point associated with this occurred around $0.58, and Polygon’s price has already decreased by 14% in total.

In spite of its current vulnerability, these two blockchain metrics imply that some investors might consider MATIC‘s decline as a chance to invest at a reduced price.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-08-28 23:06