As a seasoned crypto investor with battle scars from the 2017 bull run and 2018 bear market etched into my portfolio, I find myself intrigued by this week’s trio of altcoins: RARE, FXS, and COTI.

Last week saw a setback for altcoins, causing a decrease of approximately $40 billion in the total value of the worldwide cryptocurrency market, dropping it to around $2.09 trillion. Over the next few days, it will be interesting to observe the performance of the top three cryptocurrencies currently in the spotlight.

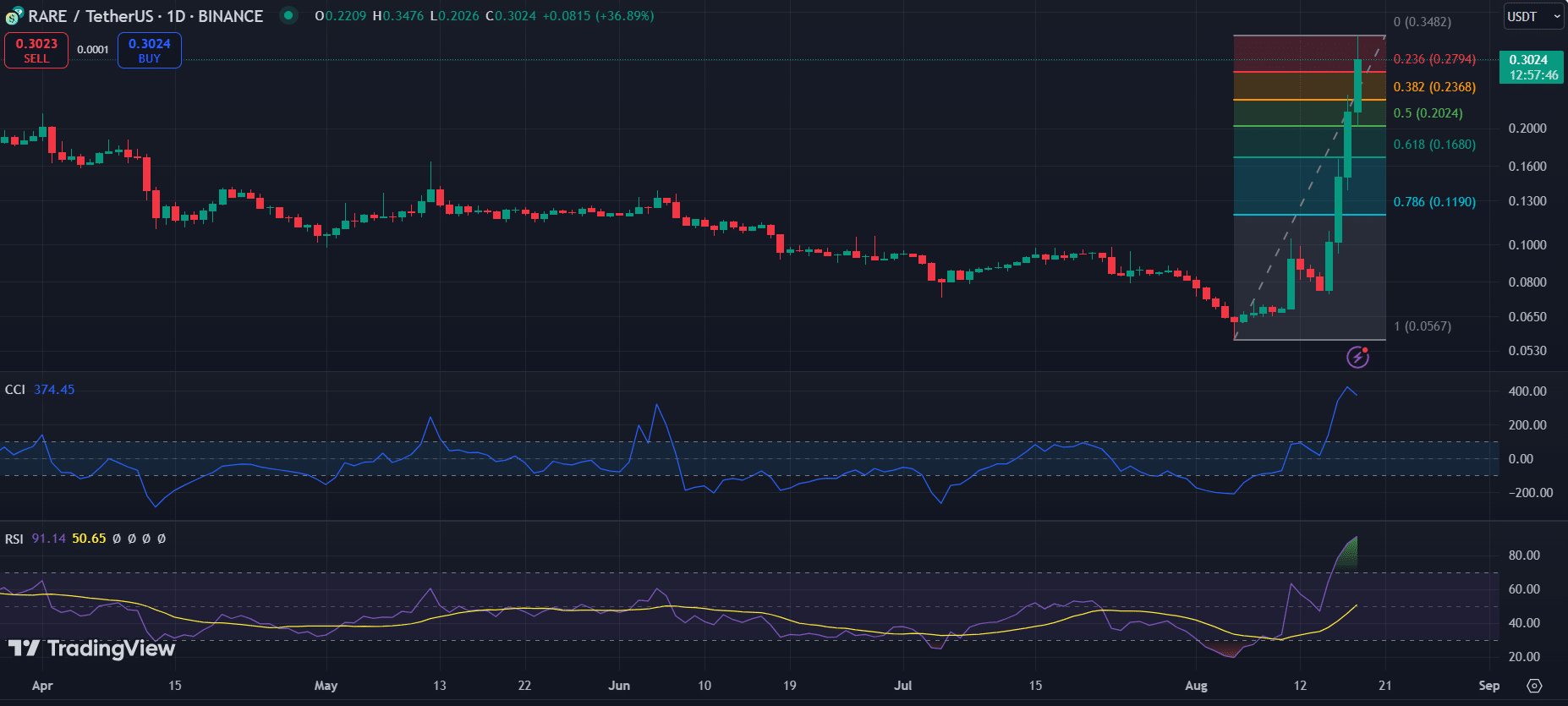

RARE secures 223% weekly gain

SuperRare (RARE), the native token of the NFT marketplace, witnessed volatility last week.

Initially, the token experienced a 34% increase at the start of the week. However, it then saw a downturn lasting three days from August 12 to 14, resulting in a decrease of 18%.

On August 15, there was a bounce-back, which ignited an increase in social media activity, as reported by LunarCrush’s recent disclosure.

Over the past few days, I’ve witnessed a remarkable surge in the value of RARE. In just three days, it saw a staggering increase of 127%, and by the end of the week, this growth had escalated to an impressive 223%. This upward trend suggests a renewed interest in the asset, making it an intriguing prospect for further analysis.

Huge week for $RARE. Price is +47% while social share jumps to 0.65% vs. all of crypto. — LunarCrush Social Intelligence (@LunarCrush) August 15, 2024

Currently, the Relative Strength Index (RSI) of this token is at 91.14, showing it’s in an overbought state. This could potentially signal a forthcoming correction. Similarly, the Commodity Channel Index (CCI), sitting at 374.45, also indicates extremely high levels of being overbought, reinforcing this prediction.

The most recent increase in price for RARE has pushed it beyond the 0.236 Fibonacci point, and at present, it’s aiming to maintain its level above $0.3. If RARE can successfully defend the 0.236 Fibonacci support, it could potentially continue climbing higher.

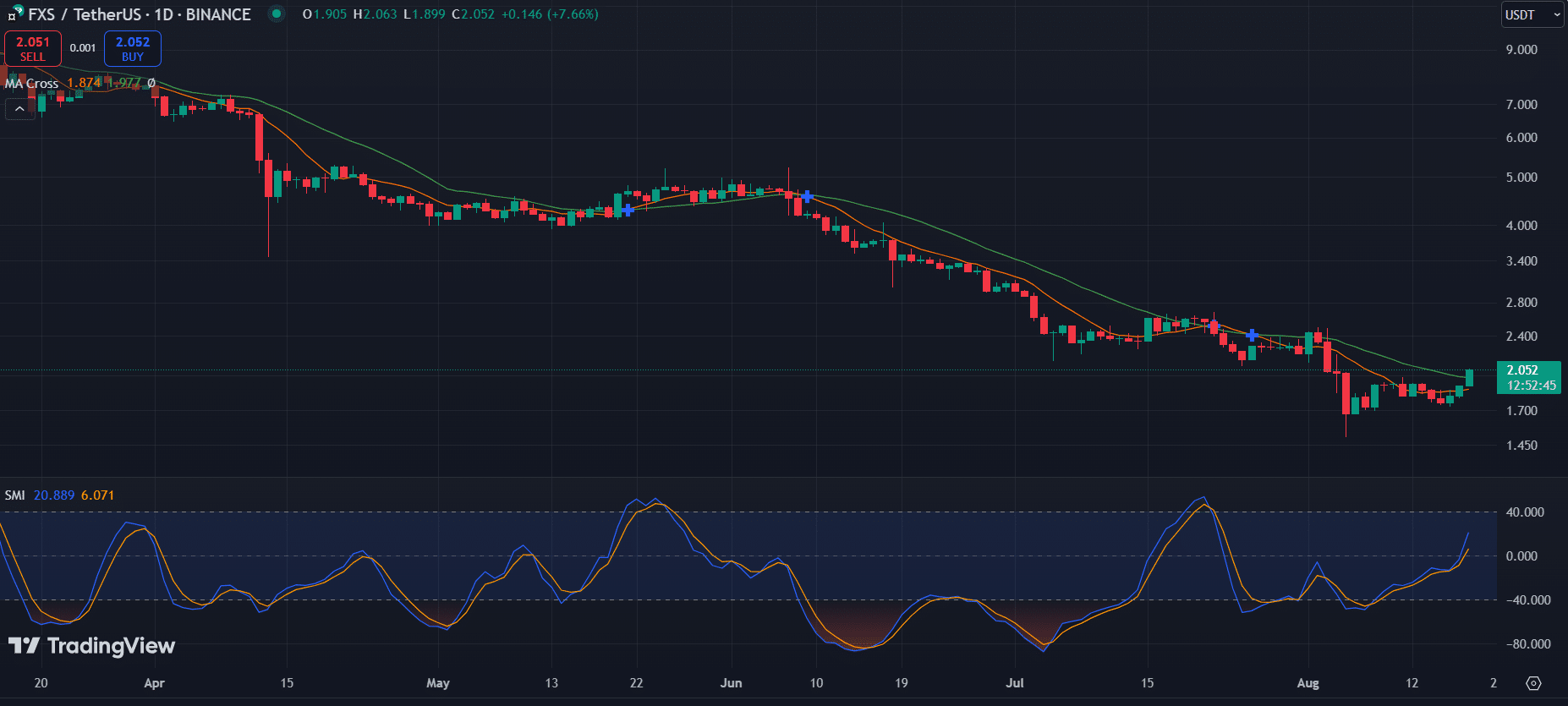

FXS maintains resilience

Last week, Frax Share (FXS) showed relatively low price fluctuations, ending at $1.906. This modest decline amounted to only 0.67%. Unlike the predominantly downward trend observed in the broader market, FXS’s subdued performance hints at a glimmer of strength or resilience from this asset.

Nevertheless, the moving averages of Frax Share suggest a bullish outlook. Lately, the asset has surpassed the nine-day Moving Average (represented by the orange line), signifying a shift in its short-term momentum towards bullishness.

Furthermore, there’s an indication that the moving average over nine days might rise above the 21-day moving average (depicted by the green line). Such a crossover might indicate a potential bullish turnaround approaching.

Based on the Stochastic Momentum Index (SMI), this outlook seems validated. The SMI line, represented by blue, has significantly increased above the Moving Average line, which is orange. This suggests a growing bullish sentiment. With both indicators in agreement, FXS might be set for an uptrend. However, it’s crucial to wait for confirmation in the coming days to be fully confident.

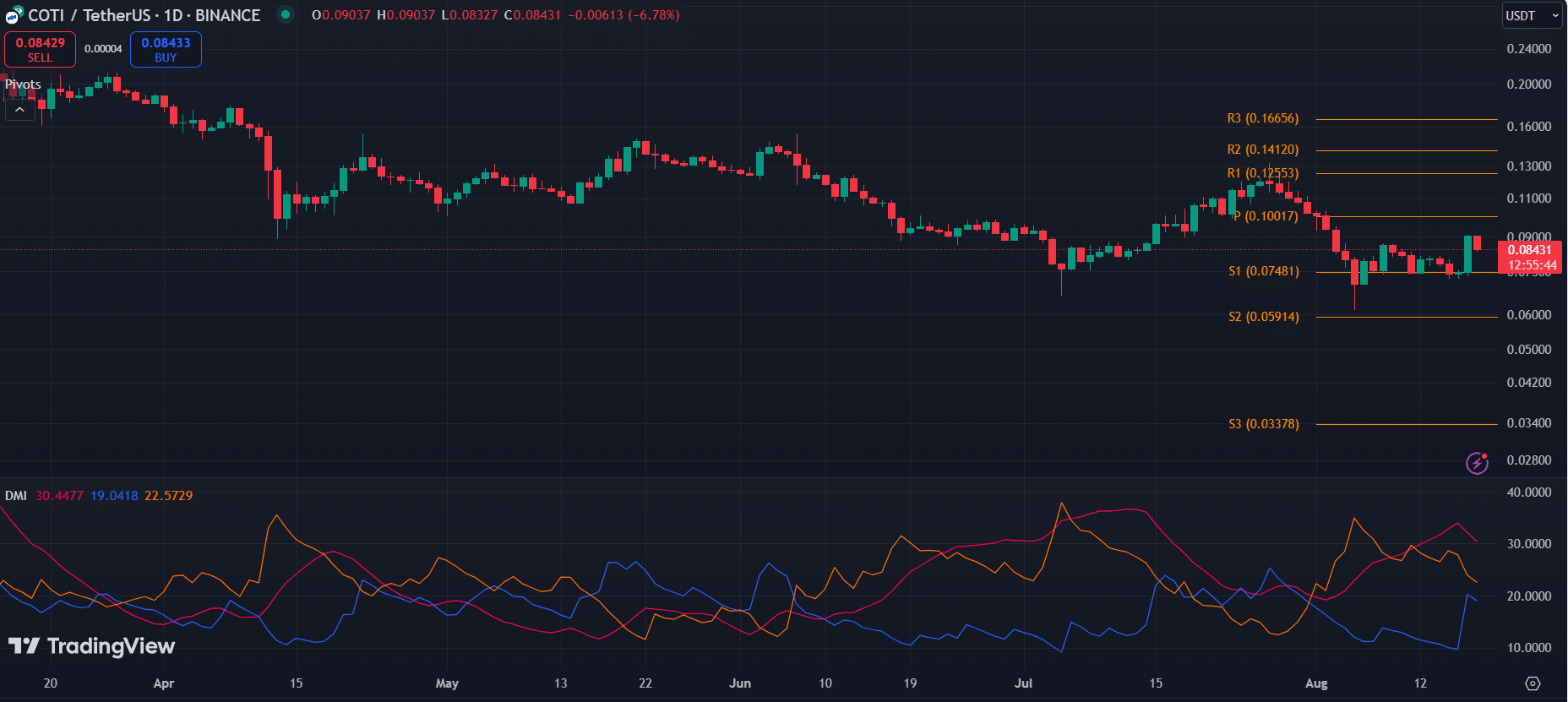

COTI faces mixed sentiments

Last week, COTI maintained a bearish trend, experiencing a 14% drop from August 11th to the 15th. Yet, it experienced a substantial 21% jump on Saturday, concluding the week with a 10% overall rise.

The asset has now been corrected as it encounters selling pressure.

As a researcher studying the market trends of COTI, I’ve observed that significant resistance levels have been established daily at approximately $0.10017, $0.12553, and $0.14120. Conversely, the immediate support for COTI can be found around $0.07481, which I’ve identified as S1 – a crucial level of potential price floor.

A breakdown below S1 could push prices towards S2 at $0.05914.

Currently, the Directional Moving Index signals a downward momentum. The ADX line, represented in red, stands at 30.4, indicating a robust trend. Moreover, the -DI line (orange) is higher than the +DI line (blue), with values of 22.57 and 19.04 respectively, which signifies prevailing bearish pressure.

Maintaining COTI’s position above the S1 level is essential. If it fails to do this, it may lead to additional declines. On the other hand, surpassing the Pivot could potentially initiate a rebounding trend.

Read More

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-08-18 20:40