As an analyst with a background in fintech and regulatory compliance, I find the development around Polymarket and its investment from Founders Fund intriguing. The platform’s unique business model, which allows users to bet on political events, has attracted significant attention and investment. However, it also faces challenges from regulators like the CFTC, which have proposed bans on political betting.

Peter Thiel’s investment firm, Founders Fund, spearheaded the fundraising process, bringing in a total of $70 million for Polymarket.

According to Bloomberg’s report, Polymarket, the political event prediction marketplace, has secured a total of $70 million in funding through two rounds. In the most recent financing round, Founders Fund took the lead, contributing $45 million.

As an analyst, I’d observe that Joey Krug, a partner at Founders Fund, expressed his perspective on the Commodity Futures Trading Commission (CFTC) proposing bans on political betting. He pointed out that there are individuals who harbor a strong dislike for prediction markets in the United States, rooted in a puritanical attitude towards gambling.

In the near to medium-term, it benefits Polymarket to focus on markets outside of the United States. However, in the future, it would be advantageous for American consumers to have access to this market as well.

Joey Krug, Founders Fund partner

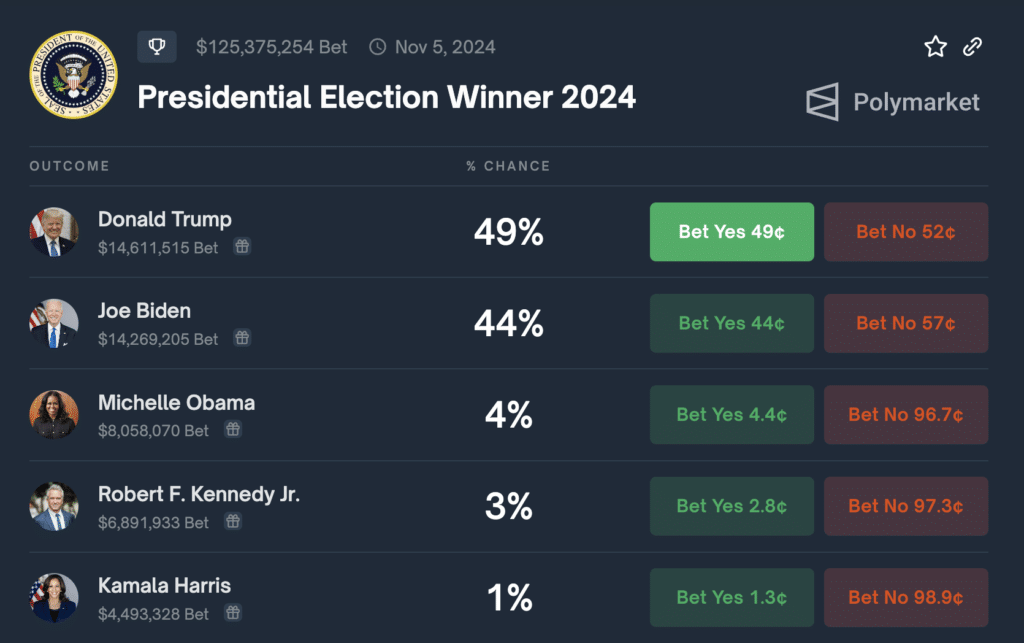

As an analyst, I’ve noticed a remarkable increase in betting activities on Polymarket, with over $170 million wagered on U.S. election-related events. Even former President Donald Trump himself referenced the platform’s predictions regarding his potential return to the White House.

In the beginning of 2022, the Commodity Futures Trading Commission (CFTC) imposed a penalty of $1.4 million on Polymarket for facilitating over-the-counter binary options trading without the necessary registration. Polymarking collaborated with the regulatory body, resulting in a reduced fine. The company subsequently announced that it had resolved this matter successfully.

I’m glad to share that we have reached a settlement agreement with the Commodity Futures Trading Commission (CFTC). Moving forward, our team is eager to concentrate on Polymarket’s future developments. In accordance with the order, any markets that don’t adhere to the law by January 14 will be terminated prematurely. Further details to follow soon.

— Polymarket (@Polymarket) January 3, 2022

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-05-14 20:44