As a seasoned analyst with years of experience navigating the cryptosphere, I must say that Raydium (RAY) has certainly been a rollercoaster ride over the past month. While its recent rally has propelled it to impressive heights, reaching levels not seen since April 2022, the current price action gives me pause.

In simpler terms, over the last month, Raydium has experienced a significant surge, which now places it in an overbought state. However, its funding rate suggests that there might be more increases to come.

As an analyst, I find myself observing a remarkable surge in value for Raydium (RAY). Over the past month, it has skyrocketed by a staggering 83%, and even more impressively, it’s climbed another 33% within just the last seven days. The token associated with the Solana-based automated market maker attained a significant milestone today, reaching a 31-month high of $3.59 – a level not observed since April 2022.

As an analyst, I’ve noticed a minor decline in RAY’s value over the past few hours, with the token currently trading at $3.25. At this moment, it’s important to note that RAY has fallen by approximately 81% from its peak of $16.93, which was achieved on September 13, 2021.

Currently ranked as the 75th largest in the digital assets market, Raydium boasts a market capitalization of approximately $858 million.

Can RAY rally again?

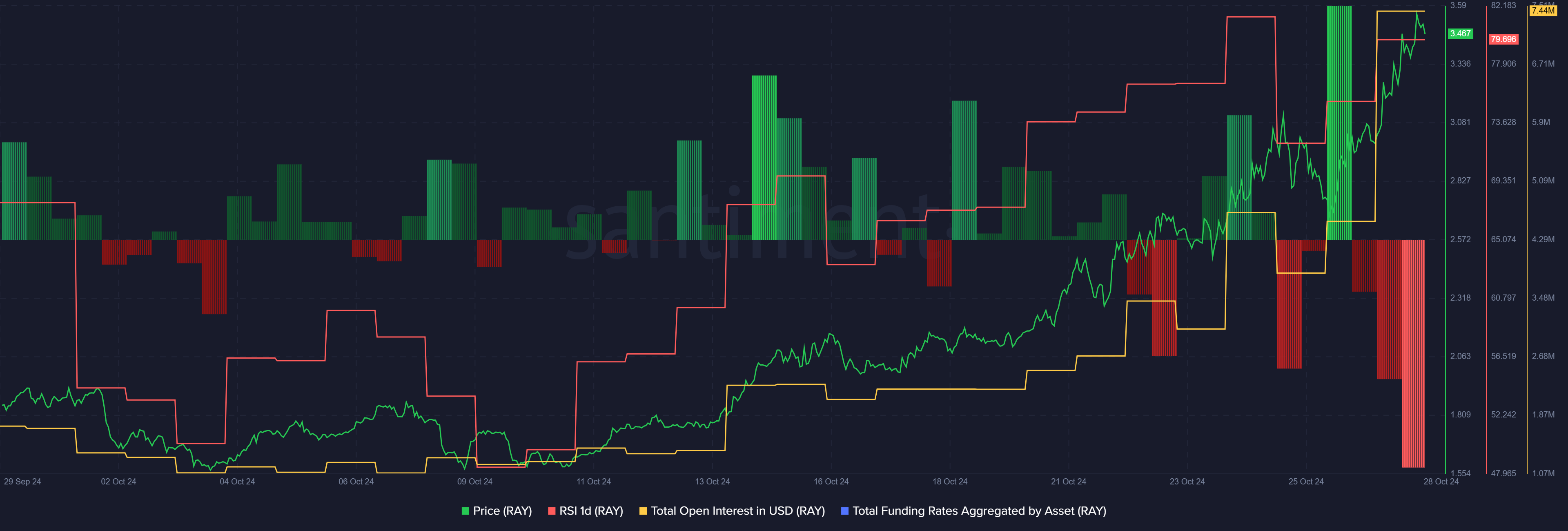

Based on the data I’ve analyzed from Santiment, it appears that Raydium’s Relative Strength Index is hovering around the 80 level. This suggests that the asset may be overbought, indicating a possible upcoming trend of profit-taking.

According to Santiment, the total value locked up on Raydium saw a significant rise of 65% over the last day – climbing from $4.5 million to $7.4 million.

An abrupt increase in the number of open positions for an asset often results in greater price fluctuations because it triggers more forced closures (liquidations).

RAY’s open interest increased significantly as more traders placed wagers predicting a decrease in the token’s price. According to Santiment, the Raydium funding rate has flipped from 0.06% on October 26th to -0.06% at the current time.

The funding rate shows an increased amount of short trades, dominating RAY’s open interest.

As a crypto investor, I’ve noticed an uptick in short RAY liquidations, which might signal another wave of bullish momentum for this asset. However, I can’t help but be cautious due to the rising open interest and Relative Strength Index (RSI), both pointing towards increased price volatility. The market still seems unclear about its direction, so it’s essential to keep a close eye on the situation.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-28 09:58