As a seasoned researcher with a keen interest in the dynamic world of NFTs and blockchain technology, I find myself both intrigued and impressed by the resilience shown by Pudgy Penguins in this challenging market environment. Having followed the ups and downs of this sector for quite some time now, I’ve learned to anticipate the ebb and flow of trends. Yet, the steady growth of Pudgy Penguins despite the broader industry downturn is a testament to its underlying strength and appeal.

In August, the popular Ethereum Non-Fungible Token series known as Pudgy Penguins managed to buck the negative trends in the crypto industry.

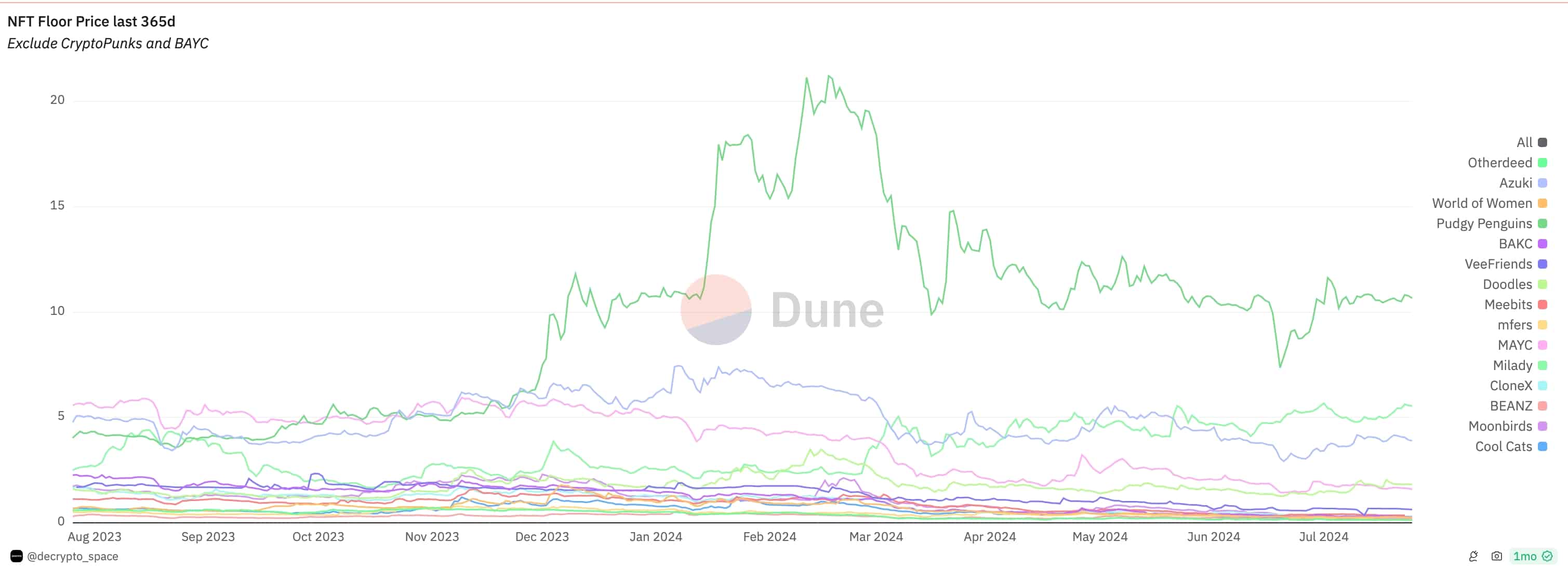

According to reports from CryptoSlam and Dune Analytics, it appears that their crucial indicators held up quite well despite the industry facing significant stress.

In August, total sales surged by a substantial 29%, reaching more than $8.6 million, due to a significant 73% increase in the number of transactions, which amounted to 348.

Furthermore, there was a significant increase in both the count of purchasers and vendors. Specifically, buyers increased by 73%, resulting in 176 individuals, while sellers increased by 39%, reaching 205. Additionally, the average holding period saw a small uptick of 5%, amounting to approximately 85.5 days.

In August, sales for Pudgy Penguins saw an increase, but they still lag significantly behind their peak record of $99.2 million set in August 2021. Additionally, these sales figures are also below the March high of $26.5 million.

Pudgy Penguins Get Pricey

The prices of Pudgy Penguin NFTs are also rising.

As reported by Dune, the minimum selling price for NFTs on marketplaces increased by 30% in August, reaching 10.66 ETH. Compared to the same time frame in 2023, this represents a significant jump of 166%.

Among the top three NFT collections, Pudgy Penguins is the one that’s experienced a significant increase in its base price over the past year. The minimum price for a Pudgy Penguin has gone up by 121%, while Milady’s floor price has risen by just 12%.

In the past year, the base price for well-known NFT collections such as CryptoPunks, Bored Ape Yacht Club, Azuki, and Mutant Ape Yacht Club has significantly decreased by more than 50%, due to a decline in demand for these items.

As reported by NFT Evening, approximately 96% of all Non-Fungible Tokens (NFTs) have become “inactive,” and around 40% of their owners currently hold an NFT at a loss. Furthermore, the typical lifespan of an NFT is now just over one year, which is significantly shorter than that of other cryptocurrencies.

Despite a general decline in overall sales, transaction numbers, and NFT users, Pudgy Penguins – a venture launched by entrepreneur Luca Schnetzler (also known as Luca Netz) – has managed to thrive and prosper.

Non-Fungible Token (NFT) sales totaled approximately $376 million in August, marking a 41% decrease compared to the record-breaking high of over $6 billion.

Following the acquisition of $11 million in funding for constructing a layer-2 network from a consortium of investors, led by Founders Fund (an investment firm co-founded by Peter Thiel), Pudgy Penguin reported a surge in sales the following month.

Additionally, the developers have introduced their own line of labeled playthings, which can be found at well-known stores such as Walmart and Target.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-09-01 19:58